Irs Form 668 a PDF

What is the IRS Form 668 A PDF?

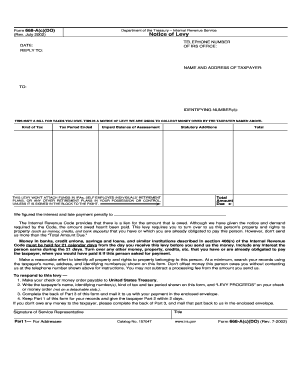

The IRS Form 668 A is a legal document used by the Internal Revenue Service to notify a taxpayer of a lien against their property due to unpaid taxes. This form serves as a public record of the IRS's claim and is essential for both the taxpayer and potential creditors. The form includes details such as the taxpayer's name, the amount owed, and the specific property affected by the lien. Understanding this form is crucial for anyone facing tax issues, as it outlines the IRS's rights and the taxpayer's obligations.

How to Obtain the IRS Form 668 A PDF

To obtain the IRS Form 668 A PDF, taxpayers can visit the official IRS website, where the form is available for download. It is important to ensure that the most current version is used, as outdated forms may not be accepted. Additionally, taxpayers may request a copy of the form by contacting the IRS directly or visiting a local IRS office. Having the correct form is essential for addressing any tax-related issues effectively.

Steps to Complete the IRS Form 668 A PDF

Completing the IRS Form 668 A requires careful attention to detail. Here are the steps to follow:

- Download the form from the IRS website or obtain a physical copy.

- Fill in the taxpayer's name, address, and Social Security number accurately.

- Specify the amount owed and any relevant details about the property subject to the lien.

- Sign and date the form to validate the information provided.

- Submit the completed form to the appropriate IRS office or follow the instructions for online submission.

Legal Use of the IRS Form 668 A PDF

The IRS Form 668 A PDF has legal significance as it officially documents the IRS's claim against a taxpayer's property. This form must be filled out correctly to ensure that it is legally binding. It is essential for taxpayers to understand their rights and obligations when dealing with this form, as it can impact their credit and financial standing. Proper legal use includes timely submission and adherence to IRS guidelines.

Key Elements of the IRS Form 668 A PDF

Several key elements define the IRS Form 668 A PDF, including:

- Taxpayer Information: Name, address, and identification number.

- Amount Owed: The total amount of taxes due.

- Property Description: Details about the property affected by the lien.

- IRS Contact Information: Where to send the completed form and any inquiries.

Penalties for Non-Compliance

Failure to comply with the requirements of the IRS Form 668 A can result in serious consequences. Taxpayers may face additional penalties, interest on unpaid taxes, and potential legal action from the IRS. It is crucial to address any liens promptly and to seek assistance if there are difficulties in resolving tax obligations. Understanding the implications of non-compliance can help taxpayers take proactive steps to mitigate risks.

Quick guide on how to complete irs form 668 a pdf 14880783

Prepare Irs Form 668 A Pdf seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a suitable environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage Irs Form 668 A Pdf across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Irs Form 668 A Pdf effortlessly

- Obtain Irs Form 668 A Pdf and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information using the features that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as an old-fashioned wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign Irs Form 668 A Pdf while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 668 a pdf 14880783

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 668A and why might I need it?

IRS Form 668A is a notice of levy used by the Internal Revenue Service to notify you that your property is subject to seizure to satisfy a tax debt. You might need it if you receive this form, as it indicates that the IRS intends to collect outstanding taxes from assets or income.

-

How can airSlate SignNow help with IRS Form 668A?

airSlate SignNow offers an easy-to-use electronic signature solution that enables you to securely sign and send IRS Form 668A documents. This streamlines the process, ensuring timely responses and compliance with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for IRS Form 668A?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Each plan provides features that can help manage the signing and sending of IRS Form 668A efficiently and cost-effectively.

-

What features does airSlate SignNow offer for handling IRS Form 668A?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking, which are essential for managing IRS Form 668A. These tools enhance productivity and help ensure that documents are processed smoothly.

-

Can I integrate airSlate SignNow with my existing software to manage IRS Form 668A?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to incorporate features for managing IRS Form 668A into your existing workflows. This integration simplifies the process and enhances efficiency.

-

What benefits does airSlate SignNow offer for IRS Form 668A processing?

Using airSlate SignNow for IRS Form 668A processing offers numerous benefits, including improved document security and faster turnaround times. The platform simplifies signing and tracking, helping you manage your tax-related documents more effectively.

-

Is the electronic signature on IRS Form 668A legally binding?

Yes, electronic signatures made through airSlate SignNow are legally binding and comply with eSignature laws, making them valid for IRS Form 668A. This ensures that your signed documents hold up under legal scrutiny.

Get more for Irs Form 668 A Pdf

- Baladiya form

- Ma form 355 7004

- Alberta delivery record part two form

- Biokinetic spinal evaluation form affordable medical cover affordablemedicalcover co

- Test di folstein online form

- Pet information sheet vshsdcom

- C o b c a r e s maxine mcclean scholarship awards programme application form

- The peace corps welcomes you to tanzania peace corps welcome book for volunteers going to tanzania peace corps peacecorps form

Find out other Irs Form 668 A Pdf

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament