Canadian Residents Request for Tax Refund Guideline Canadian Residents Request for Tax Refund Guideline Form

What is the Canadian Residents Request For Tax Refund Guideline?

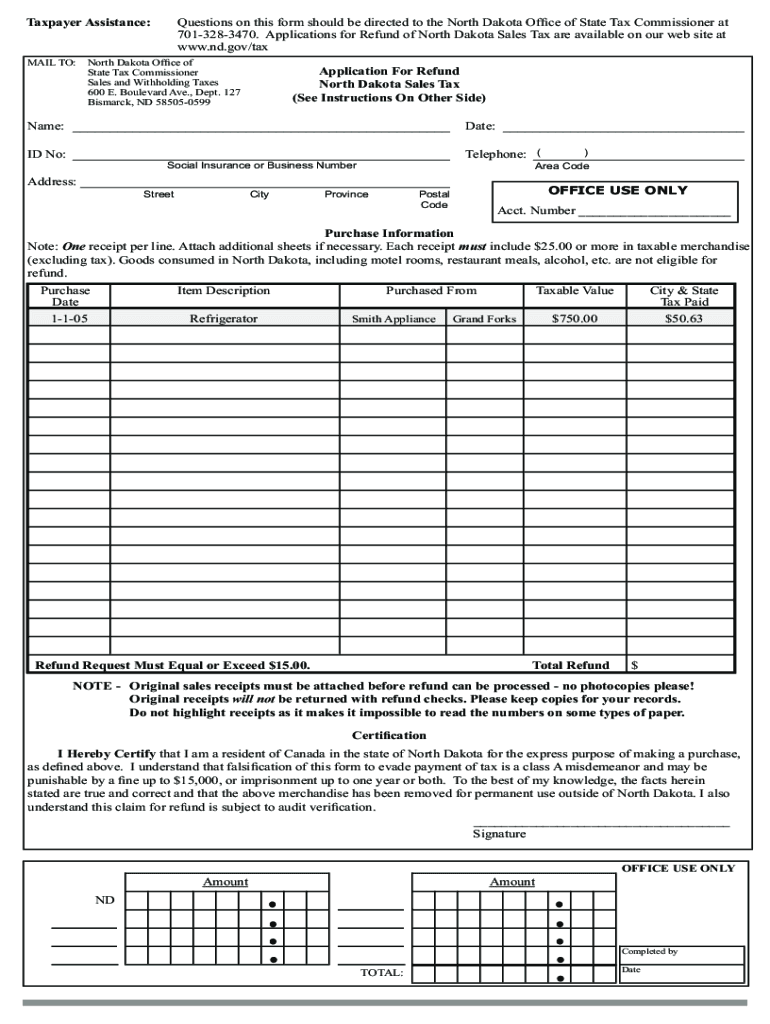

The Canadian Residents Request For Tax Refund Guideline is a formal document designed for individuals residing in Canada who seek to claim a tax refund. This guideline outlines the necessary procedures, eligibility criteria, and required documentation for residents to successfully submit their requests. Understanding this form is essential for ensuring compliance with tax regulations and for maximizing potential refunds.

Steps to Complete the Canadian Residents Request For Tax Refund Guideline

Completing the Canadian Residents Request For Tax Refund Guideline involves several key steps:

- Gather necessary documentation, including proof of residency and any relevant tax documents.

- Fill out the form accurately, ensuring all personal information is correct.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Following these steps carefully can help streamline the refund process and reduce the likelihood of delays.

Required Documents

To successfully complete the Canadian Residents Request For Tax Refund Guideline, specific documents are required. These typically include:

- Proof of residency in Canada, such as a utility bill or lease agreement.

- Tax returns for the relevant years.

- Any additional forms or documentation that support the refund claim.

Ensuring that all required documents are included will facilitate a smoother review process by tax authorities.

Form Submission Methods

The Canadian Residents Request For Tax Refund Guideline can be submitted through various methods:

- Online: Many tax authorities offer electronic submission options for convenience.

- Mail: Completed forms can be sent via postal service to the designated tax office.

- In-Person: Residents may also choose to submit their forms directly at local tax offices.

Selecting the appropriate submission method can depend on personal preference and the urgency of the refund request.

Eligibility Criteria

Eligibility for the Canadian Residents Request For Tax Refund Guideline typically includes:

- Residency in Canada for the tax year in question.

- Filing a tax return for that year.

- Meeting specific income thresholds or other criteria as outlined by tax authorities.

Understanding these criteria is crucial for determining if a refund request can be filed.

IRS Guidelines

While the Canadian Residents Request For Tax Refund Guideline pertains to Canadian tax regulations, it is important for residents to also be aware of IRS guidelines if they have tax obligations in the United States. This includes understanding how foreign income is treated and any tax treaties that may apply. Consulting with a tax professional can provide clarity on these matters.

Quick guide on how to complete canadian residents request for tax refund guideline canadian residents request for tax refund guideline

Complete Canadian Residents Request For Tax Refund Guideline Canadian Residents Request For Tax Refund Guideline effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents rapidly without interruptions. Manage Canadian Residents Request For Tax Refund Guideline Canadian Residents Request For Tax Refund Guideline on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

How to alter and eSign Canadian Residents Request For Tax Refund Guideline Canadian Residents Request For Tax Refund Guideline with ease

- Obtain Canadian Residents Request For Tax Refund Guideline Canadian Residents Request For Tax Refund Guideline and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invite link, or download it to the computer.

Eliminate worries about lost or mislaid files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Canadian Residents Request For Tax Refund Guideline Canadian Residents Request For Tax Refund Guideline and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canadian residents request for tax refund guideline canadian residents request for tax refund guideline

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Canadian Residents Request For Tax Refund Guideline?

The Canadian Residents Request For Tax Refund Guideline provides a clear procedure for Canadian residents seeking a tax refund. It outlines the necessary steps and documents required for a successful claim. Understanding this guideline ensures you maximize your tax refund potential.

-

How can airSlate SignNow assist with the Canadian Residents Request For Tax Refund Guideline?

airSlate SignNow simplifies the process of signing and sending essential tax documents. Our platform’s eSigning feature helps you quickly complete forms associated with the Canadian Residents Request For Tax Refund Guideline. This efficiency can reduce delays and ensure timely submissions.

-

What are the pricing options for using airSlate SignNow in relation to tax refund requests?

airSlate SignNow offers various pricing plans tailored to different business needs. By using our platform for the Canadian Residents Request For Tax Refund Guideline, users gain access to a cost-effective solution for document management. Review our pricing page for detailed plans that suit your requirements.

-

Are there any specific features in airSlate SignNow that support tax refund processes?

Yes, airSlate SignNow includes features such as template management and bulk sending, which can be beneficial for the Canadian Residents Request For Tax Refund Guideline. These tools help streamline document preparation and distribution, making it easier to manage requests efficiently.

-

Can airSlate SignNow integrate with other accounting software for tax refund purposes?

Absolutely! airSlate SignNow integrates seamlessly with numerous accounting software applications. This capability proves valuable for managing documents associated with the Canadian Residents Request For Tax Refund Guideline, enhancing your overall workflow.

-

What benefits can Canadian residents expect from using airSlate SignNow for their tax refunds?

By using airSlate SignNow, Canadian residents can expect a simplified and rapid document signing process. This ensures that their claims related to the Canadian Residents Request For Tax Refund Guideline are handled promptly, resulting in faster refunds and reduced stress.

-

Is airSlate SignNow compliant with Canadian regulations for tax documents?

Yes, airSlate SignNow adheres to Canadian regulations regarding the signing and storage of tax-related documents. This compliance is crucial for anyone following the Canadian Residents Request For Tax Refund Guideline, as it ensures that your documents are legally valid.

Get more for Canadian Residents Request For Tax Refund Guideline Canadian Residents Request For Tax Refund Guideline

Find out other Canadian Residents Request For Tax Refund Guideline Canadian Residents Request For Tax Refund Guideline

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple