Irs Notice 1450 View and Download 2005

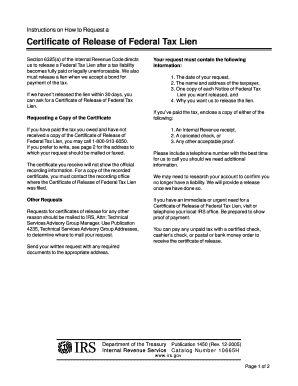

What is the IRS Notice 1450?

The IRS Notice 1450, also known as the Form 1450, is an official document issued by the Internal Revenue Service (IRS). This notice serves as a confirmation of a taxpayer's status regarding certain tax matters, such as the resolution of tax liabilities or the status of a tax return. Understanding the meaning of this notice is crucial for taxpayers who may need to address tax issues or verify their tax standing with the IRS.

How to Obtain the IRS Notice 1450

To obtain the IRS Notice 1450, taxpayers can request it directly from the IRS. This can typically be done through the IRS website, where forms can be downloaded, or by contacting the IRS customer service for assistance. Taxpayers may also receive this notice by mail if the IRS determines that it is necessary for their tax records. Ensuring that your address is up to date with the IRS is vital to receiving any official correspondence.

Key Elements of the IRS Notice 1450

The IRS Notice 1450 includes several important elements that taxpayers should be aware of. These elements typically consist of:

- Taxpayer Information: This section includes the taxpayer's name, address, and taxpayer identification number.

- Tax Year: The notice specifies the tax year related to the information provided.

- Tax Status: Information regarding the resolution of tax liabilities or the status of tax returns is detailed here.

- IRS Contact Information: The notice provides contact details for the IRS, allowing taxpayers to reach out for further clarification or assistance.

Steps to Complete the IRS Notice 1450

Completing the IRS Notice 1450 involves several steps to ensure accuracy and compliance. Here are the general steps:

- Review the notice carefully to understand its contents and any actions required.

- Gather necessary documentation that may be referenced in the notice.

- Fill out any required sections accurately, ensuring that all information matches your records.

- Submit the completed notice to the IRS by the specified deadline, if applicable.

Legal Use of the IRS Notice 1450

The IRS Notice 1450 is legally binding when completed and submitted according to IRS guidelines. It serves as an official record of a taxpayer's status and can be used in various legal contexts, such as when applying for loans or verifying tax compliance with other entities. Ensuring that the notice is filled out correctly and submitted on time is essential to maintain its legal standing.

IRS Guidelines for Notice 1450

The IRS provides specific guidelines regarding the issuance and handling of the Notice 1450. Taxpayers are encouraged to familiarize themselves with these guidelines to ensure proper compliance. Key points include:

- Timeliness: Responding to the notice promptly is crucial to avoid penalties.

- Accuracy: All information provided must be accurate to prevent delays or issues.

- Documentation: Keep copies of the notice and any correspondence with the IRS for your records.

Quick guide on how to complete irs notice 1450 view and download

Effortlessly Prepare Irs Notice 1450 View And Download on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Irs Notice 1450 View And Download on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Irs Notice 1450 View And Download with Ease

- Find Irs Notice 1450 View And Download and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Notice 1450 View And Download and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs notice 1450 view and download

Create this form in 5 minutes!

How to create an eSignature for the irs notice 1450 view and download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Notice 1450 and how does it affect me?

IRS Notice 1450 is a notification from the IRS indicating a tax lien release. Understanding this notice is crucial as it informs you that your tax debt has been satisfied. With airSlate SignNow, you can easily eSign documents related to your IRS Notice 1450, streamlining the process for your records.

-

How can airSlate SignNow assist with IRS Notice 1450 documentation?

airSlate SignNow provides a user-friendly platform for sending and eSigning necessary documents related to IRS Notice 1450. This ensures that your documentation is organized and easily accessible, helping you manage your tax-related records efficiently.

-

Are there any costs associated with using airSlate SignNow for IRS Notice 1450?

airSlate SignNow offers affordable pricing plans tailored to suit various business needs. You can utilize our platform to eSign IRS Notice 1450 documents without incurring hidden fees, making it a cost-effective solution for managing your tax documentation.

-

What features does airSlate SignNow offer for handling IRS Notice 1450?

With airSlate SignNow, you can enjoy features like secure eSigning, document tracking, and customizable templates specifically for IRS Notice 1450. These tools enhance your ability to efficiently manage documents and ensure compliance with IRS requirements.

-

Is airSlate SignNow secure for managing sensitive IRS documents?

Yes, airSlate SignNow prioritizes security with encryption and compliance measures to protect your sensitive IRS documents, including those related to IRS Notice 1450. We ensure that your information remains confidential and safe during the eSigning process.

-

Can I integrate airSlate SignNow with other applications for IRS Notice 1450 documentation?

Absolutely! airSlate SignNow offers seamless integrations with various applications, which allows you to manage your IRS Notice 1450 documentation alongside your existing workflow. This compatibility enhances efficiency and simplifies the handling of your tax-related paperwork.

-

What benefits can I expect when using airSlate SignNow for IRS Notice 1450?

Using airSlate SignNow for IRS Notice 1450 offers several benefits, including time savings, improved document accuracy, and enhanced compliance. Our platform’s intuitive interface helps you navigate the eSigning process with ease, reducing stress while managing tax documentation.

Get more for Irs Notice 1450 View And Download

- Declaration washoe nevada paternity form

- Hawaii vaccine exemption form

- Application for the 2014 nylt pin samoset council form

- Colonie police department civilian police academy application colonie form

- Compliance calendar form

- Wisconsin residential lease agreement free forms

- Form 77 omega psi phi

- Form 8582 cr rev december passive activity credit limitations

Find out other Irs Notice 1450 View And Download

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word