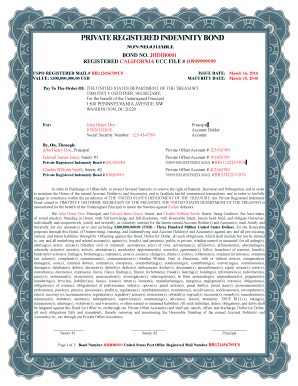

Private Registered Bond Form

What is the Private Registered Bond

A private registered bond is a type of debt security issued by a corporation or government entity that is registered in the name of the owner. Unlike bearer bonds, which are unregistered and can be transferred by mere possession, private registered bonds require the issuer to maintain a record of the bondholder's identity. This registration provides a level of security for investors, ensuring that only the registered owner can claim interest payments and principal upon maturity.

How to Obtain the Private Registered Bond

To obtain a private registered bond, an investor typically needs to approach a financial institution or brokerage that offers such securities. The process generally involves filling out an application form, providing identification, and possibly meeting certain eligibility criteria set by the issuer. Investors should also be aware of any fees associated with the purchase. Once the application is approved, the bond will be issued in the investor's name, ensuring that all rights and obligations are properly recorded.

Steps to Complete the Private Registered Bond

Completing the private registered bond involves several key steps:

- Gather necessary documentation, including identification and financial information.

- Fill out the application form accurately, ensuring all details are correct.

- Submit the application along with any required fees to the issuing authority.

- Await confirmation of bond issuance, which will include details such as the bond's face value and interest rate.

- Keep a record of the bond and any related documents for future reference.

Legal Use of the Private Registered Bond

The legal use of private registered bonds is governed by federal and state securities laws. These bonds must comply with regulations set forth by the Securities and Exchange Commission (SEC) and any applicable state laws. Investors should ensure that the bonds they purchase are properly registered and that all documentation is in order to protect their rights. Failure to comply with these regulations can lead to penalties or loss of investment.

Key Elements of the Private Registered Bond

Key elements of a private registered bond include:

- Face Value: The amount the bond will be worth at maturity, typically $1,000 or more.

- Interest Rate: The rate at which interest will be paid to the bondholder, usually fixed.

- Maturity Date: The date on which the bond will mature, and the principal will be repaid.

- Issuer: The entity that issues the bond, which could be a corporation or government body.

- Registration Details: Information regarding the bondholder's identity and rights.

Examples of Using the Private Registered Bond

Private registered bonds can be utilized in various scenarios, including:

- As a stable investment option for individuals seeking regular interest income.

- As part of a diversified investment portfolio to mitigate risk.

- For funding specific projects or initiatives by corporations or municipalities.

Quick guide on how to complete private registered bond

Prepare Private Registered Bond effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Private Registered Bond on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centered operation today.

How to modify and eSign Private Registered Bond easily

- Find Private Registered Bond and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Private Registered Bond and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the private registered bond

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a private registered bond for investment?

A private registered bond for investment is a type of debt security issued by a corporation or government that allows investors to lend money in exchange for periodic interest payments and the return of principal at maturity. Investors typically value these bonds for their fixed income potential and reliability.

-

How does a private registered bond for investment differ from other bonds?

Unlike publicly traded bonds, a private registered bond for investment is sold directly to a select group of investors, thus often providing a unique opportunity for those seeking specific investment portfolios. This privacy can appeal to investors wanting tailored financial solutions with potentially lower competition.

-

What are the benefits of investing in private registered bonds?

Investing in a private registered bond for investment can offer several benefits, including more stable returns, less volatility compared to stocks, and favorable terms negotiated directly with issuers. Investors may also enjoy personalized service and investment strategies tailored to their financial goals.

-

Are there minimum investment requirements for private registered bonds?

Yes, a private registered bond for investment typically has minimum investment requirements that can vary based on the issuer. It’s essential for investors to review these minimums, as they may be designed to cater to accredited or high-net-worth investors to maintain exclusivity.

-

What features should I look for in a private registered bond for investment?

Key features to consider when evaluating a private registered bond for investment include the bond's maturity date, interest rate (coupon), credit quality of the issuer, and any specific covenants or conditions. Understanding these aspects can help you assess the bond’s risk and potential returns more accurately.

-

How can I purchase a private registered bond for investment?

To purchase a private registered bond for investment, you typically need to work with a broker or financial advisor who specializes in fixed income securities. They can guide you through the process, including negotiations and paperwork, ensuring compliance with any regulations involved in private offerings.

-

What types of investors benefit from private registered bonds?

Private registered bonds for investment are often favored by institutional investors, high-net-worth individuals, and accredited investors desiring fixed-income assets. These groups typically seek lower-risk investment opportunities that can provide consistent income over time, balanced with their overall investment strategies.

Get more for Private Registered Bond

Find out other Private Registered Bond

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors