Homestead ExemptionsMCADOfficial Site 2023-2026

Eligibility Criteria for Veteran Property Tax Exemption

The veteran property tax exemption is designed to provide financial relief to eligible veterans and their surviving spouses. To qualify for this exemption, applicants must meet specific criteria, which can vary by state. Generally, the following conditions apply:

- The applicant must be a veteran who has served in the U.S. Armed Forces.

- Proof of service, such as a discharge document or DD-214, is typically required.

- Some states may require a disability rating from the Department of Veterans Affairs (VA) to qualify for additional exemptions.

- The property for which the exemption is claimed must be the applicant's primary residence.

- Surviving spouses may also be eligible, depending on state laws and the circumstances of the veteran's death.

Application Process & Approval Time

The application process for the veteran property tax exemption involves several steps to ensure that all necessary information is collected. Applicants should follow these general steps:

- Obtain the appropriate application form from the local tax assessor's office or the state’s official website.

- Complete the form, providing all required information, including proof of military service and any necessary documentation regarding disability status.

- Submit the completed application by the specified deadline, which can vary by state.

- Once submitted, the local tax authority will review the application and may contact the applicant for additional information.

- Approval times can vary, but applicants should expect to receive a decision within a few weeks to a few months, depending on local processing times.

Required Documents for Application

To successfully apply for the veteran property tax exemption, applicants must gather and submit several key documents. These documents typically include:

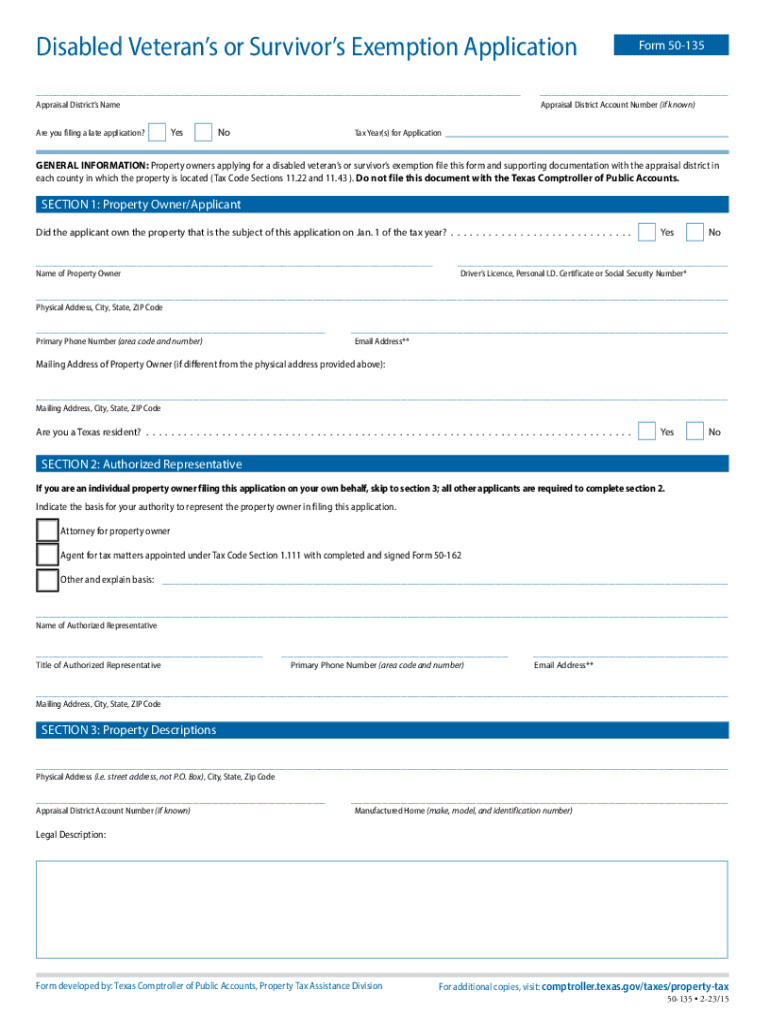

- A completed application form, such as the Texas Form 50-135 for Texas residents.

- Proof of military service, such as a DD-214 or other official discharge documents.

- Documentation of disability status, if applicable, which may include a letter from the VA detailing the veteran's disability rating.

- Identification documents, such as a driver's license or state ID, to verify residency.

- Any additional paperwork required by the local tax authority, which may vary by jurisdiction.

Filing Deadlines / Important Dates

Each state has specific deadlines for submitting applications for the veteran property tax exemption. It is crucial for applicants to be aware of these dates to ensure timely submission. Common deadlines include:

- Application submission deadlines, which may be set for the beginning of the tax year.

- Renewal deadlines for those who have previously received the exemption, as some states require periodic reapplication.

- Important dates for local tax assessments, which can affect the amount of tax owed and the impact of the exemption.

Form Submission Methods

Applicants can submit their veteran property tax exemption forms through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website, which may offer a digital form for convenience.

- Mailing the completed form to the appropriate tax office, ensuring it is sent well before the deadline.

- In-person submission at the local tax assessor's office, where applicants may also receive assistance if needed.

State-Specific Rules for Veteran Property Tax Exemption

Each state in the U.S. has its own regulations regarding the veteran property tax exemption. These rules can influence eligibility, application procedures, and the amount of tax relief provided. Key differences may include:

- The specific documentation required for application.

- The percentage of tax exemption available, which can vary based on the veteran's disability status.

- Additional exemptions or benefits for surviving spouses, which may differ from state to state.

- Local variations in deadlines and submission methods, necessitating careful attention to state guidelines.

Quick guide on how to complete homestead exemptionsmcadofficial site

Effortlessly Prepare Homestead ExemptionsMCADOfficial Site on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly option compared to conventional printed and signed documentation, allowing you to access the necessary forms and save them securely online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Homestead ExemptionsMCADOfficial Site on any device using the airSlate SignNow Android or iOS applications and streamline your document processes today.

How to Edit and Electronically Sign Homestead ExemptionsMCADOfficial Site with Ease

- Find Homestead ExemptionsMCADOfficial Site and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Craft your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional signature with ink.

- Verify the information and hit the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns regarding lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Homestead ExemptionsMCADOfficial Site to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homestead exemptionsmcadofficial site

Create this form in 5 minutes!

How to create an eSignature for the homestead exemptionsmcadofficial site

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the veteran property tax exemption?

The veteran property tax exemption is a benefit available to eligible veterans that reduces the amount of property tax they owe. This exemption can provide signNow savings, helping veterans manage their finances more effectively. Understanding this exemption is crucial for veterans looking to minimize their tax burden.

-

Who qualifies for the veteran property tax exemption?

Eligibility for the veteran property tax exemption typically includes veterans who have served in the military and have been honorably discharged. Each state may have specific criteria, so it's important to check local regulations. Additionally, some exemptions may extend to the surviving spouses of veterans.

-

How can the veteran property tax exemption benefit me?

The veteran property tax exemption can signNowly reduce the amount of property taxes you need to pay, providing financial relief and stability. This benefit can free up funds for other essential expenses or savings. Taking advantage of this exemption can greatly support veterans in managing their home ownership costs.

-

How do I apply for the veteran property tax exemption?

To apply for the veteran property tax exemption, you typically need to complete a specific application form provided by your local tax authority. It's essential to gather necessary documentation, such as proof of military service. Consulting your local government website can provide detailed application steps and deadlines.

-

Are there any specific deadlines for applying for the veteran property tax exemption?

Yes, there are often specific deadlines associated with applying for the veteran property tax exemption, which can vary by state and locality. Missing these deadlines may result in missing out on tax benefits for that year. It’s essential to check your local tax authority's guidelines for the exact dates.

-

Will the veteran property tax exemption affect my ability to sell my home?

The veteran property tax exemption does not typically affect your ability to sell your home. However, it's important to understand how transferring ownership might impact the exemption status. Consulting with a tax advisor can help clarify these aspects to ensure a smooth selling process.

-

Can I receive additional benefits along with the veteran property tax exemption?

Yes, many veterans may qualify for additional benefits alongside the veteran property tax exemption, including other tax breaks and financial assistance programs. Combining these benefits can enhance your financial situation and provide greater savings. It's advisable to explore all available options to maximize your benefits.

Get more for Homestead ExemptionsMCADOfficial Site

- Hcc emergency loan form

- Personal tax credit return bc 100114392 form

- Histology connective tissue haspi answers form

- Opm form 71 rev september

- Lafayette life insurance forms

- Second circuit oral argument statement form

- Five day notice for nonpayment of rent form

- Pursuant to chapter 45 uniform probate code

Find out other Homestead ExemptionsMCADOfficial Site

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online