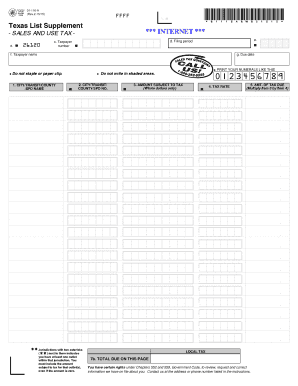

01 116 Form

What is the 01 116

The 01 116 form is a crucial document used in various administrative processes within the United States. It serves specific purposes depending on the context in which it is utilized, often related to legal or financial transactions. Understanding the nature of this form is essential for individuals and businesses alike, as it ensures compliance with relevant regulations and facilitates smooth operations.

How to use the 01 116

Using the 01 116 form effectively involves several steps. First, identify the specific purpose for which the form is required. Next, gather all necessary information and documentation needed to complete the form accurately. Once you have all the details, fill out the form carefully, ensuring that all entries are clear and legible. After completing the form, review it for accuracy before submission.

Steps to complete the 01 116

Completing the 01 116 form involves a systematic approach:

- Gather required information, including personal details and any supporting documents.

- Carefully read the instructions associated with the form to understand specific requirements.

- Fill out the form, ensuring all fields are completed accurately.

- Review the completed form for errors or omissions.

- Submit the form through the appropriate channels, whether online or by mail.

Legal use of the 01 116

The legal validity of the 01 116 form hinges on its proper completion and adherence to regulatory standards. It is essential to ensure that all signatures and required information are present. Utilizing a reliable eSignature solution, such as signNow, enhances the legal standing of the form by providing necessary authentication and compliance with electronic signature laws.

Key elements of the 01 116

Several key elements define the 01 116 form and its usage:

- Identification Information: This includes personal or business details necessary for processing.

- Signature Requirements: Signatures must be provided to validate the form.

- Submission Guidelines: Adhering to the specific submission methods is crucial for acceptance.

- Compliance Standards: The form must meet legal requirements to be considered valid.

Filing Deadlines / Important Dates

Timeliness is critical when dealing with the 01 116 form. Specific deadlines may apply depending on the purpose of the form. It is advisable to be aware of these dates to avoid penalties or complications. Keeping a calendar with important filing dates can help ensure compliance and timely submission.

Quick guide on how to complete 01 116

Complete 01 116 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, enabling you to locate the right form and securely archive it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents promptly without delays. Handle 01 116 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to alter and eSign 01 116 without any hassle

- Obtain 01 116 and then click Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you would prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device of your choice. Modify and eSign 01 116 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 01 116

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 01 116?

airSlate SignNow is a powerful eSignature solution that enables businesses to send, sign, and manage documents efficiently. The term '01 116' refers to a specific feature within the platform that enhances document security and compliance for users. With airSlate SignNow, you can leverage '01 116' to ensure your documents are protected and legally binding.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose. Generally, you can expect competitive pricing that reflects the features offered, including the '01 116' feature for advanced security. Visit our website to explore different pricing tiers and find the plan that suits your business needs.

-

What key features does the 01 116 function offer?

The '01 116' feature in airSlate SignNow includes advanced encryption and signature tracking, ensuring that all your documents are secure and easily accessible. This functionality streamlines your workflow, allowing for a more efficient signing process. Users can benefit from enhanced security that meets industry standards.

-

What benefits does airSlate SignNow provide to businesses using 01 116?

By utilizing the '01 116' feature, businesses can experience increased productivity and reduced turnaround times for document signing. This ensures that your operations run smoothly and securely. Additionally, the ease of use encourages team collaboration and enhances customer satisfaction.

-

Can airSlate SignNow integrate with other software systems?

Yes, airSlate SignNow offers various integrations with popular software solutions, which can include CRM and productivity tools. The '01 116' feature works seamlessly within these integrations, allowing for a smooth transition of documents. This capability enhances your existing workflows and improves overall efficiency.

-

How does airSlate SignNow ensure document security with 01 116?

AirSlate SignNow prioritizes document security with its '01 116' feature, which incorporates multi-layered security measures such as encryption and user authentication. These measures are designed to comply with legal standards, ensuring that all signed documents are secure and tamper-proof. You can trust that your sensitive information is protected.

-

Is it easy to use airSlate SignNow for signing documents with the 01 116 feature?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to send and sign documents. The '01 116' feature is straightforward to navigate, ensuring that users of all skill levels can quickly adopt the platform for their eSigning needs. We also provide resources to assist with any questions.

Get more for 01 116

- Primary care physician notification form

- Uptravi enrollment form

- Check request template form

- Motor dealers and chattel auctioneers form 12 cooling off

- Promise to pay agreement azusa pacific university apu form

- Evacuation roll call site attendance checklist dep form

- Fbu form

- Kennesaw state university vendor registration form kennesaw

Find out other 01 116

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship