Excise, Must Be Made Available to the Department of Revenue Upon Request 2020

Understanding the Excise for MA Form 355

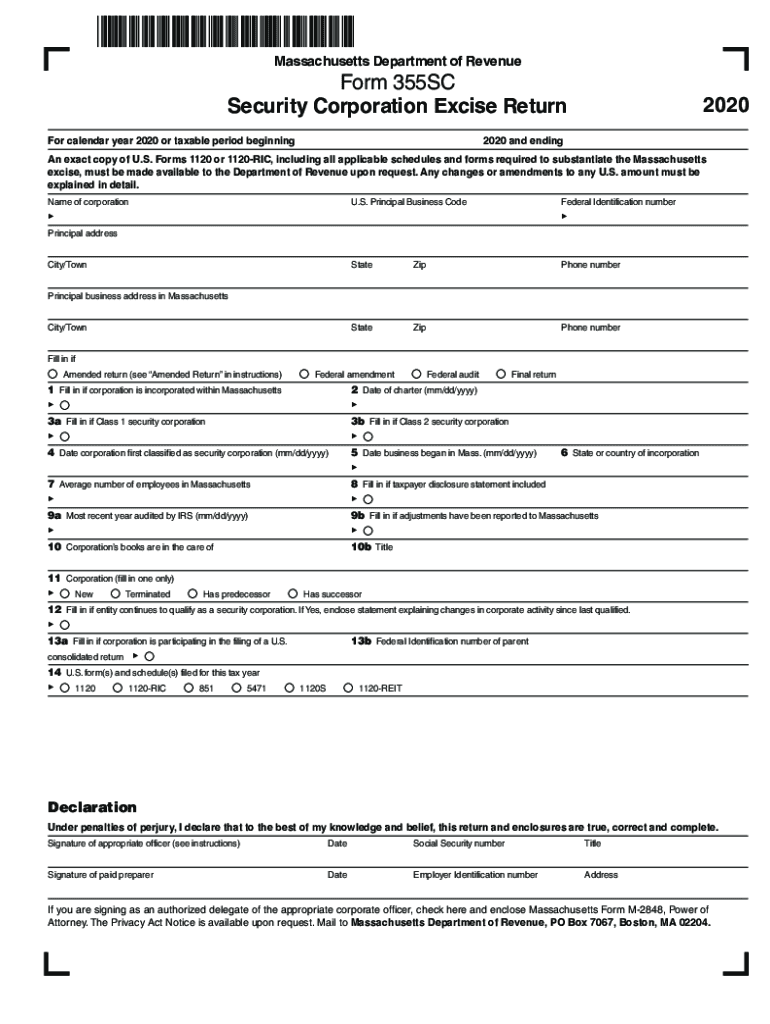

The MA Form 355 is essential for corporations operating in Massachusetts, as it serves as the annual report for both domestic and foreign corporations. This form requires specific information related to the corporation's excise tax obligations. The excise tax is based on the corporation's net income and is a crucial aspect of compliance with state tax laws. Understanding this tax is vital for accurate reporting and maintaining good standing with the Massachusetts Department of Revenue.

Steps to Complete MA Form 355

Completing the MA Form 355 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets, to determine your corporation's net income. Next, fill out the form by entering the required information, such as the corporation's name, address, and federal identification number. It's important to calculate the excise tax based on the net income accurately. Finally, review the completed form for errors before submitting it to the Massachusetts Department of Revenue.

Required Documents for MA Form 355

When preparing to file the MA Form 355, certain documents are essential to ensure a complete submission. These include:

- Financial statements, including income statements and balance sheets

- Federal tax returns for the year

- Any supporting documentation for deductions or credits claimed

- Records of prior year's excise tax payments

Having these documents on hand will streamline the process and help avoid delays in filing.

Filing Deadlines for MA Form 355

Timely filing of the MA Form 355 is crucial to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 15. It is advisable to mark this date on your calendar and prepare your documents in advance to ensure compliance.

Penalties for Non-Compliance with MA Form 355

Failure to file the MA Form 355 on time can result in significant penalties. The Massachusetts Department of Revenue may impose a late filing penalty, which can be a percentage of the owed excise tax. Additionally, interest may accrue on any unpaid taxes. It is essential to file on time to avoid these financial repercussions and maintain your corporation's good standing.

Digital Submission of MA Form 355

Filing the MA Form 355 can be done digitally, which offers several advantages. Electronic submissions are typically processed faster than paper filings, reducing the time it takes to receive confirmation from the Department of Revenue. Additionally, using a digital platform can help ensure that all required fields are completed correctly, minimizing the risk of errors that could lead to penalties. Ensure that you have the necessary software or access to a platform that supports electronic filing.

Legal Use of MA Form 355

The MA Form 355 must be completed in accordance with Massachusetts state law to be considered legally valid. This includes providing accurate financial information and adhering to all filing requirements. Corporations should keep copies of their submitted forms and any correspondence with the Department of Revenue for their records. Compliance with these legal standards is essential to avoid complications and ensure the corporation operates within the law.

Quick guide on how to complete excise must be made available to the department of revenue upon request

Effortlessly prepare Excise, Must Be Made Available To The Department Of Revenue Upon Request across any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed files, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents promptly with no hassles. Handle Excise, Must Be Made Available To The Department Of Revenue Upon Request on any device using airSlate SignNow applications available on Android or iOS, and streamline any document-related process today.

The simplest method to modify and eSign Excise, Must Be Made Available To The Department Of Revenue Upon Request effortlessly

- Obtain Excise, Must Be Made Available To The Department Of Revenue Upon Request and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of the documents or redact sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Excise, Must Be Made Available To The Department Of Revenue Upon Request and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct excise must be made available to the department of revenue upon request

Create this form in 5 minutes!

How to create an eSignature for the excise must be made available to the department of revenue upon request

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is MA Form 355?

MA Form 355 is a key document used by businesses in Massachusetts for tax reporting purposes. airSlate SignNow allows you to quickly and securely eSign MA Form 355, ensuring compliance and accurate filing. By utilizing our platform, you can manage your documents efficiently and reduce turnaround times.

-

How does airSlate SignNow help with MA Form 355?

With airSlate SignNow, you can easily upload, eSign, and share MA Form 355 documents. Our platform provides a user-friendly interface that simplifies the eSignature process, making it faster for you to get approvals. Whether you need to send the form to clients or business partners, our solution streamlines the entire process.

-

Is there a cost to use airSlate SignNow for MA Form 355?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including features specific for managing MA Form 355. You can choose between monthly or annual subscriptions based on your usage requirements. Additionally, our affordable plans help you save costs without compromising on quality.

-

What features does airSlate SignNow offer for MA Form 355 management?

Our platform includes various features such as customizable templates, real-time tracking, and reminders for eSigning MA Form 355. You can also integrate with other tools and applications to enhance your workflow. This comprehensive set of features ensures efficient handling of your documents.

-

Can I integrate airSlate SignNow with other software for MA Form 355?

Yes, airSlate SignNow supports seamless integration with a variety of third-party applications to facilitate the management of MA Form 355. This integration allows you to automatically pull in data or send completed forms directly to clients or accounting systems. Such compatibility enhances your overall productivity.

-

What are the benefits of using airSlate SignNow for MA Form 355?

Using airSlate SignNow for MA Form 355 provides several benefits, including increased efficiency, cost savings, and enhanced security. Our eSignature solution ensures that your documents are handled with the highest level of security and compliance. Additionally, you can reduce the time spent on paperwork, allowing you to focus on more important business tasks.

-

How secure is airSlate SignNow when handling MA Form 355?

AirSlate SignNow prioritizes security, employing advanced encryption protocols to protect your MA Form 355 and other sensitive documents. Our platform complies with industry standards and regulations to ensure data integrity and privacy. You can trust our solution to keep your business information safe.

Get more for Excise, Must Be Made Available To The Department Of Revenue Upon Request

Find out other Excise, Must Be Made Available To The Department Of Revenue Upon Request

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now