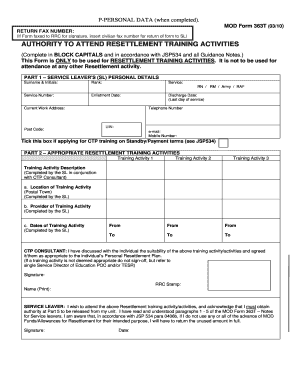

Form 363t

What is the Form 363t

The Form 363t is a specific document utilized in various legal and administrative processes. It serves as a formal means of communication between parties involved in a transaction or agreement. This form is often required for compliance with regulatory standards and is essential for maintaining accurate records.

How to use the Form 363t

Using the Form 363t involves several straightforward steps. First, ensure you have the correct version of the form, as variations may exist based on specific requirements. Next, fill out the necessary information accurately, including names, dates, and relevant details pertaining to the transaction. Once completed, the form should be signed by all parties involved, ensuring that it meets any legal requirements for validity.

Steps to complete the Form 363t

Completing the Form 363t requires careful attention to detail. Follow these steps for accurate submission:

- Obtain the latest version of the Form 363t from a reliable source.

- Read the instructions thoroughly to understand the requirements.

- Fill in all required fields with accurate information.

- Review the completed form for any errors or omissions.

- Sign the form, ensuring that all necessary parties have also signed.

- Submit the form according to the specified submission method.

Legal use of the Form 363t

The legal use of the Form 363t is contingent upon its proper completion and adherence to applicable laws. This form must be filled out with precise information to ensure it is legally binding. Additionally, it is crucial to comply with local regulations and guidelines to avoid any potential disputes or legal issues arising from improper use.

Key elements of the Form 363t

Several key elements must be included in the Form 363t to ensure its validity. These elements typically include:

- Identifying information of all parties involved.

- The date of the transaction or agreement.

- A clear description of the purpose of the form.

- Signatures of all parties, indicating consent and agreement.

Form Submission Methods

The Form 363t can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate office.

- In-person delivery at a specified location.

Quick guide on how to complete form 363t

Manage Form 363t seamlessly on any gadget

Digital document handling has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed records, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you need to create, adjust, and eSign your documents quickly without delays. Handle Form 363t on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Form 363t effortlessly

- Locate Form 363t and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Form 363t and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 363t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 363t and how is it used?

Form 363t is an essential document used for various administrative purposes, particularly in business settings. It allows users to formalize agreements and contracts, ensuring both parties are protected. With airSlate SignNow, you can create, send, and eSign Form 363t effortlessly.

-

How can I eSign Form 363t using airSlate SignNow?

You can easily eSign Form 363t using airSlate SignNow by uploading the document to our platform and adding the required recipient's email. After that, the recipient will receive a secure link to eSign, making the entire process seamless and quick. This eliminates the need for printing and scanning, saving you valuable time.

-

What are the key features of airSlate SignNow for managing Form 363t?

airSlate SignNow offers several key features for managing Form 363t, including customizable templates, advanced security options, and real-time tracking of document status. You can also integrate your existing workflows to streamline the process, making it efficient for businesses of any size. These features enhance productivity and ensure compliance with legal standards.

-

Is there a cost associated with using airSlate SignNow for Form 363t?

Yes, there is a pricing structure for using airSlate SignNow to manage Form 363t, but it is designed to be cost-effective for businesses. We offer various plans depending on your needs, ensuring scalability as your business grows. You can choose a plan that suits your budget while benefiting from our comprehensive eSigning capabilities.

-

Can I integrate airSlate SignNow with other applications when using Form 363t?

Absolutely! airSlate SignNow can be integrated with numerous applications to streamline your workflow when managing Form 363t. This capability allows you to connect with platforms like CRM systems, document storage services, and more, enhancing overall efficiency. Our easy-to-use API ensures seamless integration with your existing systems.

-

What benefits does airSlate SignNow offer when working with Form 363t?

Using airSlate SignNow for Form 363t provides numerous benefits including increased speed of document processing, reduced paperwork, and enhanced security features. The platform ensures that all eSignatures are legally binding and compliant with industry regulations. Additionally, you can track the document’s progress in real-time, ensuring smooth communication.

-

How can airSlate SignNow improve my experience with Form 363t?

airSlate SignNow simplifies your experience with Form 363t by providing a user-friendly interface and intuitive tools for document management. This means you spend less time on administrative tasks and more time focusing on your business goals. The platform also offers excellent customer support to assist you with any inquiries you may have.

Get more for Form 363t

- This graph shows a ball rolling from a to g form

- Crime incident report form boston university police ucsd

- Naming chemical compounds worksheets form

- App 01 00 nevada business registration 7 12 04 form

- Horizon medical equipment form

- Sports physical clearance form take command jfk dpsk12

- Family information sheet 204020057

- Il 1120 x form

Find out other Form 363t

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History