Get the Get the Get the Get the Get the Get the Get the Get the Get the Get Th Form

What is the Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th

The Get The Get The Get The Get The Get The Get The Get The Get The Get Th is a specific form used for various official purposes. It serves as a standardized document that facilitates the collection and submission of required information. This form is often utilized in legal, financial, or administrative contexts, ensuring that all necessary data is captured accurately and efficiently. Understanding its purpose is essential for anyone needing to complete it.

How to use the Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th

Using the Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th involves several straightforward steps. First, gather all necessary information and documents required to fill out the form. Next, carefully complete each section, ensuring accuracy to avoid delays. After filling it out, review the form for any errors before submission. Depending on the requirements, you may need to submit it electronically or via mail.

Steps to complete the Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th

Completing the Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th involves a systematic approach:

- Gather all relevant information and documents.

- Fill out the form accurately, section by section.

- Double-check for any mistakes or missing information.

- Sign and date the form as required.

- Submit the form according to the specified guidelines.

Legal use of the Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th

The Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th holds legal significance when completed correctly. It must adhere to specific regulations and standards to be considered valid. This includes ensuring that all required fields are filled and that the document is signed appropriately. Compliance with these legal requirements is crucial for the form to be accepted by relevant authorities.

Key elements of the Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th

Key elements of the Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th include:

- Identification information of the individual or entity submitting the form.

- Details specific to the purpose of the form.

- Signature and date sections for validation.

- Any additional documentation that may be required for submission.

Required Documents

To successfully complete the Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th, you may need to provide certain documents. These typically include:

- Proof of identity, such as a driver's license or passport.

- Supporting documents relevant to the information being submitted.

- Any prior forms or records that may be necessary for verification.

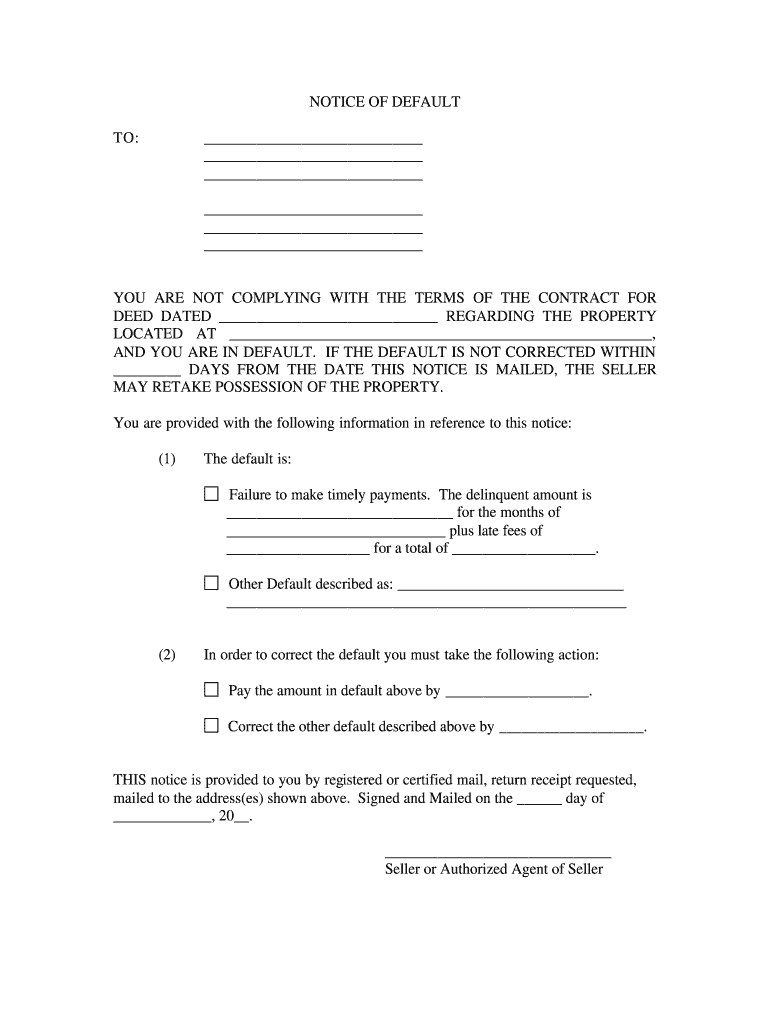

Quick guide on how to complete virginia general notice of default for contract for deed

Effortlessly Prepare Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and digitally sign your documents swiftly without delays. Manage Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th on any device with the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to Modify and Digitally Sign Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th with Ease

- Obtain Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your digital signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and hit the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and digitally sign Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

How do I fill out the form for a national scholarship, being in the general category?

Hari om , you are asking a question as to : “How do I fill out the form for a national scholarship, being in the general category?.”All categories candidates are eligible for national scholarships.It is a purely merit based scholarship.Simply fill all the columns & submit the application to the concerned authorities within the due date.If you are meritorious among the eligible applicants , you will be awarded the scholarships.Best of luck. Hari om.

-

Did you fill out the form "1099 misc"? If so, for what purpose? Within the context of work, is it like a contract?

One of the most common reasons you’d receive tax form 1099-MISC is if you are self-employed or did work as an independent contractor during the previous year. The IRS refers to this as “non-employee compensation.”In most circumstances, your clients are required to issue Form 1099-MISC when they pay you $600 or more in any year.As a self employed person you are required to report your self employment income if the amount you receive from all sources totals $400 or more. In this situation, the process of filing your taxes is a little different than a taxpayer who only receives regular employment income reported on a W-2.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

If I am living in UK with T2 General visa and work as a contractor for a US company with W-8BEN form filled out, do I still need to pay income tax to the UK government?

Yes.Every country in the world taxes people who live there. The US (which claims global jurisdiction over its citizens) taxes you because you are a citizen, the UK (which accepts that its jurisdiction stops at its own border, like every other country except the US) taxes you because you are present and earning money.But you don’t pay tax twice.The UK gets the first bite of the cherry - you’re living there, so you should pay towards public services. If you’re resident, you are taxed like the British taxpayers alongside whom you work, except if you have US investment or rental income that you don’t transfer or remit to the UK, special rules for ‘non-domiciled’ visitors may mean there’s no UK tax on this non-UK income (this is a complex area - take proper advice).You then report all your income to Uncle Sam too. The IRS lets you exclude a certain amount of foreign earned income for US tax purposes (up to $103,900 for 2018). If, even with the exclusion, you still owe US income taxes on your UK compensation, you should be able to claim a credit for UK taxes paid that reduces your US tax liability.Again, this is a complex area - take proper advice.It’s actually even more complex, because social security taxes operate under different rules. You should pay in only the UK or the US, but which country’s rules apply depends on the exact circumstances and how they fit with the US-UK bilateral social security treaty.Take advice (I hope that is clear by now!).

Create this form in 5 minutes!

How to create an eSignature for the virginia general notice of default for contract for deed

How to generate an eSignature for the Virginia General Notice Of Default For Contract For Deed online

How to generate an eSignature for the Virginia General Notice Of Default For Contract For Deed in Chrome

How to make an eSignature for putting it on the Virginia General Notice Of Default For Contract For Deed in Gmail

How to create an eSignature for the Virginia General Notice Of Default For Contract For Deed from your mobile device

How to make an eSignature for the Virginia General Notice Of Default For Contract For Deed on iOS

How to create an electronic signature for the Virginia General Notice Of Default For Contract For Deed on Android devices

People also ask

-

What is airSlate SignNow and how can it help my business?

airSlate SignNow is an innovative platform that empowers businesses to send and eSign documents efficiently. By choosing airSlate SignNow, you can get the get the get the get the get the get the get the get the get the get th solution that simplifies document management while ensuring security and compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can get the get the get the get the get the get the get the get the get the get th pricing that best fits your needs, whether you are a solo entrepreneur or a large enterprise.

-

What key features does airSlate SignNow offer?

airSlate SignNow includes a variety of features designed to enhance document workflows. You can get the get the get the get the get the get the get the get the get the get th functionalities like customizable templates, secure eSignature options, and real-time collaboration tools.

-

How does airSlate SignNow ensure document security?

Security is a top priority for airSlate SignNow. When you use our platform, you can get the get the get the get the get the get the get the get the get the get th peace of mind knowing that all documents are encrypted and compliant with industry standards.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow offers seamless integrations with a wide range of applications. You can get the get the get the get the get the get the get the get the get the get th integrations you need to streamline your workflows and enhance productivity.

-

What are the benefits of using airSlate SignNow for my organization?

Using airSlate SignNow can signNowly reduce the time and costs associated with document handling. With our platform, you can get the get the get the get the get the get the get the get the get the get th advantages of increased efficiency, improved compliance, and enhanced customer satisfaction.

-

Is there a mobile app available for airSlate SignNow?

Yes, airSlate SignNow offers a mobile application that allows you to manage documents on the go. With our mobile app, you can get the get the get the get the get the get the get the get the get the get th convenience of signing and sending documents anytime, anywhere.

Get more for Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th

- Omntec oel8000ii troubleshooting form

- Wsib form 3947a

- Science fair evaluation sheet form

- Privacy act consent form

- Instructor evaluation form 42147653

- Commonwealth of massachusetts request for verification of taxation reporting information substitute w 9 form

- State form 11274r30 11 12

- Electrical permit example form

Find out other Get The Get The Get The Get The Get The Get The Get The Get The Get The Get Th

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself