Arizona Form321Credit for Contributions to Qualify 2024-2026

What is the Arizona Form321Credit For Contributions To Qualify

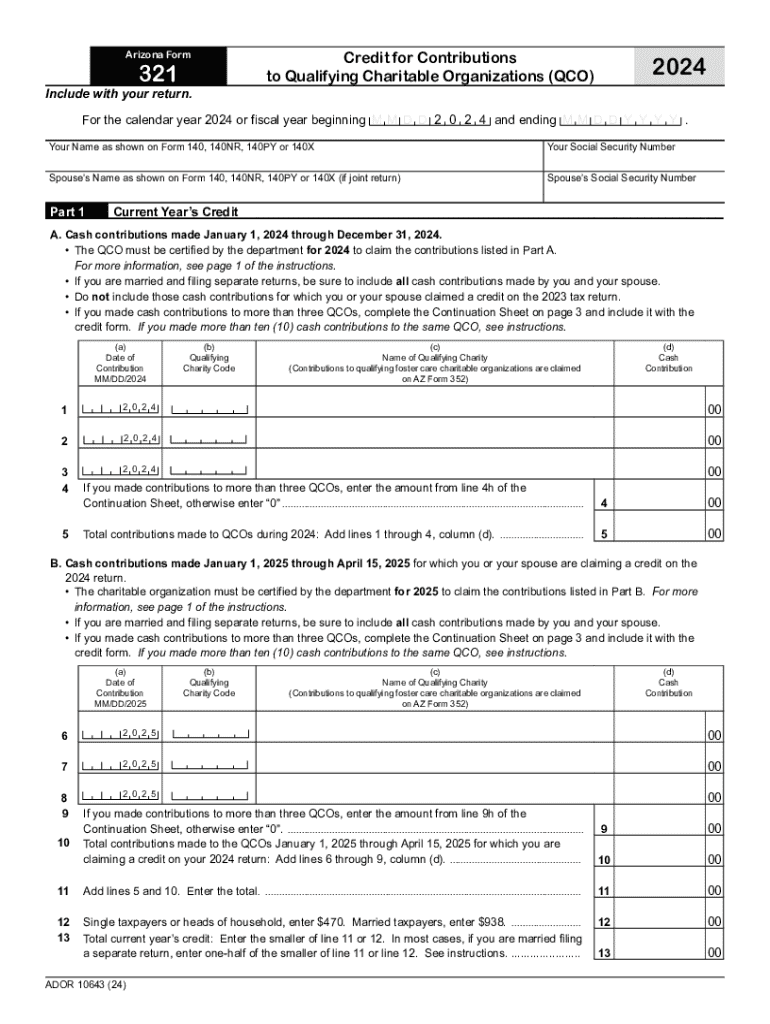

The Arizona Form321Credit For Contributions To Qualify is a tax form designed to facilitate contributions to qualifying charitable organizations within the state of Arizona. This form allows taxpayers to claim a credit against their state income tax for contributions made to these organizations, encouraging charitable giving and supporting local communities. The credit is available to individual taxpayers who meet specific eligibility criteria, and it aims to promote philanthropy while providing financial benefits to contributors.

How to use the Arizona Form321Credit For Contributions To Qualify

To effectively use the Arizona Form321Credit For Contributions To Qualify, taxpayers should first ensure they are eligible to claim the credit. This involves reviewing the list of qualifying charitable organizations and confirming that contributions meet the required thresholds. Once eligibility is established, taxpayers can fill out the form by providing necessary personal information, detailing the contributions made, and calculating the credit amount. It is essential to retain documentation of contributions for record-keeping and potential audits.

Steps to complete the Arizona Form321Credit For Contributions To Qualify

Completing the Arizona Form321Credit For Contributions To Qualify involves several key steps:

- Gather documentation of contributions made to qualifying organizations.

- Obtain the form from the Arizona Department of Revenue's website or through tax preparation software.

- Fill out personal information, including name, address, and Social Security number.

- Detail the contributions made, including the name of the organization and the amount donated.

- Calculate the total credit by following the instructions provided on the form.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Arizona Form321Credit For Contributions To Qualify, taxpayers must meet specific eligibility criteria. These include being an individual taxpayer filing a state income tax return, making contributions to qualifying charitable organizations as defined by Arizona law, and adhering to the contribution limits set forth by the state. Additionally, taxpayers should ensure that the organizations they contribute to are recognized by the Arizona Department of Revenue as eligible for the credit.

Required Documents

When completing the Arizona Form321Credit For Contributions To Qualify, taxpayers should have several key documents on hand. These include:

- Receipts or acknowledgments from the charitable organizations for contributions made.

- A copy of the taxpayer's Arizona income tax return.

- Any additional documentation required by the Arizona Department of Revenue to substantiate the credit claim.

Form Submission Methods

The Arizona Form321Credit For Contributions To Qualify can be submitted through various methods. Taxpayers have the option to file the form electronically using tax preparation software that supports Arizona tax forms. Alternatively, the form can be printed and mailed to the appropriate address provided by the Arizona Department of Revenue. In-person submissions may also be possible at designated state revenue offices, depending on local regulations and services available.

Create this form in 5 minutes or less

Find and fill out the correct arizona form321credit for contributions to qualify

Create this form in 5 minutes!

How to create an eSignature for the arizona form321credit for contributions to qualify

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form321Credit For Contributions To Qualify?

The Arizona Form321Credit For Contributions To Qualify is a tax credit designed to incentivize contributions to qualifying charitable organizations in Arizona. By utilizing this form, taxpayers can receive a dollar-for-dollar credit on their state tax liability, making it a beneficial option for both donors and charities.

-

How can airSlate SignNow help with the Arizona Form321Credit For Contributions To Qualify?

airSlate SignNow streamlines the process of sending and eSigning documents related to the Arizona Form321Credit For Contributions To Qualify. Our platform ensures that all necessary forms are completed accurately and efficiently, allowing users to focus on their contributions without the hassle of paperwork.

-

What are the pricing options for using airSlate SignNow for Arizona Form321Credit For Contributions To Qualify?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those looking to manage Arizona Form321Credit For Contributions To Qualify. Our cost-effective solutions ensure that you can efficiently handle your documentation without breaking the bank.

-

What features does airSlate SignNow provide for managing Arizona Form321Credit For Contributions To Qualify?

With airSlate SignNow, users can enjoy features such as customizable templates, secure eSigning, and real-time tracking for documents related to the Arizona Form321Credit For Contributions To Qualify. These features enhance the user experience and ensure compliance with state requirements.

-

Are there any benefits to using airSlate SignNow for Arizona Form321Credit For Contributions To Qualify?

Using airSlate SignNow for Arizona Form321Credit For Contributions To Qualify offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the documentation process, allowing you to maximize your contributions and tax credits.

-

Can airSlate SignNow integrate with other tools for Arizona Form321Credit For Contributions To Qualify?

Yes, airSlate SignNow seamlessly integrates with various tools and applications, making it easier to manage your Arizona Form321Credit For Contributions To Qualify. This integration capability allows users to streamline their workflows and enhance productivity.

-

Is airSlate SignNow user-friendly for completing Arizona Form321Credit For Contributions To Qualify?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the Arizona Form321Credit For Contributions To Qualify. Our intuitive interface ensures that users can navigate the platform effortlessly, regardless of their technical expertise.

Get more for Arizona Form321Credit For Contributions To Qualify

- Fd foc4033 a motion to transfer your case to another michigan 3rdcc form

- General change endorsement federal emergency management fema form

- Declaration of section 214 status www1 honolulu form

- Honorarium letter for pastor form

- Dwc12 form

- Blue card fire scene size up cheat sheet form

- Waiver of subrogation form

- Apartment condition statement 100390076 form

Find out other Arizona Form321Credit For Contributions To Qualify

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application