Sample 1120 Filled Out 2022

What is the sample 1120 filled out

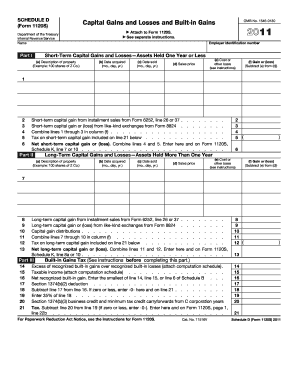

The sample 1120 filled out represents a completed version of the IRS Form 1120, which is used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations in the United States to calculate their federal income tax liability. A filled-out sample provides a clear illustration of how to accurately complete the form, including all necessary sections such as income, deductions, and tax computation. Understanding this sample can help businesses ensure compliance with tax regulations and facilitate smoother filing processes.

Steps to complete the sample 1120 filled out

Completing the sample 1120 involves several key steps:

- Gather necessary documents: Collect financial statements, income records, and any relevant deductions.

- Fill out basic information: Enter the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report income: Complete the income section by detailing gross receipts and other income sources.

- Detail deductions: List all allowable deductions, including operating expenses, salaries, and benefits.

- Calculate tax: Use the information provided to compute the corporation's tax liability based on current tax rates.

- Sign and date: Ensure that the form is signed by an authorized officer of the corporation and dated appropriately.

Legal use of the sample 1120 filled out

The legal use of the sample 1120 filled out is crucial for compliance with IRS regulations. A properly completed form serves as a legal document that reflects the corporation's financial activities for the tax year. It is essential to ensure that all information provided is accurate and truthful to avoid penalties. Additionally, electronic submission of the form through a compliant platform can enhance the legal standing of the document, as it adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations.

IRS guidelines for the sample 1120 filled out

The IRS provides specific guidelines for completing the sample 1120 filled out. These include instructions on how to report various types of income, allowable deductions, and tax credits. It is important to follow these guidelines closely to ensure that the form is completed correctly. The IRS also updates its guidelines periodically, so staying informed about any changes is essential for accurate reporting. Consulting the IRS instructions for Form 1120 can provide additional clarity on complex areas of the form.

Filing deadlines for the sample 1120 filled out

Filing deadlines for the sample 1120 filled out are critical for compliance. Generally, corporations must file their Form 1120 by the fifteenth day of the fourth month following the end of their tax year. For corporations operating on a calendar year, this means the deadline is April fifteenth. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations can also apply for an automatic six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Key elements of the sample 1120 filled out

The key elements of the sample 1120 filled out include several critical sections that must be accurately completed:

- Income section: This includes total income, cost of goods sold, and gross profit.

- Deductions: Corporations can deduct various expenses, including salaries, rent, and utilities.

- Tax computation: This section calculates the total tax due based on taxable income.

- Signature block: An authorized officer must sign the form, affirming its accuracy.

Quick guide on how to complete sample 1120 filled out

Effortlessly Prepare Sample 1120 Filled Out on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly without delays. Manage Sample 1120 Filled Out on any device with the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to Edit and eSign Sample 1120 Filled Out with Ease

- Obtain Sample 1120 Filled Out and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Sample 1120 Filled Out and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sample 1120 filled out

Create this form in 5 minutes!

How to create an eSignature for the sample 1120 filled out

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 1120 example?

A form 1120 example refers to a sample of the U.S. Corporation Income Tax Return, which corporations use to report income, gains, losses, deductions, and credits. Understanding a form 1120 example can help businesses accurately complete their tax returns. airSlate SignNow can streamline the process of filling out and submitting such forms securely.

-

How can airSlate SignNow assist with filling out a form 1120 example?

airSlate SignNow provides customizable templates that make completing a form 1120 example easier for users. The platform allows businesses to add their information directly into the template, ensuring accuracy and compliance. Additionally, the ease of eSigning promotes faster submission of tax documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including a basic plan suitable for small businesses and more advanced plans for larger organizations. Each plan includes features that facilitate document management, including access to a form 1120 example template. Detailed pricing information can be found on the airSlate SignNow website.

-

Are there benefits to using airSlate SignNow for form 1120 example submissions?

Using airSlate SignNow for form 1120 example submissions offers numerous benefits, including enhanced security and ease of use. The platform ensures that your documents are safely stored and tracked, reducing the risk of errors. Moreover, the eSignature feature expedites the signing process, allowing for timely filing.

-

Can I integrate airSlate SignNow with other software for form 1120 example processing?

Yes, airSlate SignNow can be integrated with various business applications, enhancing the efficiency of the form 1120 example processing. Popular integrations include CRM systems and accounting software, which help automate data transfer and save time. This ensures that your tax documentation remains organized and easily accessible.

-

Is airSlate SignNow suitable for both small and large businesses handling form 1120 examples?

Absolutely! airSlate SignNow is designed to cater to the needs of both small and large businesses dealing with form 1120 examples. Its robust features and scalable pricing plans make it a versatile solution whether you're managing one or multiple tax returns.

-

What features does airSlate SignNow provide for managing a form 1120 example?

airSlate SignNow includes features like automated workflows, customizable templates, and secure eSigning specifically for managing a form 1120 example. These tools help simplify the tax filing process while ensuring compliance and accuracy. By utilizing these features, businesses can effectively manage their tax submissions with ease.

Get more for Sample 1120 Filled Out

- Tvfc forms

- Titling trust form

- Irs form 741

- Va form 21 8951 pdf

- Sedgwick fax number form

- Create a venn diagram that compares the characteristics of perseus and medusa form

- Rbf online application form

- Hcv rent increase requeststhe chicago housing authorityrent increase notice sample letterpdf wordrent increase letter form

Find out other Sample 1120 Filled Out

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe