Real Estate Withholding Vermont Department of Taxes 2024-2026

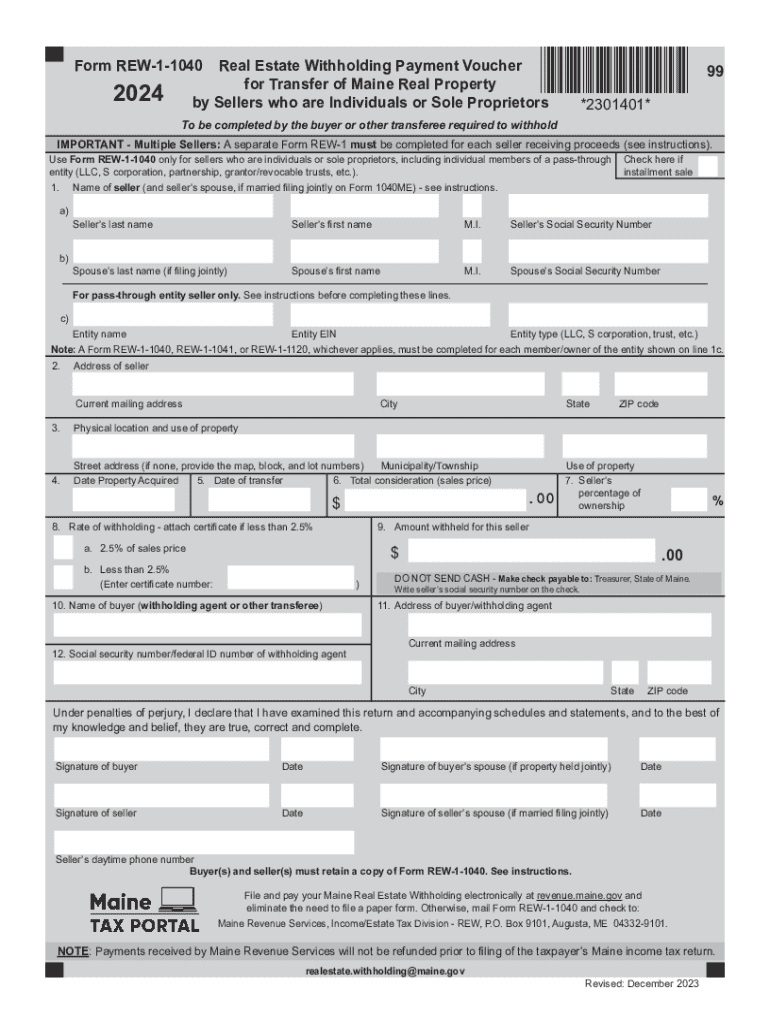

Understanding the Maine REW1 1040 Form

The Maine REW1 1040 form is essential for individuals involved in real estate transactions in Maine. This form is specifically designed for real estate withholding, ensuring that the appropriate amount of tax is withheld from the proceeds of the sale. It is crucial for sellers to understand their responsibilities under Maine law when transferring property, as this form helps facilitate compliance with state tax regulations.

Steps to Complete the Maine REW1 1040 Form

Filling out the Maine REW1 1040 form involves several key steps:

- Gather necessary information, including the seller's details, property address, and sale price.

- Calculate the withholding amount based on the sale price and applicable tax rates.

- Complete the form by accurately entering all required information in the designated fields.

- Review the form for accuracy to avoid delays or penalties.

- Submit the completed form as part of the closing process for the real estate transaction.

Required Documents for the Maine REW1 1040 Form

To successfully complete the Maine REW1 1040 form, certain documents are necessary. These include:

- Proof of identity for the seller, such as a driver's license or state ID.

- Documentation of the property sale, including the purchase agreement and closing statement.

- Any previous tax returns that may impact withholding calculations.

Filing Deadlines for the Maine REW1 1040 Form

It is important to be aware of the filing deadlines associated with the Maine REW1 1040 form. Generally, the form must be submitted at the time of closing or within a specified period after the sale. Failure to meet these deadlines can result in penalties and interest on unpaid taxes.

Legal Use of the Maine REW1 1040 Form

The Maine REW1 1040 form is legally mandated for real estate transactions where withholding is applicable. It serves to ensure that the state collects the necessary taxes from sellers who may not be residents or who may have tax obligations in Maine. Understanding the legal implications of this form is vital for compliance and avoiding potential legal issues.

Examples of Using the Maine REW1 1040 Form

Consider a scenario where a non-resident sells a property in Maine. The buyer is required to withhold a portion of the sale proceeds as per the Maine REW1 1040 requirements. This withholding protects the state’s interests and ensures that taxes are collected from sellers who may not file a Maine tax return. Properly completing and submitting the REW1 1040 form in this case is essential for both the buyer and seller.

Quick guide on how to complete real estate withholding vermont department of taxes

Effortlessly Prepare Real Estate Withholding Vermont Department Of Taxes on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents promptly and without issues. Handle Real Estate Withholding Vermont Department Of Taxes on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to Edit and Electronically Sign Real Estate Withholding Vermont Department Of Taxes with Ease

- Obtain Real Estate Withholding Vermont Department Of Taxes and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Real Estate Withholding Vermont Department Of Taxes and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct real estate withholding vermont department of taxes

Create this form in 5 minutes!

How to create an eSignature for the real estate withholding vermont department of taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the maine rew1 1040 form and why is it important?

The maine rew1 1040 form is a crucial document for Maine residents to report their income and calculate their state taxes. It ensures compliance with state tax laws and helps individuals avoid penalties. Understanding this form is essential for accurate tax filing and maximizing potential refunds.

-

How can airSlate SignNow help with the maine rew1 1040 process?

airSlate SignNow streamlines the maine rew1 1040 process by allowing users to easily send, sign, and manage their tax documents electronically. This reduces the time spent on paperwork and enhances accuracy. With our platform, you can ensure that your maine rew1 1040 is completed and submitted efficiently.

-

What are the pricing options for using airSlate SignNow for maine rew1 1040?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for handling maine rew1 1040 forms. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This ensures you only pay for what you need.

-

What features does airSlate SignNow provide for managing maine rew1 1040 documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically designed for maine rew1 1040 forms. These tools help you manage your documents efficiently and ensure that all signatures are collected in a timely manner. Additionally, you can store and access your documents securely in the cloud.

-

Are there any integrations available with airSlate SignNow for maine rew1 1040?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for maine rew1 1040 management. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document handling. This integration capability allows for a more cohesive experience when managing your tax documents.

-

What are the benefits of using airSlate SignNow for maine rew1 1040?

Using airSlate SignNow for your maine rew1 1040 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the signing process, allowing you to focus on other important tasks. Additionally, it helps ensure compliance with state regulations, minimizing the risk of errors.

-

Is airSlate SignNow secure for handling sensitive maine rew1 1040 information?

Absolutely, airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your sensitive maine rew1 1040 information. Our platform is designed to comply with industry standards, ensuring that your data remains confidential and secure throughout the signing process. You can trust us to safeguard your important documents.

Get more for Real Estate Withholding Vermont Department Of Taxes

Find out other Real Estate Withholding Vermont Department Of Taxes

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself