Gpf Withdrawal Form

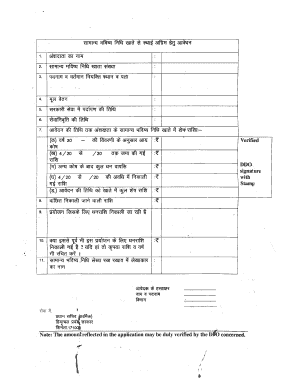

What is the GPF Withdrawal Form

The GPF withdrawal form is a document used by individuals to request the withdrawal of their General Provident Fund (GPF) savings. This form is essential for employees who wish to access their accumulated funds, typically upon retirement, resignation, or other qualifying events. It serves as an official request to the relevant authorities to process the withdrawal and release the funds to the employee.

How to Obtain the GPF Withdrawal Form

To obtain the GPF withdrawal form, individuals can typically visit the official website of their employer or the relevant government department managing the GPF. Many organizations provide downloadable versions of the form. Additionally, employees can request a physical copy from their human resources department or finance office. It is important to ensure that the correct version of the form is used to avoid delays in processing.

Steps to Complete the GPF Withdrawal Form

Completing the GPF withdrawal form involves several key steps:

- Gather necessary personal information, including your employee ID and contact details.

- Provide the reason for withdrawal, such as retirement or resignation.

- Specify the amount to be withdrawn, ensuring it complies with the rules governing GPF withdrawals.

- Sign and date the form to validate your request.

- Submit the form to the appropriate department, either electronically or in person, as required.

Legal Use of the GPF Withdrawal Form

The GPF withdrawal form must be completed and submitted in accordance with applicable laws and regulations. This includes ensuring that all information is accurate and that the form is signed appropriately. The legal validity of the form is reinforced by compliance with electronic signature laws, such as the ESIGN Act, which recognizes eSignatures as legally binding when specific criteria are met.

Key Elements of the GPF Withdrawal Form

Several key elements are essential for the GPF withdrawal form to be considered complete and valid:

- Personal Information: Full name, employee ID, and contact details.

- Withdrawal Details: Reason for withdrawal and the amount requested.

- Signature: A valid signature or eSignature to authenticate the request.

- Date: The date on which the form is completed and submitted.

Form Submission Methods

The GPF withdrawal form can typically be submitted through various methods, depending on the employer's policies:

- Online Submission: Many organizations allow electronic submission via their HR portals.

- Mail: The form can be printed and sent via postal service to the designated department.

- In-Person: Employees may also submit the form directly to their HR or finance office.

Quick guide on how to complete gpf withdrawal form

Complete gpf withdrawal form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely maintain it online. airSlate SignNow equips you with all the features necessary to create, edit, and eSign your documents promptly without holdups. Manage gpf withdrawal form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign gpf withdrawal form with ease

- Obtain gpf withdrawal form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign gpf withdrawal form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to gpf withdrawal form

Create this form in 5 minutes!

How to create an eSignature for the gpf withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask gpf withdrawal form

-

What is a GPF withdrawal form and why is it important?

A GPF withdrawal form is a mandatory document that allows employees to withdraw from their General Provident Fund account. This form serves as a formal request to access accumulated funds, ensuring a smooth financial transition during retirement or job changes. Understanding its importance can facilitate timely processing and prevent delays.

-

How can I create a GPF withdrawal form using airSlate SignNow?

Creating a GPF withdrawal form with airSlate SignNow is straightforward. Simply utilize our user-friendly platform to upload your document, add necessary fields for signatures, and customize it to meet your requirements. Once set up, you can easily send it for eSigning, ensuring quick processing and compliance.

-

Are there any costs associated with using the GPF withdrawal form on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include the ability to create and manage a GPF withdrawal form. We provide a subscription model that caters to different business sizes and needs, ensuring that you get the best value for your eSigning and document management requirements.

-

What features does airSlate SignNow offer for managing GPF withdrawal forms?

With airSlate SignNow, you can easily create, send, and track your GPF withdrawal forms. Our platform allows for real-time updates, document templates, and automated reminders, ensuring a seamless workflow. Furthermore, our robust security features protect sensitive information throughout the signing process.

-

How does airSlate SignNow enhance the eSigning process for GPF withdrawal forms?

airSlate SignNow boosts the eSigning process for GPF withdrawal forms by providing an intuitive interface that simplifies the signing experience. You can track the status of your forms in real-time, receive notifications, and integrate with various applications to enhance workflow. This ensures that your documents are signed quickly and efficiently.

-

Can I integrate airSlate SignNow with other tools for managing GPF withdrawal forms?

Yes, airSlate SignNow can be easily integrated with a range of applications to streamline the management of GPF withdrawal forms. Whether it's CRM systems or document storage solutions, our platform allows for seamless connectivity, enabling you to maintain a smooth operational flow. Integration improves efficiency and saves time in document handling.

-

What are the benefits of using airSlate SignNow for GPF withdrawal forms over traditional methods?

Utilizing airSlate SignNow for GPF withdrawal forms offers several benefits over traditional paper-based methods. It reduces processing time signNowly, minimizes the risk of errors, and provides secure storage for your documents. Additionally, the platform enhances collaboration, allowing for easy communication and updates between parties.

Get more for gpf withdrawal form

Find out other gpf withdrawal form

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy