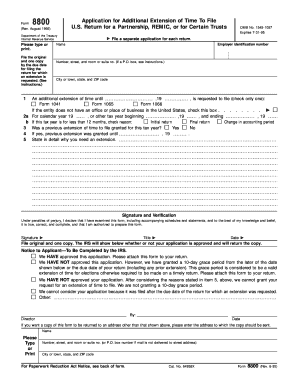

Irs Form 8800

What is the IRS Form 8800?

The IRS Form 8800, also known as the Form 8800 Savers Credit, is a tax form used by eligible taxpayers to claim a credit for contributions made to retirement savings accounts. This form is particularly beneficial for low- to moderate-income earners who contribute to qualified retirement plans, such as 401(k)s or IRAs. By completing this form, taxpayers can reduce their tax liability, making it a valuable tool for enhancing retirement savings.

How to Use the IRS Form 8800

Using the IRS Form 8800 involves several steps to ensure accurate completion and submission. Taxpayers must first determine their eligibility based on income and filing status. Once eligibility is confirmed, they can gather necessary documentation, including proof of retirement contributions. The form requires specific information about the taxpayer and their retirement accounts. After filling out the form, it should be submitted along with the federal tax return, ensuring all details are correct to avoid delays in processing.

Steps to Complete the IRS Form 8800

Completing the IRS Form 8800 involves a systematic approach:

- Determine eligibility based on income limits and filing status.

- Gather documentation of retirement contributions made during the tax year.

- Fill out personal information, including name, address, and Social Security number.

- Provide details of retirement accounts and contributions on the form.

- Calculate the credit amount based on the provided information.

- Review the completed form for accuracy.

- Submit the form with your federal tax return.

Key Elements of the IRS Form 8800

The IRS Form 8800 includes several critical elements that taxpayers must be aware of:

- Personal Information: Name, address, and Social Security number are required.

- Retirement Contributions: Details of contributions made to qualified retirement accounts.

- Credit Calculation: A section to calculate the eligible credit based on contributions and income.

- Signature: The taxpayer must sign the form to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8800 align with the annual tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, which typically extends the deadline to October 15. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Eligibility Criteria

To qualify for the Savers Credit using the IRS Form 8800, taxpayers must meet specific eligibility criteria. These include:

- Being at least eighteen years old.

- Not being a full-time student during the tax year.

- Not being claimed as a dependent on someone else's tax return.

- Meeting income limits set by the IRS, which vary based on filing status.

Legal Use of the IRS Form 8800

The IRS Form 8800 is legally recognized for claiming the Savers Credit, provided that all information is accurate and complete. Compliance with IRS regulations is essential to ensure that the credit is valid. Taxpayers should retain copies of the form and supporting documents for their records, as the IRS may request verification of the claimed credit during audits or reviews.

Quick guide on how to complete irs form 8800

Effortlessly Prepare Irs Form 8800 on Any Device

The digital management of documents has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed materials, allowing for proper form retrieval and secure online storage. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without hassle. Manage Irs Form 8800 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Simple Steps to Modify and Electronically Sign Irs Form 8800 with Ease

- Locate Irs Form 8800 and click Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools designed specifically for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method of delivering the form, whether by email, text message (SMS), an invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and electronically sign Irs Form 8800 while ensuring outstanding communication throughout the entirety of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8800

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8800?

Form 8800 is a document used by businesses to report and claim certain tax credits. This form is essential for ensuring compliance with tax regulations and maximizing benefits. airSlate SignNow simplifies the process of filling out and submitting Form 8800 by providing an intuitive eSigning solution.

-

How can airSlate SignNow help with Form 8800?

airSlate SignNow streamlines the completion and eSigning of Form 8800, making it easy for businesses to gather necessary signatures and submit the form quickly. The platform allows users to create templates, ensuring uniformity and reducing the likelihood of errors. This efficiency helps businesses meet their tax responsibilities more effectively.

-

Is there a cost associated with using airSlate SignNow for Form 8800?

Yes, airSlate SignNow offers several pricing plans to cater to different business needs. Users can choose a plan that includes features for efficiently managing Form 8800 and other documents. A free trial is also available for businesses to explore the platform before committing.

-

What features does airSlate SignNow offer for Form 8800 management?

airSlate SignNow includes features like document templates, real-time tracking, and integration with other software to manage Form 8800 efficiently. The platform ensures that all parties involved can sign documents electronically anytime and anywhere. Additionally, audit trails provide transparency and security.

-

Can I integrate airSlate SignNow with my existing systems for Form 8800 handling?

Absolutely! airSlate SignNow offers robust integrations with various CRM, ERP, and productivity tools, facilitating seamless document management for Form 8800. This enables businesses to streamline their workflows and improve overall productivity when dealing with tax documents.

-

What are the benefits of using airSlate SignNow for Form 8800?

Using airSlate SignNow for Form 8800 offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced compliance. The platform automates routine tasks, allowing users to focus on more critical business operations. Additionally, eSigning helps speed up the process of obtaining necessary approvals.

-

Is airSlate SignNow secure for eSigning Form 8800?

Yes, airSlate SignNow employs industry-standard security measures to protect sensitive information related to Form 8800. With end-to-end encryption and secure access protocols, businesses can trust that their documents remain safe throughout the signing process. Compliance with regulations further assures secure transactions.

Get more for Irs Form 8800

- Questionnaire email form

- Form 941 prrev january employers quarterly federal tax return puerto rican version

- Cers accessid request form

- Word choice exercise 1 answer key form

- Medical claim form php carolinas

- Speed ii questionnaire for dry eye diseaseocular surface disease form

- Physician order request form

- Ancillary data intake form providers amerihealth caritas north carolina ancillary data intake form

Find out other Irs Form 8800

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document