Com103 Alabama Department of Revenue Form

What is the Com103 Alabama Department Of Revenue Form

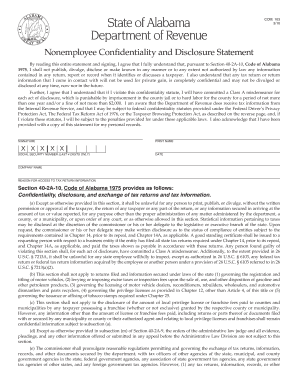

The Com103 Alabama Department Of Revenue Form is a specific document utilized for tax-related purposes in the state of Alabama. This form is primarily designed to facilitate the reporting of certain tax information by individuals and businesses. It is essential for ensuring compliance with state tax regulations and for the accurate calculation of tax liabilities. Understanding the purpose of this form is crucial for anyone required to file it, as it helps in maintaining proper records and fulfilling legal obligations.

How to use the Com103 Alabama Department Of Revenue Form

Using the Com103 Alabama Department Of Revenue Form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including financial records and any relevant tax information. Next, fill out the form with the required details, ensuring that all information is accurate and complete. After filling out the form, review it carefully to avoid any errors. Finally, submit the form according to the specified guidelines, which may include online submission, mailing, or in-person delivery to the appropriate tax office.

Steps to complete the Com103 Alabama Department Of Revenue Form

Completing the Com103 Alabama Department Of Revenue Form can be straightforward if approached methodically. Follow these steps:

- Gather necessary documents such as income statements, receipts, and previous tax returns.

- Download the form from the official Alabama Department of Revenue website or access it through authorized platforms.

- Carefully fill in each section of the form, ensuring that all fields are completed accurately.

- Double-check all entries for accuracy and completeness, correcting any errors found.

- Sign and date the form where required.

- Submit the form via the designated method, ensuring compliance with any deadlines.

Legal use of the Com103 Alabama Department Of Revenue Form

The legal use of the Com103 Alabama Department Of Revenue Form is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted in accordance with the regulations set forth by the Alabama Department of Revenue. It is important to note that any discrepancies or inaccuracies may lead to penalties or legal issues. Therefore, ensuring that the form is filled out correctly and submitted on time is essential for compliance with state tax laws.

Key elements of the Com103 Alabama Department Of Revenue Form

Several key elements must be included in the Com103 Alabama Department Of Revenue Form to ensure its validity and effectiveness. These elements typically include:

- Taxpayer identification information, such as name, address, and Social Security number or EIN.

- Details regarding income, deductions, and credits applicable to the taxpayer.

- Signature of the taxpayer or authorized representative, confirming the accuracy of the information provided.

- Any additional schedules or attachments required to support the information reported on the form.

Form Submission Methods

The Com103 Alabama Department Of Revenue Form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the state. Common submission methods include:

- Online submission through the Alabama Department of Revenue's official website.

- Mailing the completed form to the designated tax office address.

- In-person delivery at local tax offices or designated locations.

Quick guide on how to complete com103 alabama department of revenue form

Effortlessly finalize Com103 Alabama Department Of Revenue Form on any device

Digital document management has surged in popularity among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the accurate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Com103 Alabama Department Of Revenue Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Com103 Alabama Department Of Revenue Form with ease

- Locate Com103 Alabama Department Of Revenue Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Com103 Alabama Department Of Revenue Form and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the com103 alabama department of revenue form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Com103 Alabama Department Of Revenue Form?

The Com103 Alabama Department Of Revenue Form is a crucial document used for filing specific tax returns in the state of Alabama. This form collects essential information about the taxpayer's financial activities and is required for compliance with Alabama tax regulations.

-

How can airSlate SignNow assist with the Com103 Alabama Department Of Revenue Form?

airSlate SignNow provides a streamlined platform for businesses to fill out, sign, and submit the Com103 Alabama Department Of Revenue Form electronically. This not only enhances efficiency but also reduces the likelihood of errors that can occur with paper submissions.

-

Is there a cost associated with using airSlate SignNow for the Com103 Alabama Department Of Revenue Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is typically determined by the features and functionalities needed for efficient management of forms, including the Com103 Alabama Department Of Revenue Form.

-

What features does airSlate SignNow provide for the Com103 Alabama Department Of Revenue Form?

airSlate SignNow offers robust features such as electronic signatures, customizable templates, and secure document storage which make managing the Com103 Alabama Department Of Revenue Form easy and efficient. These tools ensure compliance and streamline the filing process.

-

Are there integrations available with airSlate SignNow for the Com103 Alabama Department Of Revenue Form?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, which enhance its functionality for managing the Com103 Alabama Department Of Revenue Form. This allows users to connect with existing systems, improving workflow efficiency.

-

What are the benefits of using airSlate SignNow for the Com103 Alabama Department Of Revenue Form?

Using airSlate SignNow for the Com103 Alabama Department Of Revenue Form provides numerous benefits, including time savings, increased accuracy, and secure processing. This results in a more efficient filing experience, allowing businesses to focus on their core activities.

-

Can I track the status of my Com103 Alabama Department Of Revenue Form with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of the Com103 Alabama Department Of Revenue Form throughout the signing and submission process. This transparency ensures that you are always informed of the document's progress.

Get more for Com103 Alabama Department Of Revenue Form

Find out other Com103 Alabama Department Of Revenue Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors