Form 8853

What is the Form 8853

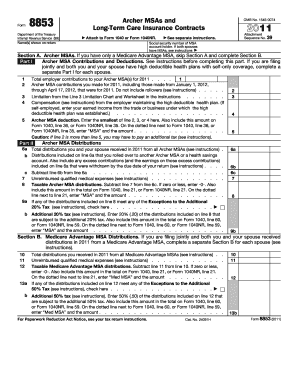

The Form 8853 is a tax form used in the United States for reporting certain health savings accounts (HSAs) and other medical savings accounts. It is primarily utilized by taxpayers to provide the Internal Revenue Service (IRS) with information regarding contributions, distributions, and other relevant details associated with these accounts. Understanding this form is essential for ensuring compliance with tax regulations and maximizing potential tax benefits related to health care expenses.

How to use the Form 8853

Using the Form 8853 involves several key steps. First, gather all necessary information, including details about your health savings account, contributions made during the tax year, and any distributions taken. Next, accurately fill out each section of the form, ensuring that all figures are correct and reflect your financial activities related to the account. Finally, submit the completed form along with your tax return to the IRS, ensuring you adhere to the filing deadlines to avoid penalties.

Steps to complete the Form 8853

Completing the Form 8853 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name and Social Security number.

- Report contributions made to your health savings account during the tax year in the designated section.

- Document any distributions taken from the account, specifying the amounts and purposes for which they were used.

- Review the form to ensure accuracy, checking for any potential errors or omissions.

- Sign and date the form before submitting it with your tax return.

Legal use of the Form 8853

The legal use of the Form 8853 is governed by IRS regulations, which stipulate that accurate reporting of health savings accounts is mandatory. Failure to complete and submit this form correctly can result in penalties, including fines or disallowance of tax benefits associated with HSAs. It is crucial to maintain compliance with all IRS guidelines to ensure that your use of the form is legally valid.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8853 align with the general tax return deadlines in the United States. Typically, individual taxpayers must file their tax returns, including Form 8853, by April 15 of the following year. If you require additional time, you may file for an extension, but it is essential to ensure that the form is submitted by the extended deadline to avoid penalties.

Required Documents

To complete the Form 8853, you will need several documents, including:

- Your health savings account statements for the tax year.

- Records of contributions made to the account.

- Documentation of any distributions taken, including receipts or invoices for qualified medical expenses.

Having these documents on hand will facilitate accurate completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete form 8853 1649619

Prepare Form 8853 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly without any holdups. Manage Form 8853 on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign Form 8853 with ease

- Obtain Form 8853 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to retain your modifications.

- Select your preferred method to send your form, via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new paper copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 8853 to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8853 1649619

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8853 and why is it important?

Form 8853 is a tax form used to report Health Savings Accounts (HSAs) and other tax-advantaged medical savings accounts. It is essential for individuals who want to claim deductions or seek tax benefits associated with their health accounts. Properly filing Form 8853 can help save money on taxes related to healthcare expenses.

-

How can airSlate SignNow assist with the completion of Form 8853?

airSlate SignNow offers an intuitive platform that simplifies the signing process for Form 8853. Users can easily eSign documents, ensuring that all necessary signatures are captured efficiently. This streamlines the filing process and reduces the risk of errors in your tax documents.

-

What features of airSlate SignNow support eSigning Form 8853?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure cloud storage that are ideal for handling Form 8853. The platform's mobile accessibility allows users to sign documents on-the-go, making it a versatile solution for busy professionals needing to manage their tax documents.

-

Is there a cost for using airSlate SignNow for Form 8853?

Yes, airSlate SignNow offers several pricing plans to suit different needs, including options for individuals and businesses. Pricing typically varies based on the number of users and features required. However, using airSlate SignNow can be a cost-effective solution compared to traditional printing and mailing methods for Form 8853.

-

Can I integrate airSlate SignNow with other apps for managing Form 8853?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications, including cloud storage services and accounting software. This integration allows users to manage Form 8853 and related documents easily, enhancing workflow efficiency and keeping everything organized in one place.

-

What are the benefits of signing Form 8853 electronically?

Signing Form 8853 electronically using airSlate SignNow increases efficiency and reduces turnaround time. It enhances document security through encryption, ensuring sensitive information remains protected. Additionally, electronic signing provides a better user experience by allowing access from anywhere, anytime.

-

How secure is my information when using airSlate SignNow for Form 8853?

airSlate SignNow prioritizes security by employing advanced encryption technologies to protect your information while completing Form 8853. User data is securely stored in compliance with industry-standard regulations. You can confidently manage your sensitive tax documents, knowing they are safeguarded.

Get more for Form 8853

Find out other Form 8853

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation