1040x Form

What is the 1040x Form

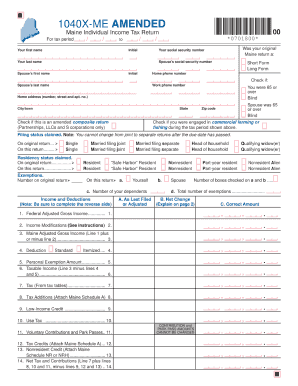

The 1040x form is the official document used by taxpayers in the United States to amend their previously filed federal income tax returns. This form allows individuals to correct errors or make changes to their tax information, such as income, deductions, or credits. It is important to note that the 1040x form cannot be used to change a return that has already been adjusted by the IRS or to amend a return for a year that is not within the statute of limitations.

Steps to complete the 1040x Form

Completing the 1040x form involves several key steps to ensure accuracy and compliance. First, gather all relevant tax documents, including the original tax return and any supporting documentation for the changes being made. Second, fill out the 1040x form, clearly indicating the changes in the appropriate sections. It is essential to provide a detailed explanation of why the changes are being made. Finally, review the completed form for errors before submitting it to the IRS.

How to obtain the 1040x Form

The 1040x form can be obtained directly from the IRS website or through various tax preparation software programs. It is available as a downloadable PDF, which can be printed and completed by hand. Additionally, taxpayers can request a physical copy of the form by contacting the IRS directly. It is advisable to ensure that you are using the correct version of the form for the tax year you are amending.

Legal use of the 1040x Form

The legal use of the 1040x form is governed by IRS regulations, which stipulate that it must be filed within three years of the original return's due date or within two years of the date the tax was paid, whichever is later. To ensure that the amended return is legally binding, it is crucial to sign and date the form appropriately. Additionally, any changes made on the 1040x must be supported by documentation that verifies the adjustments.

Filing Deadlines / Important Dates

When filing the 1040x form, it is important to be aware of the deadlines associated with it. Generally, the form must be submitted within three years from the original tax return due date, including extensions. Taxpayers should also consider the deadlines for any state tax amendments, as these may differ from federal deadlines. Keeping track of these dates can help avoid penalties and ensure compliance with tax laws.

Form Submission Methods (Online / Mail / In-Person)

The 1040x form can be submitted to the IRS via mail, as electronic filing is not currently available for amended returns. When mailing the form, it is recommended to send it via certified mail to ensure it is received. Taxpayers should also keep a copy of the completed form for their records. In-person submissions are not typically accepted for the 1040x form, as the IRS encourages taxpayers to use postal services for this process.

Quick guide on how to complete 1040x form

Prepare 1040x Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without any delays. Manage 1040x Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign 1040x Form without breaking a sweat

- Find 1040x Form and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information carefully and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign 1040x Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040x Form?

The 1040x Form is an amended U.S. federal income tax return form that allows taxpayers to make corrections to their original 1040 forms. It is crucial for ensuring that tax returns are accurate and up-to-date. Utilizing the 1040x Form can help taxpayers claim missed deductions or correct errors.

-

How can airSlate SignNow help with the 1040x Form?

airSlate SignNow streamlines the process of filling out and eSigning the 1040x Form, providing an easy-to-use platform for both individuals and businesses. Our solution allows for quick document transmission and secure electronic signatures, ensuring that your amended return is submitted efficiently. This saves time and reduces the complexity involved in handling tax documents.

-

Is there a cost associated with using airSlate SignNow for the 1040x Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans provide access to features that streamline the signing and management of the 1040x Form. Considering the time and resources saved, many users find our cost-effective solution to be an excellent investment.

-

What features does airSlate SignNow offer for the 1040x Form?

airSlate SignNow features easy-to-use templates, mobile compatibility, and secure eSigning capabilities specifically for documents like the 1040x Form. Additionally, our platform provides tracking options that keep you updated on the signing status of your form, ensuring that you never lose sight of your important tax documentation.

-

Can I integrate airSlate SignNow with other software for the 1040x Form?

Absolutely! airSlate SignNow offers integrations with various popular software solutions, which can enhance your workflow for managing the 1040x Form. Whether you're using accounting software or a customer relationship management system, integrating our eSigning platform can simplify the submission process.

-

What benefits does using airSlate SignNow provide for filing the 1040x Form?

Using airSlate SignNow for your 1040x Form filing provides several benefits, including faster processing times and enhanced document security. The platform's user-friendly interface ensures you can complete your amendments without hassle, while electronic signatures help avoid the delays associated with traditional paper methods.

-

How secure is the airSlate SignNow platform for submitting the 1040x Form?

The security of your documents is our top priority. airSlate SignNow utilizes advanced encryption and compliance with industry standards to safeguard your information when submitting the 1040x Form. You can trust that your sensitive tax data remains protected throughout the eSigning process.

Get more for 1040x Form

- New patient medical history form pdf family medical maternity

- Council on aging fitness program medical clearance form chicopeema

- Us script pbm for louisiana healthcare connections form

- Ulthera pdf form

- Income eligibility statement connecticut state department of sde ct form

- Youth program registration form stonington ct stonington ct

- Letter of support lloyd f moss clinic lloydfmossclinic form

- Survivors invite relay for life relay acsevents form

Find out other 1040x Form

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter