Form or TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 2017

Understanding the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

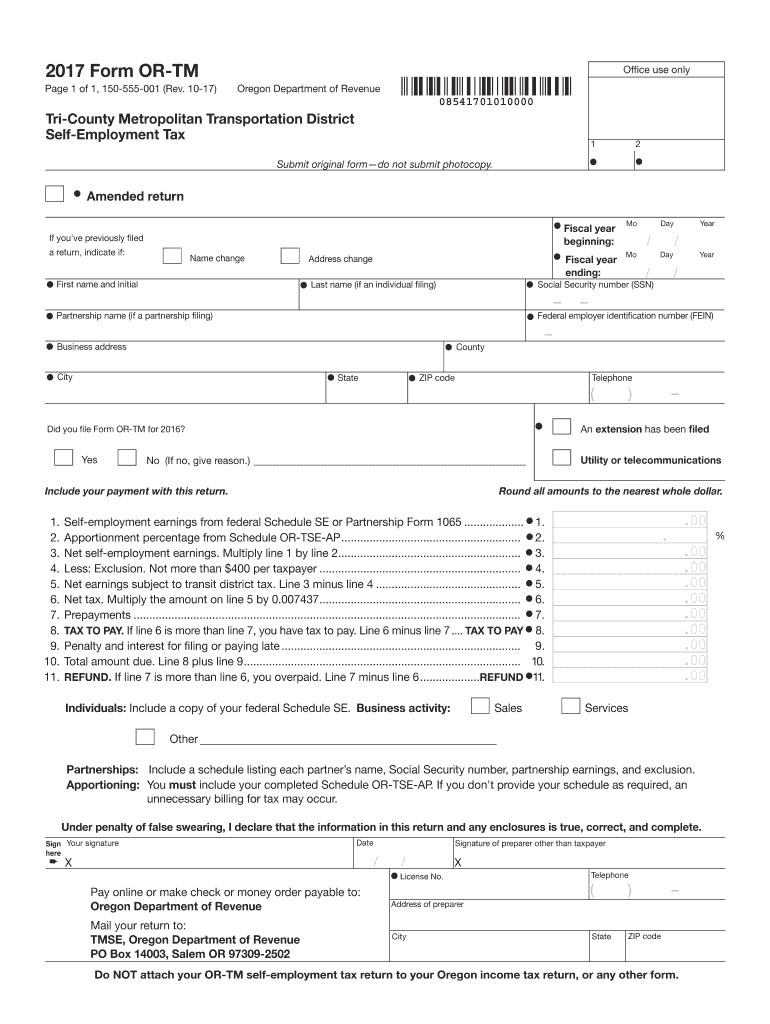

The Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 is a tax document specifically designed for self-employed individuals operating within the Tri County Metropolitan Transportation District. This form is essential for reporting self-employment income and calculating the corresponding taxes owed to the district. It ensures compliance with local tax regulations and helps maintain accurate financial records for businesses and freelancers.

Steps to Complete the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

Completing the Form OR TM involves several key steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Fill in your personal information, such as name, address, and Social Security number.

- Report your total self-employment income and any applicable deductions.

- Calculate the tax owed based on the provided guidelines.

- Review the completed form for accuracy before submission.

How to Obtain the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

The Form OR TM can be obtained through various channels. It is typically available on the official website of the Tri County Metropolitan Transportation District. Additionally, taxpayers may request a physical copy from local tax offices or download it directly from authorized government platforms. Ensure that you are using the most recent version of the form to comply with current regulations.

Legal Use of the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

The legal use of the Form OR TM is crucial for self-employed individuals to ensure compliance with local tax laws. Filing this form accurately helps avoid penalties and ensures that the taxpayer meets their obligations to the Tri County Metropolitan Transportation District. It is important to understand the specific regulations governing self-employment taxes in your area to ensure proper usage of the form.

Filing Deadlines for the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

Filing deadlines for the Form OR TM are typically aligned with federal tax deadlines. Self-employed individuals should be aware of the specific due dates to avoid late fees and penalties. Generally, the form must be submitted by April fifteenth of the following tax year, but it is advisable to check for any updates or changes in local regulations that may affect these dates.

Form Submission Methods for the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

The Form OR TM can be submitted through various methods, including:

- Online submission via the official tax portal of the Tri County Metropolitan Transportation District.

- Mailing a printed copy to the designated tax office address.

- In-person submission at local tax offices during business hours.

Choosing the appropriate submission method can facilitate a smoother filing process and ensure timely processing of your tax return.

Quick guide on how to complete 2017 form or tm tri county metropolitan transportation district self employment tax 150 555 001

Your assistance manual on preparing your Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

If you are wondering how to finalize and submit your Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001, here are some straightforward instructions to simplify the tax filing process.

To begin, you just need to create your airSlate SignNow profile to transform the way you manage documents online. airSlate SignNow is a highly user-friendly and effective document solution that enables you to modify, generate, and finalize your tax paperwork effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures, and revisit to amend information as necessary. Optimize your tax handling with sophisticated PDF editing, electronic signing, and convenient sharing options.

Follow these steps to finalize your Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Explore our directory to find any IRS tax form; browse various versions and schedules.

- Click Obtain form to open your Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Signature Tool to apply your legally-recognized electronic signature (if necessary).

- Review your document and correct any mistakes.

- Store changes, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to file your taxes electronically with airSlate SignNow. Remember that submitting on paper can lead to increased errors and delayed refunds. Furthermore, before e-filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form or tm tri county metropolitan transportation district self employment tax 150 555 001

Create this form in 5 minutes!

How to create an eSignature for the 2017 form or tm tri county metropolitan transportation district self employment tax 150 555 001

How to generate an eSignature for the 2017 Form Or Tm Tri County Metropolitan Transportation District Self Employment Tax 150 555 001 in the online mode

How to create an eSignature for your 2017 Form Or Tm Tri County Metropolitan Transportation District Self Employment Tax 150 555 001 in Chrome

How to make an eSignature for putting it on the 2017 Form Or Tm Tri County Metropolitan Transportation District Self Employment Tax 150 555 001 in Gmail

How to make an electronic signature for the 2017 Form Or Tm Tri County Metropolitan Transportation District Self Employment Tax 150 555 001 right from your smartphone

How to generate an electronic signature for the 2017 Form Or Tm Tri County Metropolitan Transportation District Self Employment Tax 150 555 001 on iOS

How to create an eSignature for the 2017 Form Or Tm Tri County Metropolitan Transportation District Self Employment Tax 150 555 001 on Android

People also ask

-

What is the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001?

The Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 is a tax form used by self-employed individuals in the Tri County Metropolitan area to report their income and calculate their self-employment tax. This form ensures compliance with local tax regulations and helps in accurately assessing the tax obligations for self-employed workers.

-

How can airSlate SignNow help with the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001?

airSlate SignNow offers a streamlined solution for signing and sending the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 electronically. With our easy-to-use platform, you can quickly fill out the form, collect necessary signatures, and securely share it with relevant parties, enhancing your workflow and efficiency.

-

Is there a cost associated with using airSlate SignNow for the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001?

Yes, airSlate SignNow provides a cost-effective solution for managing documents, including the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001. Our pricing plans are designed to suit various business needs, ensuring you can access essential features without breaking the bank.

-

What features does airSlate SignNow offer for managing the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001?

airSlate SignNow offers several features to manage the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001, including customizable templates, secure e-signatures, and document tracking. These features enhance the ease of use, making it simpler to prepare and submit your tax forms efficiently.

-

Can I integrate airSlate SignNow with other software for handling the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001?

Absolutely! airSlate SignNow seamlessly integrates with various software applications to help you manage the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001. This integration allows for smooth data transfer and improved workflow between different platforms, making your tax management process even more efficient.

-

What are the benefits of using airSlate SignNow for the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001?

Using airSlate SignNow for the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 provides numerous benefits, including increased speed in document processing, enhanced security for sensitive information, and improved compliance with tax regulations. These advantages contribute to a more productive and stress-free tax preparation experience.

-

Is airSlate SignNow user-friendly for completing the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001?

Yes, airSlate SignNow is designed to be user-friendly, allowing individuals to easily complete the Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 without any technical expertise. Our intuitive interface guides users through the process, ensuring a smooth experience from start to finish.

Get more for Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

- United way donation form

- Bank details form

- Generation chart fillable online form

- New york employees retirement system subsequent employment of active rs 5520 form

- Opedge comwp contentuploadsoampampp jobs calendar insertion order opedge com form

- Gerrard excavating inc public data ampamp applications form

- Articles of dissolution form

- City of nichols hills permits ampamp licensing homepage form

Find out other Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors