Form or Stt V

What is the Form Or Stt V

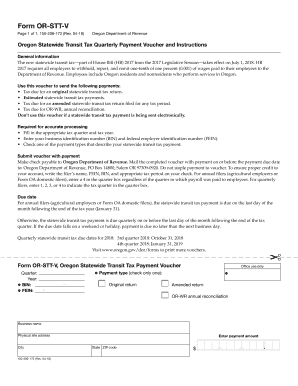

The Form Or Stt V is a specific document used primarily for reporting and remitting the Oregon transit tax. This form is essential for individuals and businesses that are subject to this tax, which is levied to fund public transportation initiatives within the state. Understanding the purpose and requirements of the Form Or Stt V is crucial for compliance with Oregon tax regulations.

How to use the Form Or Stt V

Using the Form Or Stt V involves several key steps. First, you must determine if you are required to file this form based on your income and residency status. Once confirmed, you can obtain the form through the Oregon Department of Revenue's website or other designated sources. After filling out the necessary information, ensure that all calculations are accurate to avoid penalties. Finally, submit the form by the specified deadline to remain compliant with state tax laws.

Steps to complete the Form Or Stt V

Completing the Form Or Stt V requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Download or request a copy of the Form Or Stt V.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income and calculate the transit tax owed based on the provided guidelines.

- Review the completed form for accuracy, ensuring all figures are correct.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal use of the Form Or Stt V

The legal use of the Form Or Stt V is governed by Oregon tax laws. It is important to ensure that the form is filled out accurately and submitted on time to avoid any legal repercussions. The form serves as a declaration of your income subject to the transit tax and must be completed in accordance with the guidelines set by the Oregon Department of Revenue. Failure to comply with these regulations can result in penalties or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Form Or Stt V are critical for compliance. Typically, the form must be submitted by April 15 of the year following the tax year in question. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to stay informed about these dates to ensure timely submission and avoid any potential late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form Or Stt V can be submitted through various methods to accommodate different preferences. You can file online through the Oregon Department of Revenue's e-filing system, which is often the quickest option. Alternatively, you may choose to mail the completed form to the designated address provided by the state. For those who prefer face-to-face interactions, in-person submission at local tax offices is also an option. Each method has its own processing times, so consider this when deciding how to submit your form.

Quick guide on how to complete form or stt v

Complete Form Or Stt V effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage Form Or Stt V on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to edit and eSign Form Or Stt V with ease

- Find Form Or Stt V and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this function.

- Generate your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Or Stt V and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form or stt v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to or stt v?

airSlate SignNow is a versatile eSignature solution designed to simplify the process of sending and signing documents online. The 'or stt v' feature integrates seamlessly into your workflow, enabling users to leverage electronic signatures efficiently within their organizations. With a user-friendly interface, airSlate SignNow ensures that documents can be completed faster and with increased security.

-

How much does airSlate SignNow cost compared to or stt v alternatives?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs, making it a cost-effective choice when compared to or stt v alternatives. Our subscription plans offer flexibility and are designed to provide maximum value, ensuring you only pay for the features you need. Start with a free trial to experience the savings firsthand.

-

What features does airSlate SignNow offer that enhance or stt v?

airSlate SignNow comes equipped with powerful features like customizable templates, automated workflows, and advanced security options that enhance the 'or stt v' experience. These features streamline your document management processes, improving efficiency while maintaining compliance with industry standards. Additionally, the platform supports in-app collaboration, making teamwork easier.

-

Can airSlate SignNow integrate with other applications in relation to or stt v?

Absolutely! airSlate SignNow can integrate with numerous third-party applications to enhance its functionality in line with or stt v. Whether you use CRMs like Salesforce or project management tools, our integration options allow for a smooth workflow without disrupting your existing processes. This flexibility ensures that you can maximize productivity.

-

What are the benefits of using airSlate SignNow for companies considering or stt v?

Using airSlate SignNow provides numerous benefits for companies interested in or stt v, including increased efficiency, reduced paper waste, and improved compliance. By transitioning to electronic signatures, businesses can accelerate their document turnaround time and enhance customer satisfaction. The platform is designed to be easy for all users, regardless of technical experience.

-

Is airSlate SignNow secure for sensitive documents compared to or stt v solutions?

Yes, airSlate SignNow takes security seriously and offers robust measures to protect sensitive documents, making it a reliable option compared to or stt v solutions. The platform uses industry-standard encryption, secure storage, and compliance with regulations such as GDPR and HIPAA, ensuring your data is safe. Our commitment to security allows you to sign with confidence.

-

How does airSlate SignNow support mobile users in relation to or stt v?

airSlate SignNow is optimized for mobile use, ensuring users can access the 'or stt v' functionalities on the go. Whether signing documents from a smartphone or tablet, the mobile app provides a seamless experience. This flexibility allows businesses to operate efficiently, even when away from their desks.

Get more for Form Or Stt V

Find out other Form Or Stt V

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now