Page 1 of 1, 150 555 001 Rev Oregon 2016

What is the Page 1 Of 1, 150 555 001 Rev Oregon

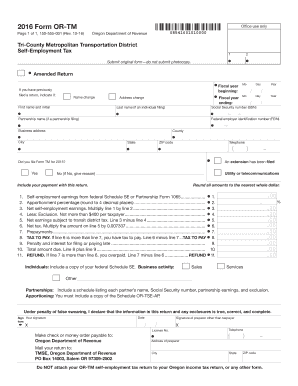

The Page 1 Of 1, 150 555 001 Rev Oregon form is a specific document used primarily for tax reporting purposes in the state of Oregon. This form serves as a means for individuals and businesses to provide necessary information to the state tax authority. It includes various fields that must be filled out accurately to ensure compliance with state tax laws. Understanding the purpose and requirements of this form is essential for timely and correct submission.

Steps to complete the Page 1 Of 1, 150 555 001 Rev Oregon

Completing the Page 1 Of 1, 150 555 001 Rev Oregon form involves several key steps:

- Gather all necessary information, including personal details, income data, and any deductions applicable.

- Access the form online, ensuring you are using the most current version available.

- Carefully fill out each section, double-checking for accuracy and completeness.

- Review the completed form to confirm that all required fields are filled out correctly.

- Sign the form electronically using a secure eSignature solution, ensuring compliance with legal requirements.

- Submit the form electronically or via mail, depending on your preference and the submission guidelines.

Legal use of the Page 1 Of 1, 150 555 001 Rev Oregon

The legal use of the Page 1 Of 1, 150 555 001 Rev Oregon form is governed by state tax regulations. It is essential to ensure that the form is completed in accordance with these regulations to avoid penalties. The form must be signed, either physically or electronically, to be considered valid. By using a recognized eSignature solution, you can ensure that your submission meets legal standards and is accepted by the state tax authority.

IRS Guidelines

While the Page 1 Of 1, 150 555 001 Rev Oregon form is specific to Oregon, it is important to be aware of IRS guidelines that may affect your tax reporting. The IRS has implemented measures to facilitate electronic submissions, allowing certain forms to be signed digitally. Familiarizing yourself with these guidelines can help ensure that your form is compliant with federal standards, especially if you are reporting income or deductions that may also be relevant to federal tax filings.

Form Submission Methods

Submitting the Page 1 Of 1, 150 555 001 Rev Oregon form can be done through various methods:

- Online Submission: This is often the fastest method, allowing for immediate processing and confirmation of receipt.

- Mail: You can print the completed form and send it to the appropriate state tax office. Ensure you use the correct mailing address and consider using certified mail for tracking.

- In-Person: Some individuals may choose to submit their forms in person at local tax offices. This option allows for direct interaction with tax officials, should any questions arise.

Key elements of the Page 1 Of 1, 150 555 001 Rev Oregon

Understanding the key elements of the Page 1 Of 1, 150 555 001 Rev Oregon form is crucial for accurate completion:

- Personal Information: This includes your name, address, and Social Security number or taxpayer identification number.

- Income Details: Report all sources of income, including wages, self-employment income, and any other taxable earnings.

- Deductions and Credits: Identify any deductions or credits you may qualify for, as these can significantly affect your tax liability.

- Signature Section: Ensure you sign the form, as this confirms the accuracy of the information provided and your agreement to the terms outlined.

Quick guide on how to complete page 1 of 1 150 555 001 rev oregon

Your assistance manual on how to prepare your Page 1 Of 1, 150 555 001 Rev Oregon

If you’re curious about how to finalize and submit your Page 1 Of 1, 150 555 001 Rev Oregon, here are a few concise guidelines to facilitate tax submission.

To begin, you just need to register your airSlate SignNow account to revolutionize your online paperwork handling. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, create, and complete your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, returning to modify responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow these instructions to complete your Page 1 Of 1, 150 555 001 Rev Oregon in just a few minutes:

- Set up your account and start working on PDFs in a matter of minutes.

- Browse our library to locate any IRS tax form; explore versions and schedules.

- Click Acquire form to access your Page 1 Of 1, 150 555 001 Rev Oregon in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Signature Tool to add your legally-binding eSignature (if applicable).

- Examine your document and fix any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to more errors and longer refund delays. Importantly, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct page 1 of 1 150 555 001 rev oregon

FAQs

-

How many glasses of soda, each to be filled with 150 cubic cm can be made from 5 family size bottles of soda containing 1.5 liters?

I learned simple divisions and metric conversione in fourth grade. Sorry, but if you can't solve this really elementary problem you are not worth getting an answer because this is really one of the simplest problems of all. (Hint: not 42.)

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

-

Is it feasible to figure out how to rank on page 1 of Google for a competitive search term as a single person working on my SEO strategy?

I think I'm qualified to answer this question as I was the online marketing manager (mainly focussing on Social Media, Content Marketing and SEO).I worked with a start-up which was into professional training for designers. They had 7 courses related to UX. When I joined them they were just about on the first page (10th link on the page). Eventually this position was lost and it was pushed to second page.Now the first 8 links were firmly in grip of established brands (who also gave training in the same domain) and competitors. I took time to understand the competitors and their rankings. Once done, I created a strategy which would propel my company among top 6 or 7 links on the first page (the immediate goal was to get back on the first page).Did lot of link building, content marketing, blogging. Not much wasn't happening on ranking front. But somewhere I knew my strategy will deliver the results. And boy didn't it.I was serving my notice period and had two weeks remaining. As usual I decided to check on the ranking and boom! my company was straight up on 4th position for for its primary keyword (which had a PPC cost of 445 INR). Can you imagine that?Two days later I again check, the company moved two position up and it was on second position (the first position was acquired by Quora thread).And just a day before I was to complete my notice period, as you may have guessed it, it was (and still is) ranking number position. Finally I did it.You know what's even better? For all the local SEO queries for all the courses, my company ranked (and is still ranking number one). Still better, there was another major keyword we were trying to rank for and we achieved number spot for it too.What makes this crazy is that for 3 variations of 5 different major keywords of 5 different courses we rank among top 6. Trust me it was the best way to sign off from a job. Taking your company to number position in a competitive and tough domain.So trust me when I say that you can certainly deliver the result and figure it out how to rank as the top result on Google. BTW, I was the one man show for handling online marketing for the company.Still if you want to check out just Google "UX Design Course" and the very first link you see (not the paid advertising) is the company. I have already moved out of the company and longer work with them.If you (or anyone reading this) needs guidance on how to achieve this can PM me. I'm open to freelancing. I love helping start-ups.

-

Five pumps are required to fill a tank in 1 1/2 hours. How many forms of the same type are used to fill the tank in half an hour?

Five pumps are required to fill a tank in one and half hours.Here the question is how many pumps requires to fill a tank in half an hour..Here we can make an equation like thatIn 1 and 1/2 hours, requires 5 pumps to fill the tank..Therefore in 1/2 an hour, how many pumps are requires to fill the tank?=(0.5 hour×5 pumps)÷(1.5 hours)=1.6666…. PumpsBut we know that the number of pumps should be whole..So we should take near by digit of 1.66It is 2 .So we have to take atleast 2 pumps to fill the tank in half an hour…I hope my answer convinces you..And if this answer need any type of edit please message me or comment…

Create this form in 5 minutes!

How to create an eSignature for the page 1 of 1 150 555 001 rev oregon

How to make an electronic signature for the Page 1 Of 1 150 555 001 Rev Oregon online

How to create an eSignature for your Page 1 Of 1 150 555 001 Rev Oregon in Chrome

How to generate an electronic signature for putting it on the Page 1 Of 1 150 555 001 Rev Oregon in Gmail

How to make an eSignature for the Page 1 Of 1 150 555 001 Rev Oregon right from your mobile device

How to make an eSignature for the Page 1 Of 1 150 555 001 Rev Oregon on iOS

How to generate an electronic signature for the Page 1 Of 1 150 555 001 Rev Oregon on Android OS

People also ask

-

What is the purpose of Page 1 Of 1, 150 555 001 Rev Oregon?

Page 1 Of 1, 150 555 001 Rev Oregon is a crucial document template designed to streamline the signing and documentation process. It helps businesses efficiently manage their eSignatures and ensure compliance with state regulations.

-

How does airSlate SignNow support Page 1 Of 1, 150 555 001 Rev Oregon?

airSlate SignNow offers seamless support for Page 1 Of 1, 150 555 001 Rev Oregon by allowing users to easily upload, share, and sign this document electronically. The platform ensures a smooth workflow and enhances document security.

-

What features does airSlate SignNow provide for managing Page 1 Of 1, 150 555 001 Rev Oregon?

With airSlate SignNow, users can enjoy features such as customizable templates, automated reminders, and real-time tracking for Page 1 Of 1, 150 555 001 Rev Oregon. Additionally, the platform provides an intuitive user interface that simplifies the eSigning process.

-

Is there a cost associated with using Page 1 Of 1, 150 555 001 Rev Oregon on airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including access to Page 1 Of 1, 150 555 001 Rev Oregon. Users can choose from various subscription options to find the most cost-effective solution for their organization.

-

Can Page 1 Of 1, 150 555 001 Rev Oregon be integrated with other tools?

Yes, airSlate SignNow allows integration with various systems, enabling users to connect Page 1 Of 1, 150 555 001 Rev Oregon with their existing software. This enhances productivity and ensures a seamless flow of information across platforms.

-

What are the benefits of using airSlate SignNow for Page 1 Of 1, 150 555 001 Rev Oregon?

Using airSlate SignNow for Page 1 Of 1, 150 555 001 Rev Oregon offers numerous benefits, including increased efficiency, improved compliance, and enhanced security. The platform also helps reduce paper usage, aligning your business with environmentally friendly practices.

-

How can I get started with Page 1 Of 1, 150 555 001 Rev Oregon on airSlate SignNow?

Getting started with Page 1 Of 1, 150 555 001 Rev Oregon on airSlate SignNow is quick and easy. Simply sign up for an account, access the document template, and follow the prompts to customize and send your documents for eSignature.

Get more for Page 1 Of 1, 150 555 001 Rev Oregon

- Gma email address form

- Parenting plan utah state courts utcourts form

- Course 2 chapter 2 percents answer key form

- Worksheet sex linked crosses unit 3 genetics form

- Fillable tc 94 32 form

- Audio visual amp technology equipment request form ecusd7

- 913 384 3955 kansas city ks reverse phone number lookup form

- Livestock purchase agreement gasper family farm form

Find out other Page 1 Of 1, 150 555 001 Rev Oregon

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word