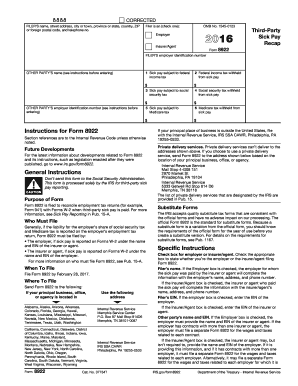

Form 8922 Third Party Sick Pay Recap

What is the Form 8922 Third Party Sick Pay Recap

The Form 8922 Third Party Sick Pay Recap is a tax form used in the United States to report third-party sick pay. This form is essential for employers who provide sick pay through a third party, such as an insurance company. It helps ensure that the sick pay is accurately reported to the Internal Revenue Service (IRS) and that employees receive the correct tax treatment for these payments. The form captures key details about the sick pay provided, including the amounts and the recipients, and it plays a crucial role in maintaining compliance with federal tax regulations.

How to use the Form 8922 Third Party Sick Pay Recap

Using the Form 8922 Third Party Sick Pay Recap involves several steps to ensure accurate reporting. First, gather all necessary information regarding the sick pay disbursed, including the total amount paid and the recipients' details. Next, accurately fill out the form, ensuring that all fields are completed as required. Once the form is filled out, it must be submitted to the IRS along with any other necessary tax documents. Employers should keep a copy of the form for their records, as it may be needed for future reference or audits.

Steps to complete the Form 8922 Third Party Sick Pay Recap

Completing the Form 8922 Third Party Sick Pay Recap requires attention to detail. Follow these steps:

- Obtain the form from the IRS website or trusted tax software.

- Fill in your business information, including your Employer Identification Number (EIN).

- Report the total amount of sick pay provided to employees.

- List the names and Social Security numbers of the recipients of the sick pay.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 8922 Third Party Sick Pay Recap

The legal use of the Form 8922 Third Party Sick Pay Recap is governed by IRS regulations. Employers must use this form to report third-party sick pay accurately to avoid penalties. The information provided must be truthful and complete, as inaccuracies can lead to legal issues or audits. Compliance with tax laws is essential, and using the form correctly helps ensure that both the employer and employees meet their tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8922 Third Party Sick Pay Recap are crucial to avoid penalties. Typically, the form must be submitted to the IRS by the end of February following the tax year in which the sick pay was issued. If filing electronically, the deadline may extend to March 31. Employers should mark their calendars and ensure timely submission to maintain compliance with IRS regulations.

Who Issues the Form

The Form 8922 Third Party Sick Pay Recap is issued by the Internal Revenue Service (IRS). It is part of the tax documentation that employers must complete to report third-party sick pay. Employers should ensure they are using the most current version of the form, as updates may occur periodically to reflect changes in tax laws or regulations.

Quick guide on how to complete form 8922 third party sick pay recap

Effortlessly Prepare Form 8922 Third Party Sick Pay Recap on Any Device

Managing documents online has gained popularity among both companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form 8922 Third Party Sick Pay Recap on any device using the airSlate SignNow applications for Android or iOS and enhance any document-based process today.

How to Modify and eSign Form 8922 Third Party Sick Pay Recap with Ease

- Obtain Form 8922 Third Party Sick Pay Recap and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for those purposes.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, and mistakes that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your device of choice. Edit and eSign Form 8922 Third Party Sick Pay Recap and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8922 third party sick pay recap

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8922 Third Party Sick Pay Recap?

Form 8922 Third Party Sick Pay Recap is a tax form used by employers to report sick pay that was paid to employees by a third party. It helps ensure proper tax withholding and reporting. Understanding this form is crucial for compliance and accurate payroll management.

-

How can airSlate SignNow help with Form 8922 Third Party Sick Pay Recap?

airSlate SignNow provides a streamlined platform for electronically signing and managing Form 8922 Third Party Sick Pay Recap. Our solution allows businesses to easily create, send, and eSign documents, ensuring compliance and reducing paper usage. This enhances efficiency and keeps your records organized.

-

Is there a cost associated with using airSlate SignNow for Form 8922 Third Party Sick Pay Recap?

Yes, airSlate SignNow offers various pricing plans tailored to fit businesses of all sizes. Each plan includes features that facilitate the completion and management of documents, including Form 8922 Third Party Sick Pay Recap. Our cost-effective solution ensures you get value for your investment in time-saving technologies.

-

What features does airSlate SignNow provide for managing Form 8922 Third Party Sick Pay Recap?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage for Form 8922 Third Party Sick Pay Recap. These features help streamline the documentation process and ensure your forms are easily accessible. The user-friendly interface makes it simple for anyone to navigate.

-

Can I integrate airSlate SignNow with other software for Form 8922 Third Party Sick Pay Recap?

Absolutely! airSlate SignNow offers seamless integrations with various business applications that can complement your management of Form 8922 Third Party Sick Pay Recap. Whether you're using accounting software or HR tools, our platform can help you streamline processes across different systems.

-

What are the benefits of using airSlate SignNow for Form 8922 Third Party Sick Pay Recap?

Using airSlate SignNow for Form 8922 Third Party Sick Pay Recap provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our platform not only simplifies the signing process but also allows for easy tracking and management of your documents. This gives businesses peace of mind when dealing with tax forms.

-

Is airSlate SignNow secure for handling Form 8922 Third Party Sick Pay Recap?

Yes, security is a top priority for airSlate SignNow. We implement advanced encryption and compliance measures to ensure that all documents, including Form 8922 Third Party Sick Pay Recap, are protected. Our platform is designed to keep your sensitive information safe while facilitating easy access.

Get more for Form 8922 Third Party Sick Pay Recap

Find out other Form 8922 Third Party Sick Pay Recap

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free