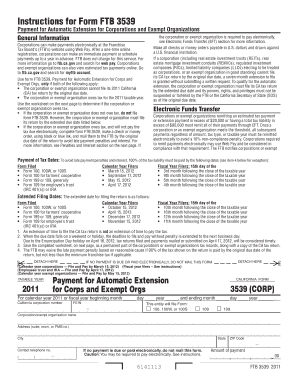

California Franchise Tax 3539 Form

What is the California Franchise Tax 3539 Form

The California Franchise Tax 3539 form is a specific document required by the California Franchise Tax Board (FTB) for certain business entities. This form is primarily used by corporations and limited liability companies (LLCs) to report their estimated tax payments. It is essential for ensuring compliance with state tax obligations and helps businesses maintain their good standing with the FTB.

How to use the California Franchise Tax 3539 Form

Using the California Franchise Tax 3539 form involves several key steps. First, gather all necessary financial information, including your business's income and expenses. Next, accurately fill out the form by entering the required details, such as your business name, address, and estimated tax amount. After completing the form, review it for accuracy to avoid any potential issues. Finally, submit the form by the due date to ensure compliance with California tax regulations.

Steps to complete the California Franchise Tax 3539 Form

Completing the California Franchise Tax 3539 form requires careful attention to detail. Follow these steps:

- Obtain the form from the California Franchise Tax Board website or through authorized distributors.

- Provide your business information, including the name, address, and entity type.

- Calculate your estimated tax liability based on your projected income for the year.

- Enter the estimated tax amount on the form.

- Sign and date the form to certify the information is accurate.

- Submit the completed form by mail or electronically, following the instructions provided by the FTB.

Legal use of the California Franchise Tax 3539 Form

The legal use of the California Franchise Tax 3539 form is crucial for businesses operating in California. This form serves as a declaration of estimated tax payments and must be filed timely to avoid penalties. By using this form, businesses can fulfill their tax obligations and demonstrate compliance with California tax laws. Additionally, proper use of the form can help prevent issues during audits or inquiries from the Franchise Tax Board.

Filing Deadlines / Important Dates

Filing deadlines for the California Franchise Tax 3539 form are critical for maintaining compliance. Typically, the form is due on the 15th day of the fourth month following the end of your business's tax year. For most entities operating on a calendar year, this means the form is due by April 15. It is essential to mark your calendar and ensure that the form is submitted on time to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The California Franchise Tax 3539 form can be submitted through various methods to accommodate different preferences. Businesses can file the form electronically through the California Franchise Tax Board's online portal, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate address listed on the FTB website. In-person submission is also an option at designated FTB offices, although this may require an appointment. Each method ensures that businesses can meet their filing obligations effectively.

Quick guide on how to complete california franchise tax 3539 form

Prepare California Franchise Tax 3539 Form effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to generate, alter, and eSign your documents swiftly without delays. Manage California Franchise Tax 3539 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign California Franchise Tax 3539 Form with ease

- Find California Franchise Tax 3539 Form and click Get Form to begin.

- Make use of the resources we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Adjust and eSign California Franchise Tax 3539 Form and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california franchise tax 3539 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3539 form and how can airSlate SignNow help with it?

The 3539 form is an essential document for various business processes, and airSlate SignNow streamlines its handling. With our platform, you can easily fill out, sign, and send the 3539 form electronically, ensuring compliance and improving efficiency. Our user-friendly interface makes managing this form convenient for all users.

-

Is there a cost associated with using airSlate SignNow for the 3539 form?

Yes, airSlate SignNow provides competitive pricing plans that cater to different business needs. Costs may vary depending on the features you require to manage the 3539 form effectively. We also offer a free trial so you can evaluate our services before committing.

-

What features does airSlate SignNow offer for managing the 3539 form?

airSlate SignNow offers a range of features for the 3539 form, including customizable templates, electronic signatures, and document tracking. These tools ensure that your forms are processed quickly and securely, allowing for a smooth workflow. Our platform also supports team collaboration, letting multiple users work on the form simultaneously.

-

Can airSlate SignNow integrate with other tools for handling the 3539 form?

Absolutely! airSlate SignNow integrates with various third-party applications to enhance your workflow with the 3539 form. Whether you use CRM systems, cloud storage, or project management tools, our integration capabilities help create a seamless experience. This versatility allows you to incorporate airSlate SignNow into your existing processes efficiently.

-

What are the benefits of using airSlate SignNow for the 3539 form?

Using airSlate SignNow for the 3539 form offers numerous advantages, such as time savings, improved compliance, and reduced paper usage. Our platform not only speeds up the signing process but also ensures that your documents are securely stored and easily accessible. Additionally, eSigning eliminates the hassle of faxing and mailing physical copies.

-

Is airSlate SignNow secure for handling sensitive information in the 3539 form?

Yes, security is a top priority at airSlate SignNow. We employ industry-leading encryption protocols and compliance measures to protect sensitive information contained in the 3539 form. This commitment to security ensures that your documents are safe during every stage of processing.

-

How can I begin using airSlate SignNow for my 3539 form needs?

Getting started with airSlate SignNow for the 3539 form is simple. Just visit our website, sign up for an account, and explore our features with a free trial. Our intuitive platform will guide you through the process of creating and managing your 3539 form with ease.

Get more for California Franchise Tax 3539 Form

- Standard written order template form

- Emergency room excuse for work document search engine form

- Prepare food and beverage sales tax monthly remittance formrevised

- Drywall bid template 39933848 form

- Download the award request form air mauritius

- Pharmacy prior authorization form anthem providers

- Hazardous material declaration health amp safety assessment report form

- How to become a marriage and family therapist mft form

Find out other California Franchise Tax 3539 Form

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement