Form CT 1040V CT Gov Ct

What is the Form CT 1040V CT gov Ct

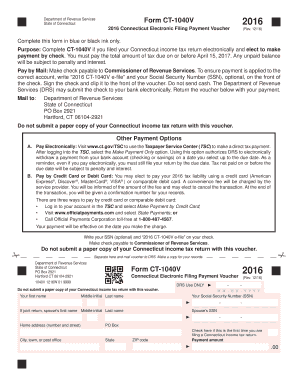

The Form CT 1040V is a payment voucher used by taxpayers in Connecticut to submit their state income tax payments. This form is essential for individuals who owe taxes and want to ensure their payments are processed correctly by the Connecticut Department of Revenue Services. The CT 1040V helps streamline the payment process, allowing taxpayers to provide necessary details such as their name, address, and Social Security number, along with the payment amount. Using this form can help avoid delays and ensure compliance with state tax regulations.

How to use the Form CT 1040V CT gov Ct

To use the Form CT 1040V effectively, start by downloading the form from the official Connecticut government website or accessing it through authorized tax software. Fill in your personal information, including your name, address, and Social Security number. Indicate the payment amount you are submitting. After completing the form, you can either mail it along with your payment to the designated address or submit it electronically if your payment method allows for it. Ensure that you keep a copy of the completed form for your records.

Steps to complete the Form CT 1040V CT gov Ct

Completing the Form CT 1040V involves several straightforward steps:

- Download the form from the Connecticut Department of Revenue Services website.

- Enter your personal information, including your full name, address, and Social Security number.

- Specify the payment amount you are submitting.

- Review the form for accuracy to avoid any potential issues.

- Choose your submission method: mail it with your payment or submit electronically.

- Keep a copy of the completed form and payment for your records.

Legal use of the Form CT 1040V CT gov Ct

The Form CT 1040V is legally recognized as a valid method for submitting state income tax payments in Connecticut. It serves as proof of payment when filed correctly. To ensure its legal standing, taxpayers must adhere to all relevant tax laws and regulations. This includes submitting the form by the appropriate deadlines and providing accurate information. Failure to comply with these requirements may result in penalties or delays in processing payments.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form CT 1040V is crucial for taxpayers. Typically, payments are due on the same day as the state income tax return, which is usually April 15 for most individuals. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines announced by the Connecticut Department of Revenue Services to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form CT 1040V. The most common methods include:

- Mail: Send the completed form along with your payment to the address specified on the form.

- Online: Use the Connecticut Department of Revenue Services' online payment system, which may allow for electronic submission of the form.

- In-Person: Visit a local Department of Revenue Services office to submit the form and payment directly.

Choosing the right submission method can help ensure timely processing of your payment.

Quick guide on how to complete form ct 1040v ct gov ct

Complete Form CT 1040V CT gov Ct effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Handle Form CT 1040V CT gov Ct on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form CT 1040V CT gov Ct with ease

- Find Form CT 1040V CT gov Ct and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, either by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and eSign Form CT 1040V CT gov Ct and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 1040v ct gov ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 1040V CT gov Ct?

Form CT 1040V CT gov Ct is a payment voucher form used by taxpayers in Connecticut to submit payments with their income tax returns. This form helps ensure that payments are processed accurately by the state and is essential for meeting your tax obligations.

-

How can airSlate SignNow help with Form CT 1040V CT gov Ct?

airSlate SignNow streamlines the process of filling out and sending Form CT 1040V CT gov Ct. Our user-friendly platform allows for easy eSigning and document management, ensuring that your tax forms are submitted securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form CT 1040V CT gov Ct?

Yes, airSlate SignNow offers various pricing plans that are budget-friendly for businesses and individuals alike. Each plan provides access to essential features to manage documents like Form CT 1040V CT gov Ct effectively, ensuring a cost-effective solution for eSigning.

-

What features does airSlate SignNow offer for Form CT 1040V CT gov Ct?

Our platform offers features such as easy eSignature capture, customizable workflows, and secure document storage specifically for handling forms like Form CT 1040V CT gov Ct. These tools can help you streamline your tax filing process and enhance document integrity.

-

Can I integrate airSlate SignNow with other applications for Form CT 1040V CT gov Ct?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and CRMs, which facilitate the easy management of documents like Form CT 1040V CT gov Ct. This allows you to centralize your workflows and keep your documents organized.

-

What are the benefits of using airSlate SignNow for Form CT 1040V CT gov Ct?

Using airSlate SignNow for Form CT 1040V CT gov Ct simplifies the eSigning process, reduces paperwork, and enhances overall efficiency. You can track your document's status in real-time, ensuring that your tax submissions are handled promptly.

-

How secure is airSlate SignNow for handling Form CT 1040V CT gov Ct?

airSlate SignNow prioritizes security with features like encryption and compliance with various regulations. When handling sensitive forms like Form CT 1040V CT gov Ct, you can trust that your information is protected and managed with the highest standards of security.

Get more for Form CT 1040V CT gov Ct

- Affirms under penalties of perjury that form

- Continuance request form minnesota judicial branch mncourts

- South carolina mortgage south carolina bar association scbar form

- Residential specialty license reinstatement application form

- Acrobat south carolina judicial department judicial state sc form

- Scca form 223b 2 doc judicial state sc

- Homestead exemptionsmcadofficial site form

- Ea 120 response to request for elder or dependent adult abuse restraining orders form

Find out other Form CT 1040V CT gov Ct

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple