Printable Payee Records Form

What is the Printable Payee Records Form

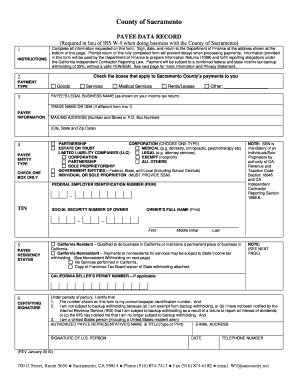

The Printable Payee Records Form is a document used primarily for recording payments made to individuals or entities. This form is essential for businesses and organizations that need to keep accurate records of payees for tax reporting purposes. It typically includes details such as the payee's name, address, tax identification number, and the amount paid. This form helps ensure compliance with IRS regulations and can be crucial during audits or tax filings.

How to use the Printable Payee Records Form

Using the Printable Payee Records Form involves several straightforward steps. First, gather all necessary information about the payee, including their legal name, address, and tax identification number. Next, fill out the form accurately, ensuring that all details are correct to avoid issues with tax reporting. Once completed, the form can be printed for physical records or saved as a digital file for electronic submission. It is important to retain a copy for your records, as this can be beneficial during tax season or if any discrepancies arise.

Steps to complete the Printable Payee Records Form

Completing the Printable Payee Records Form requires attention to detail. Follow these steps:

- Collect the payee's information, including their name, address, and tax identification number.

- Enter the payment amount and date on the form.

- Review the form for accuracy, ensuring all fields are filled out correctly.

- Sign and date the form if required, depending on your organization's policies.

- Make a copy for your records before submitting or filing the form.

Legal use of the Printable Payee Records Form

The Printable Payee Records Form is legally binding when filled out correctly and used in accordance with IRS guidelines. It serves as a record of payments made, which can be essential for tax compliance. To ensure its legal standing, it is important to follow all applicable laws regarding record-keeping and reporting. Additionally, using a secure method for submitting the form, such as electronic signature solutions, can further enhance its legal validity.

Key elements of the Printable Payee Records Form

Several key elements must be included in the Printable Payee Records Form to ensure it serves its purpose effectively:

- Payee Information: Name, address, and tax identification number.

- Payment Details: Amount paid and the date of payment.

- Signature: Depending on the organization, a signature may be required to validate the form.

- Record-Keeping: A section for notes or additional information can be beneficial for future reference.

Examples of using the Printable Payee Records Form

The Printable Payee Records Form can be used in various scenarios, including:

- Documenting payments made to independent contractors for services rendered.

- Recording reimbursements to employees for business-related expenses.

- Tracking payments to vendors for goods or services provided to the organization.

Quick guide on how to complete printable payee records form

Complete Printable Payee Records Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your files swiftly without delays. Handle Printable Payee Records Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

The easiest method to alter and eSign Printable Payee Records Form without hassle

- Find Printable Payee Records Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Printable Payee Records Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable payee records form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Printable Payee Records Form?

The Printable Payee Records Form is a document used to maintain accurate records of payments made to individuals or entities. This form is essential for businesses that need to track disbursements and ensure compliance with payment reporting requirements.

-

How can I access the Printable Payee Records Form?

You can easily access the Printable Payee Records Form through the airSlate SignNow platform. Simply log in to your account, navigate to the templates section, and download or fill out the form directly online.

-

Is the Printable Payee Records Form customizable?

Yes, the Printable Payee Records Form is fully customizable to meet your specific needs. You can modify fields, add branding elements, and adjust signing requirements to ensure the form aligns perfectly with your business processes.

-

What are the key features of airSlate SignNow related to the Printable Payee Records Form?

airSlate SignNow offers seamless eSignature capabilities, document sharing, and real-time collaboration features for the Printable Payee Records Form. Additionally, our platform provides cloud storage and easy integration with existing business tools.

-

Are there any costs associated with using the Printable Payee Records Form?

Using the Printable Payee Records Form is included in the various pricing plans of airSlate SignNow. We offer cost-effective solutions tailored to different business sizes, ensuring you find the right plan that suits your budget.

-

How does the Printable Payee Records Form benefit my business?

Utilizing the Printable Payee Records Form enhances your business operations by improving accuracy and efficiency in payment tracking. It streamlines record-keeping processes, which helps save time and reduce the likelihood of errors in financial reporting.

-

Can I integrate the Printable Payee Records Form with other tools?

Absolutely! The Printable Payee Records Form can be integrated with a variety of popular business applications and software. airSlate SignNow supports integrations with tools like Google Drive, Salesforce, and more, facilitating seamless workflows.

Get more for Printable Payee Records Form

- Application for ethyl grain alcohol purchase form

- Plcb 193 form

- Waiverauthorization and late filing statement pennsylvania liquor form

- Dance registration form doc

- Pdf file ri department of labor and training dlt ri form

- What is an alternate inspection form

- Ground ambulance self inspection report division of ems and scdhec form

- Adsap transfer form daodas daodas state sc

Find out other Printable Payee Records Form

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself