2848 Form

What is the 2848 Form

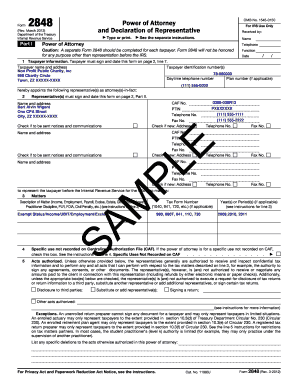

The 2848 Form, officially known as the Power of Attorney and Declaration of Representative, is a document used by taxpayers in the United States to authorize an individual to represent them before the Internal Revenue Service (IRS). This form allows the designated representative to handle various tax matters on behalf of the taxpayer, including discussions regarding tax liabilities, audits, and appeals. It is essential for ensuring that the representative has the legal authority to act in the taxpayer's best interests.

Steps to complete the 2848 Form

Completing the 2848 Form involves several straightforward steps to ensure accuracy and compliance. Begin by entering the taxpayer's information, including their name, address, and Social Security number or Employer Identification Number. Next, provide details about the representative, including their name, address, and the specific tax matters they are authorized to handle. It is crucial to clearly indicate the tax years or periods covered by the authorization. Finally, both the taxpayer and the representative must sign and date the form to validate it.

Legal use of the 2848 Form

The legal use of the 2848 Form is governed by specific IRS guidelines. The form must be signed by the taxpayer, granting explicit permission for the representative to act on their behalf. This authorization is legally binding, provided that the form is filled out correctly and submitted to the IRS. It is important to note that the representative must also comply with IRS regulations and maintain confidentiality regarding the taxpayer's information.

Examples of using the 2848 Form

There are various scenarios in which the 2848 Form may be utilized. For instance, a self-employed individual may use the form to authorize an accountant to handle their tax filings and represent them during an audit. Similarly, a business owner may designate a tax attorney to negotiate tax liabilities with the IRS. These examples illustrate the versatility of the 2848 Form in facilitating effective communication and representation between taxpayers and the IRS.

How to obtain the 2848 Form

The 2848 Form can be easily obtained from the IRS website or through various tax preparation software. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax professionals have access to the form and can provide it to clients as needed. Ensuring that you have the most current version of the form is vital, as updates may occur periodically.

Form Submission Methods (Online / Mail / In-Person)

The completed 2848 Form can be submitted to the IRS through various methods. Taxpayers may choose to mail the form directly to the appropriate IRS office, depending on the type of tax matter involved. Alternatively, some taxpayers may opt to submit the form electronically through authorized e-filing services. In-person submissions may also be possible at local IRS offices, although it is advisable to check for specific requirements or appointments beforehand.

Quick guide on how to complete 2848 form

Effortlessly Prepare 2848 Form on Any Device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 2848 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Easiest Way to Modify and eSign 2848 Form with Ease

- Locate 2848 Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to store your changes.

- Choose your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign 2848 Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2848 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 2848 example?

A form 2848 example refers to a specific instance of the IRS Form 2848, which is used to authorize an individual to represent a taxpayer before the IRS. This example can help users understand how to fill out the form correctly and ensure all necessary information is provided.

-

How does airSlate SignNow help with form 2848 examples?

airSlate SignNow provides an intuitive platform for creating, signing, and sending documents, including form 2848 examples. Users can easily upload their example forms, apply electronic signatures, and share them securely with authorized parties, streamlining the approval process.

-

Is there a cost associated with using airSlate SignNow for form 2848 examples?

Yes, airSlate SignNow offers various pricing plans based on your needs. Each plan gives you unlimited access to electronic signatures, document management, and helps you efficiently manage form 2848 examples without any hidden fees.

-

Can I integrate airSlate SignNow with other software for form 2848 examples?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications such as Google Workspace, Microsoft Office, and CRM tools. This means you can easily manage and share form 2848 examples alongside your existing workflows.

-

What are the benefits of using airSlate SignNow for form 2848 examples?

Using airSlate SignNow for form 2848 examples allows for faster document turnaround times, enhanced security, and reduced paperwork. Its electronic signature feature not only expedites approval but also ensures compliance with legal standards.

-

How secure is the process for managing form 2848 examples on airSlate SignNow?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your sensitive information. This ensures that any form 2848 examples shared through the platform remain confidential and secure.

-

Can I access my form 2848 examples on mobile devices with airSlate SignNow?

Yes, you can access and manage your form 2848 examples on mobile devices using the airSlate SignNow app. This mobile compatibility allows you to sign and send documents while on the go, providing flexibility and convenience.

Get more for 2848 Form

- Page 1 of 2 150 101 190 rev form

- Form or ps care provider statement 150 101 190

- 2018 form or 40 oregon individual income tax return for full year residents 150 101 040

- Form or tm trimet self employment tax oregongov

- Page 1 of 1 150 555 001 rev oregon form

- 2017 form or tm tri county metropolitan transportation district self employment tax 150 555 001

- 83 a272a 2017 2019 form

- 83 a272a 2014 form

Find out other 2848 Form

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template