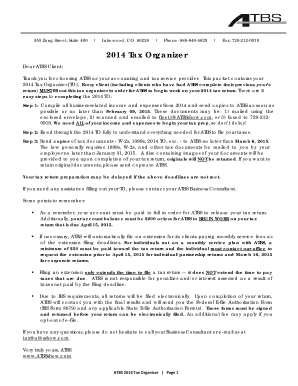

Atbs Tax Organizer Form

What is the Atbs Tax Organizer

The Atbs Tax Organizer is a comprehensive document designed to assist individuals and businesses in gathering and organizing their financial information for tax preparation. This form helps streamline the tax filing process by providing a structured format to collect necessary data, such as income, deductions, and credits. Utilizing the Atbs Tax Organizer ensures that all relevant information is captured efficiently, reducing the risk of errors and omissions during tax filing.

How to Use the Atbs Tax Organizer

Using the Atbs Tax Organizer involves several straightforward steps. First, gather all financial documents, including W-2s, 1099s, and receipts for deductible expenses. Next, fill out the organizer by entering the required information into the designated fields. It is essential to be thorough and accurate to ensure compliance with IRS regulations. Once completed, review the organizer for any missing information before submitting it to your tax preparer or using it for self-filing.

Steps to Complete the Atbs Tax Organizer

Completing the Atbs Tax Organizer can be broken down into clear steps:

- Collect all relevant financial documents, such as income statements and expense receipts.

- Fill out personal information, including your name, address, and Social Security number.

- Document all sources of income, including wages, freelance earnings, and investment income.

- List all deductible expenses, ensuring to categorize them appropriately.

- Double-check all entries for accuracy and completeness.

- Submit the completed organizer to your tax preparer or use it for your own filing process.

Legal Use of the Atbs Tax Organizer

The Atbs Tax Organizer is legally recognized as a valid tool for tax preparation. It complies with IRS guidelines, ensuring that the information provided is suitable for filing tax returns. By using this organizer, taxpayers can maintain accurate records, which is essential for audit purposes. It is crucial to ensure that all information is truthful and complete to avoid potential penalties for non-compliance.

Required Documents

To effectively fill out the Atbs Tax Organizer, certain documents are necessary. These include:

- W-2 forms from employers for reporting wages.

- 1099 forms for reporting freelance or contract income.

- Receipts for deductible expenses, such as medical bills and charitable donations.

- Statements for interest and dividends from bank accounts and investments.

- Any other relevant financial documentation that supports income and deductions.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial when using the Atbs Tax Organizer. The standard deadline for filing personal tax returns is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of any state-specific deadlines that may apply. Filing on time helps avoid penalties and interest on unpaid taxes.

Quick guide on how to complete atbs tax organizer

Finalize Atbs Tax Organizer effortlessly on any device

Digital document administration has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to locate the suitable form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Atbs Tax Organizer on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

The simplest method to alter and electronically sign Atbs Tax Organizer seamlessly

- Locate Atbs Tax Organizer and click on Get Form to begin.

- Utilize the features we provide to finish your form.

- Highlight pertinent sections of your documents or obscure confidential information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Atbs Tax Organizer to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the atbs tax organizer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the atbs phone number for customer support?

The atbs phone number for customer support is available on our website and can be signNowed during business hours. We are dedicated to assisting you with any inquiries or issues about the airSlate SignNow platform. Our support team is ready to provide quick and efficient solutions tailored to your needs.

-

How can I find the atbs phone number for billing inquiries?

To get the atbs phone number for billing inquiries, please visit our billing section on the airSlate SignNow website. Here, you’ll find detailed contact information and support resources. Our team is eager to help you with questions related to pricing and payment options.

-

What features does airSlate SignNow offer?

AirSlate SignNow offers a variety of features including electronic signatures, document templates, and integration options with popular software. These tools are designed to streamline your document workflow and enhance productivity. For detailed inquiries, you can also call us using the atbs phone number.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for new users to experience the platform's features firsthand. This gives you an opportunity to explore our eSigning capabilities without any commitment. For more information on starting your free trial, you can signNow out using the atbs phone number.

-

How does airSlate SignNow ensure document security?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and compliance measures to protect your documents and data. If you have specific security concerns, don't hesitate to contact us through the atbs phone number for more detailed information.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow can seamlessly integrate with various popular applications such as CRM, project management, and cloud storage solutions. This allows for a smoother workflow and enhances user convenience. For a full list of integrations or assistance, please call us using the atbs phone number.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to meet diverse business needs, from individuals to large enterprises. You can find detailed pricing information on our website, and our team is also available for personalized consultation at the atbs phone number.

Get more for Atbs Tax Organizer

- Application form city university london city ac

- Army rotc fitness test form

- Daftar org 44102412 form

- Piping rt result quality control and inspection report form 1

- Sbe form p 8c

- Balanced and unbalanced forces notes answer key form

- Consulting retainer agreement template form

- Consulting fee agreement template form

Find out other Atbs Tax Organizer

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast