E 555 Form

What is the E 555

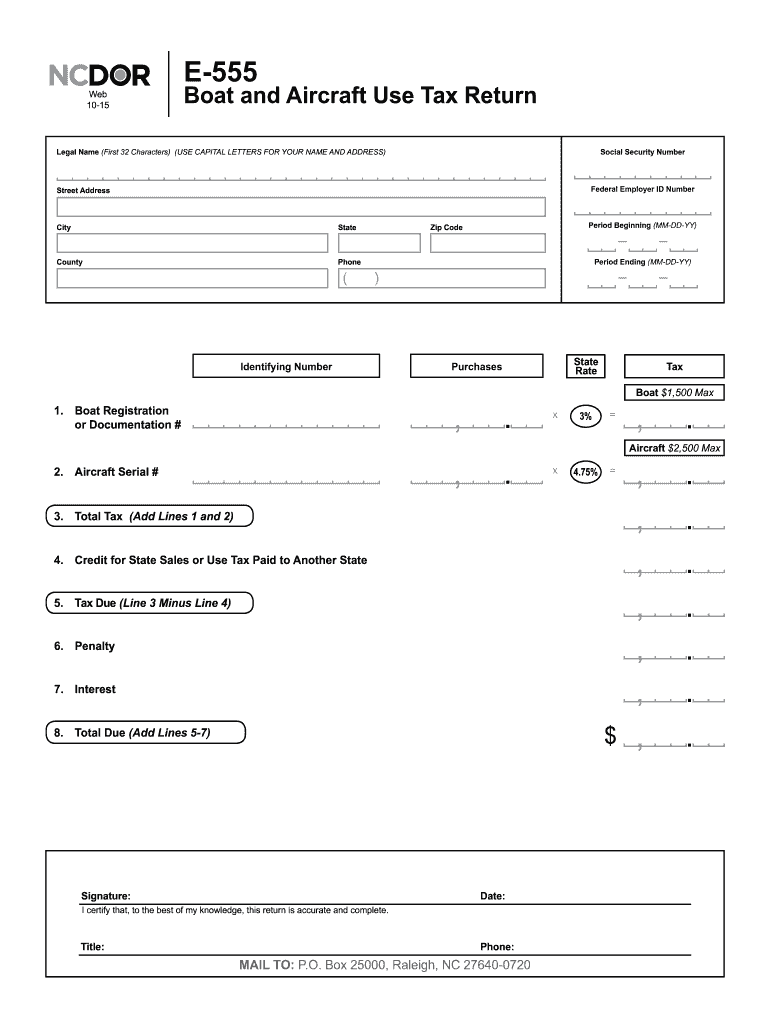

The E 555 form is a specific document used in certain legal and administrative processes. It serves as a formal request or application that may require specific information from the individual or entity submitting it. Understanding its purpose is vital for ensuring proper completion and compliance with relevant regulations. The E 555 form may be utilized in various contexts, such as tax filings or regulatory compliance, depending on the requirements set forth by governing bodies.

How to use the E 555

Using the E 555 form involves several steps to ensure that it is completed accurately and submitted correctly. First, gather all necessary information and documentation required to fill out the form. This may include personal identification details, financial information, or other relevant data. Next, carefully complete each section of the form, ensuring that all fields are filled out as instructed. After completing the form, review it for accuracy before submission to avoid delays or issues with processing.

Steps to complete the E 555

Completing the E 555 form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather required documents and information.

- Read the instructions carefully to understand the requirements.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the E 555

The legal use of the E 555 form is contingent upon adherence to applicable laws and regulations. It is essential to ensure that the form is filled out truthfully and accurately, as any discrepancies may lead to legal repercussions. The form must also comply with relevant federal and state laws governing its use, ensuring that it meets all necessary legal criteria for acceptance by the requesting agency or institution.

Key elements of the E 555

Several key elements are essential for the E 555 form to be considered valid and effective. These include:

- Accurate personal or business information.

- Proper signatures, which may require digital or handwritten formats.

- Compliance with any specific instructions provided with the form.

- Submission by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the E 555 form can vary based on the specific context in which it is used. It is crucial to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or delays in processing. Always check the latest guidelines from the relevant authority to confirm the specific dates associated with the E 555 form.

Quick guide on how to complete e 555

Manage E 555 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage E 555 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign E 555 with ease

- Locate E 555 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you prefer. Modify and electronically sign E 555 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e 555

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is e 555 in the context of airSlate SignNow?

The e 555 reference in airSlate SignNow pertains to our robust eSignature feature that allows for secure, legally binding digital signatures on documents. This functionality streamlines the signing process, making it easy for users to manage agreements from anywhere.

-

How does airSlate SignNow's e 555 feature improve document workflow?

With the e 555 feature, businesses can expedite their document workflows signNowly. Users can send documents for signing, track their status in real-time, and receive notifications upon completion, thus enhancing overall efficiency and productivity.

-

What pricing options are available for the e 555 functionality?

airSlate SignNow offers various pricing plans that incorporate the e 555 feature, catering to different business needs. Pricing is competitive and provides excellent value, allowing businesses of all sizes to implement effective eSignature solutions without breaking the bank.

-

Is the e 555 feature secure for sensitive documents?

Absolutely! The e 555 feature in airSlate SignNow is designed with top-notch security measures, including encryption and authentication protocols. This ensures that all signed documents remain confidential and protected from unauthorized access.

-

Can I integrate the e 555 feature with other software applications?

Yes, airSlate SignNow's e 555 functionality can be easily integrated with various software applications such as CRMs, document management systems, and productivity tools. This flexibility allows businesses to streamline their operations and enhance their existing workflows.

-

What are the benefits of using the e 555 feature for remote teams?

The e 555 feature is particularly advantageous for remote teams, as it facilitates seamless collaboration on documents regardless of location. With airSlate SignNow, team members can sign and send documents securely, enabling faster decision-making and improved communication.

-

How user-friendly is the e 555 signing process?

The e 555 signing process in airSlate SignNow is extremely user-friendly, ensuring that users can easily navigate through document signing tasks. Its intuitive interface allows even those with minimal technical skills to complete the signing process efficiently.

Get more for E 555

- How do i change my direct deposit for child support in texas form

- Boost job application form

- View sample pennsylvania association of realtors parealtor form

- A worksheet on principal and principle wordpress clark u form

- Form 1716 missouri application for specialty and personalized specialty license plates

- Rev f009 consumer use tax return form

- Vermont form8879 vt cfor office use onlyvermo

- Corporation business and fiduciary e filing form

Find out other E 555

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online