Mi 1045 Form

What is the MI 1045?

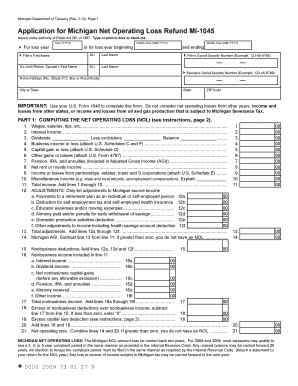

The MI 1045 form is a tax document used by businesses in Michigan to report net operating losses (NOLs) for state tax purposes. This form allows taxpayers to carry forward losses to offset future taxable income, which can significantly reduce tax liability. Understanding the MI 1045 is essential for businesses looking to maximize their tax efficiency and ensure compliance with state regulations.

How to use the MI 1045

To effectively use the MI 1045, businesses must first determine their net operating loss for the tax year. This involves calculating total income and allowable deductions. Once the NOL is established, the MI 1045 can be filled out to report the loss to the Michigan Department of Treasury. It is crucial to follow the instructions carefully to ensure accurate reporting and compliance with state tax laws.

Steps to complete the MI 1045

Completing the MI 1045 involves several key steps:

- Gather financial records to determine your net operating loss.

- Fill out the MI 1045 form, providing necessary details such as income, deductions, and the calculated NOL.

- Review the form for accuracy to avoid any potential issues with the Michigan Department of Treasury.

- Submit the completed form by the designated filing deadline.

Legal use of the MI 1045

The MI 1045 must be used in accordance with Michigan tax laws. It is legally binding when properly completed and submitted. Businesses should ensure they meet all eligibility criteria for claiming a net operating loss and adhere to the guidelines set forth by the Michigan Department of Treasury. Failure to comply may result in penalties or denial of the loss claim.

Filing Deadlines / Important Dates

Filing deadlines for the MI 1045 are critical for taxpayers. Typically, the form must be submitted by the due date of the business's annual tax return. It is essential to stay informed about any changes in deadlines or specific dates set by the Michigan Department of Treasury to avoid late penalties.

Required Documents

To complete the MI 1045, businesses need to gather several key documents, including:

- Prior year tax returns to establish baseline income.

- Financial statements detailing income and expenses for the current year.

- Any supporting documentation for deductions claimed.

Eligibility Criteria

Eligibility for using the MI 1045 requires that the business has incurred a net operating loss during the tax year. Additionally, the business must be registered in Michigan and subject to the state's corporate income tax. Understanding these criteria is vital for ensuring that the form is applicable and that the loss can be utilized effectively for tax purposes.

Quick guide on how to complete mi 1045

Complete Mi 1045 seamlessly on any device

Managing documents online has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents efficiently without complications. Handle Mi 1045 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Mi 1045 effortlessly

- Locate Mi 1045 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Mi 1045 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1045

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mi 1045 form and why is it important?

The mi 1045 form is a crucial document for businesses that need to report income and manage tax obligations. Understanding the content and purpose of the mi 1045 can help ensure compliance with tax regulations. Proper handling of this form can streamline your business's financial management and reduce the risk of penalties.

-

How can airSlate SignNow assist with mi 1045 document management?

airSlate SignNow offers a seamless solution for managing the mi 1045 document by allowing users to upload, sign, and send it electronically. This not only saves time but also improves the accuracy of your submissions. With airSlate SignNow, you can ensure your mi 1045 is processed efficiently and stored securely.

-

What features does airSlate SignNow offer for handling mi 1045?

airSlate SignNow provides features like customizable templates, electronic signatures, and real-time tracking for documents such as the mi 1045. These functionalities enhance collaboration and streamline the signing process. By using airSlate SignNow, you can simplify workflow associated with the mi 1045 for your business.

-

Is there a cost associated with using airSlate SignNow for mi 1045?

Yes, airSlate SignNow offers competitive pricing plans tailored to the needs of businesses handling documents like the mi 1045. These plans provide access to features that can greatly reduce administrative burdens. With various pricing options, you can choose a plan that fits your budget while effectively managing the mi 1045.

-

Are there integrations available for mi 1045 processing on airSlate SignNow?

airSlate SignNow integrates seamlessly with various applications that can help you manage the mi 1045, including cloud storage and accounting software. These integrations facilitate a smoother workflow, allowing you to connect your preferred tools and enhance productivity. By leveraging these integrations, you can efficiently handle the mi 1045 without interruptions.

-

What are the benefits of using airSlate SignNow for mi 1045 submissions?

Using airSlate SignNow for your mi 1045 submissions can signNowly improve the speed and accuracy of document handling. The platform's user-friendly interface and eSignature capabilities ensure documents are signed quickly, reducing delays. Moreover, electronic submissions help in maintaining a clear audit trail for all mi 1045 transactions, boosting overall compliance.

-

Can I access mi 1045 documents from my mobile device using airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile access, allowing you to manage your mi 1045 documents on the go. This flexibility ensures that you can send and sign documents anytime, anywhere, which is especially useful for busy professionals. With the mobile app, you can keep your mi 1045 workflow uninterrupted.

Get more for Mi 1045

Find out other Mi 1045

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document