Form Vat 28 See Rule 46

What is the Form Vat 28 See Rule 46

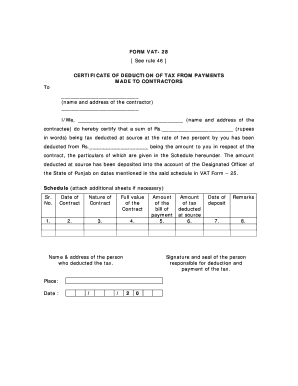

The Form Vat 28 See Rule 46 is a specific document utilized in the context of tax compliance. It is essential for businesses and individuals to accurately report their VAT obligations. This form ensures that taxpayers provide the necessary information regarding their VAT transactions, which helps in maintaining transparency and accountability in tax reporting. Understanding the purpose and requirements of this form is crucial for anyone involved in VAT-related activities.

How to use the Form Vat 28 See Rule 46

Using the Form Vat 28 See Rule 46 involves several straightforward steps. First, gather all relevant financial documents related to your VAT transactions. This may include invoices, receipts, and any other supporting documentation. Next, accurately fill out the form, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions before submission. Proper use of this form can help avoid penalties and ensure compliance with tax regulations.

Steps to complete the Form Vat 28 See Rule 46

Completing the Form Vat 28 See Rule 46 requires careful attention to detail. Follow these steps for successful completion:

- Collect all necessary documentation related to your VAT transactions.

- Fill in your personal or business information at the top of the form.

- Detail your VAT transactions, ensuring accuracy in amounts and dates.

- Double-check the calculations and totals to confirm correctness.

- Sign and date the form to validate your submission.

Legal use of the Form Vat 28 See Rule 46

The legal use of the Form Vat 28 See Rule 46 is governed by specific regulations that ensure compliance with tax laws. It is important to understand that submitting this form accurately is not only a legal requirement but also a means to avoid potential penalties. The form must be completed in accordance with the guidelines set forth by the tax authorities, ensuring that all information is truthful and complete. Failure to comply with these legal standards can result in fines or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form Vat 28 See Rule 46 are critical to avoid penalties. Typically, this form must be submitted by the end of the tax period in which the VAT transactions occurred. It's essential to stay informed about specific deadlines, which may vary based on state regulations or changes in tax law. Marking these dates on your calendar can help ensure timely submission and compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form Vat 28 See Rule 46 can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online submission via the official tax authority’s website.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, where assistance may be available.

Choosing the right submission method can depend on personal preferences and the specific requirements of your local tax authority.

Quick guide on how to complete form vat 28 see rule 46

Complete Form Vat 28 See Rule 46 effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Handle Form Vat 28 See Rule 46 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to modify and eSign Form Vat 28 See Rule 46 without difficulty

- Find Form Vat 28 See Rule 46 and click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form Vat 28 See Rule 46 to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form vat 28 see rule 46

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form Vat 28 See Rule 46?

Form Vat 28 See Rule 46 is a specific tax form utilized to report VAT on certain transactions. Understanding this form is crucial for businesses to remain compliant with tax regulations. By using airSlate SignNow, you can easily eSign and send this form securely, ensuring timely submission.

-

How can airSlate SignNow assist in completing Form Vat 28 See Rule 46?

airSlate SignNow simplifies the process of filling out Form Vat 28 See Rule 46 by providing user-friendly templates and document management features. You can easily edit and sign the form electronically, reducing the time spent on paperwork. This streamlines your workflow and enhances accuracy.

-

Is there a free trial available for using airSlate SignNow to manage Form Vat 28 See Rule 46?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for managing Form Vat 28 See Rule 46. This trial provides full access to eSigning and document management tools, enabling you to assess the platform’s benefits without any commitment. Sign up today to get started!

-

What are the pricing options for airSlate SignNow for handling Form Vat 28 See Rule 46?

airSlate SignNow offers competitive pricing plans tailored to different business needs. Options start at affordable monthly rates, making it cost-effective for managing documents like Form Vat 28 See Rule 46. You can choose a plan that best fits your budget and usage requirements.

-

Can Form Vat 28 See Rule 46 be shared electronically with stakeholders using airSlate SignNow?

Absolutely! With airSlate SignNow, you can share Form Vat 28 See Rule 46 electronically with relevant stakeholders. The platform ensures secure transmission of documents, allowing all parties to access and eSign the form promptly, enhancing collaboration and efficiency.

-

What integrations does airSlate SignNow offer for managing Form Vat 28 See Rule 46?

airSlate SignNow integrates seamlessly with various business platforms, enhancing your ability to manage Form Vat 28 See Rule 46. You can connect with tools like Dropbox, Google Drive, and CRM systems to import, export, and store your documents. This integration helps streamline your workflow.

-

How does airSlate SignNow ensure the security of Form Vat 28 See Rule 46?

Security is a priority at airSlate SignNow, especially for sensitive documents like Form Vat 28 See Rule 46. The platform employs encryption and secure storage practices, ensuring your data is protected throughout the signing process. You can confidently manage your documents knowing they are safe.

Get more for Form Vat 28 See Rule 46

- Oewd form 117 written employment and education verification form

- Pediatric septic shock collaborative triage trigger tool childrens mercy form

- Chemistry form ws8 3 1a

- K wc 50 rev form

- Setting up your cac for use on your macintosh visually form

- Title 310 oklahoma state department of health chapter 664 form

- Payment agent agreement template form

- Paymaster agreement template 787745558 form

Find out other Form Vat 28 See Rule 46

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter