355sc 2018

What is the 355sc

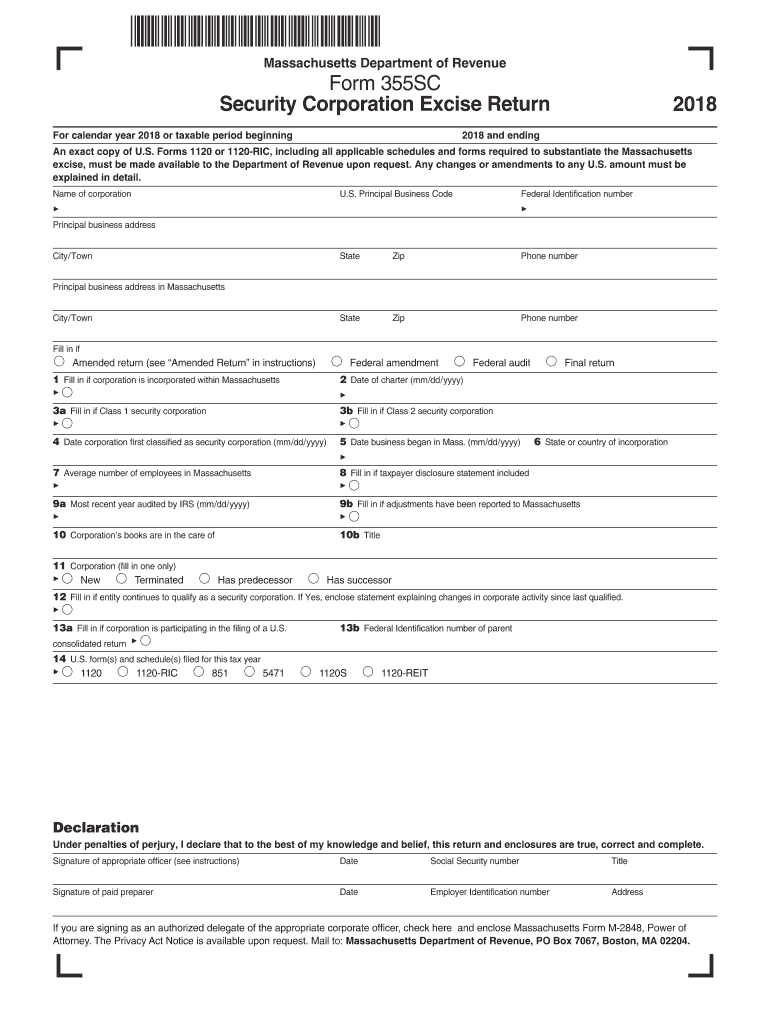

The 355sc is a specific form used for reporting excise taxes by security corporations in the United States. This form is essential for businesses that operate as security corporations to comply with state tax regulations. It provides a structured format for reporting income and calculating the appropriate excise tax owed. Understanding the purpose of the 355sc is crucial for accurate tax reporting and compliance with state laws.

How to use the 355sc

Using the 355sc involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents related to your business operations. This includes income statements, expense reports, and any other relevant financial data. Next, fill out the form with the required information, ensuring that all fields are accurately completed. After filling out the form, review it for any errors before submitting it electronically or through traditional mail. Utilizing eSignature solutions can streamline this process, allowing for secure and efficient submissions.

Steps to complete the 355sc

Completing the 355sc involves a systematic approach:

- Gather Information: Collect all necessary financial documents, including income and expense records.

- Fill Out the Form: Enter the required information in the designated fields, ensuring accuracy.

- Review: Check the completed form for any errors or omissions.

- Submit: Send the form electronically or by mail, ensuring compliance with submission guidelines.

Legal use of the 355sc

The legal use of the 355sc is governed by state tax laws, which require security corporations to report their excise taxes accurately. Compliance with these regulations is critical to avoid penalties or legal issues. The form must be completed in accordance with the guidelines set forth by the state tax authority, ensuring that all information is truthful and complete. Utilizing an eSignature solution can further enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the 355sc can vary by state, but typically, security corporations must submit their excise tax returns annually. It is essential to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar with important dates, such as the due date for the 355sc submission and any estimated tax payment deadlines, can help ensure timely compliance.

Form Submission Methods

The 355sc can be submitted through various methods, including electronic submission and traditional mail. Electronic submission is often preferred for its speed and efficiency. Utilizing an eSignature solution can simplify the process, allowing for secure signing and submission of the form. For those who prefer traditional methods, ensure that the form is mailed to the correct address as specified by the state tax authority.

Quick guide on how to complete form 355sc security corporation excise return 2018

Your assistance manual on how to prepare your 355sc

If you’re looking to learn how to create and submit your 355sc, here are some concise guidelines on making tax submission easier.

To begin, you simply need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a straightforward and robust document solution that enables you to modify, draft, and complete your income tax paperwork with simplicity. Using its editor, you can alternate between text, checkboxes, and eSignatures, and go back to amend information as necessary. Streamline your tax management with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow the steps below to finish your 355sc in just a few minutes:

- Create your profile and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your 355sc in our editor.

- Complete the necessary fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to affix your legally-binding eSignature (if needed).

- Examine your document and rectify any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper can lead to errors and delay refunds. Naturally, before e-filing your taxes, check the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 355sc security corporation excise return 2018

FAQs

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

When and how are the assignments for IGNOU CHR to be submitted for the December 2018 TEE? How and when to fill out the examination form? Where do I look for the datasheet?

First download the assignments from IGNOU - The People's University website and write them with A4 size paper then submitted it in your study center.check the above website you will find a link that TEE from fill up for dec 2018 after got the link you will fill your tee from online.Remember while filling your TEE you should put tick mark on the box like this;Are you submitted assignments: yes[ ] No[ ]

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

Create this form in 5 minutes!

How to create an eSignature for the form 355sc security corporation excise return 2018

How to make an eSignature for your Form 355sc Security Corporation Excise Return 2018 online

How to create an electronic signature for the Form 355sc Security Corporation Excise Return 2018 in Chrome

How to create an electronic signature for putting it on the Form 355sc Security Corporation Excise Return 2018 in Gmail

How to create an electronic signature for the Form 355sc Security Corporation Excise Return 2018 right from your mobile device

How to make an eSignature for the Form 355sc Security Corporation Excise Return 2018 on iOS devices

How to create an electronic signature for the Form 355sc Security Corporation Excise Return 2018 on Android

People also ask

-

What is 355sc and how does it relate to airSlate SignNow?

The 355sc is a unique identifier for features within airSlate SignNow that enable businesses to streamline document workflows. This powerful tool ensures efficient eSigning and document management, making it an essential solution for companies looking to enhance their productivity.

-

How much does airSlate SignNow cost and is 355sc included?

airSlate SignNow offers a range of pricing plans to accommodate different business needs, and the 355sc features are available on all tiers. Each plan provides access to essential tools for eSigning and document automation, helping you to choose the best option for your budget.

-

What are the key features of airSlate SignNow with 355sc?

The key features of airSlate SignNow, including the 355sc functionalities, involve eSigning, document templates, and advanced workflow automation. These features are designed to simplify the signing process and enhance document management efficiency for businesses of all sizes.

-

How can businesses benefit from using 355sc in airSlate SignNow?

Businesses can signNowly benefit from the 355sc features in airSlate SignNow by reducing turnaround times for document approvals and enhancing collaboration. This cost-effective tool allows teams to work seamlessly, increasing overall productivity and client satisfaction.

-

Does airSlate SignNow with 355sc integrate with other applications?

Yes, airSlate SignNow supports numerous integrations with popular applications such as Salesforce, Google Drive, and Microsoft Office. The 355sc functionalities ensure these integrations are smooth, providing a cohesive user experience and allowing for seamless data exchange.

-

Is it easy to use airSlate SignNow with 355sc for beginners?

Absolutely! airSlate SignNow is designed to be user-friendly, ensuring that even beginners can navigate its features, including 355sc. The intuitive interface and helpful resources make it easy to start managing documents and eSignatures right away.

-

Can I customize templates while using 355sc in airSlate SignNow?

Yes, airSlate SignNow allows you to customize document templates easily while utilizing the 355sc features. This flexibility helps you tailor documents to meet your specific needs, improving efficiency and ensuring your branding remains consistent.

Get more for 355sc

- St johns first aid kit checklist form

- Wfrmls 15067230 form

- Parking permit application form posted april hawaii

- American international college transcript request form

- Laguardia readmission form

- Employer s statement of return to work reset ple form

- Brenda parkinson calgary form

- St benedict catholic secondary school registration form

Find out other 355sc

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample