Form 8879 Rev January Internal Revenue Service 2021-2026

What is the Form 8879?

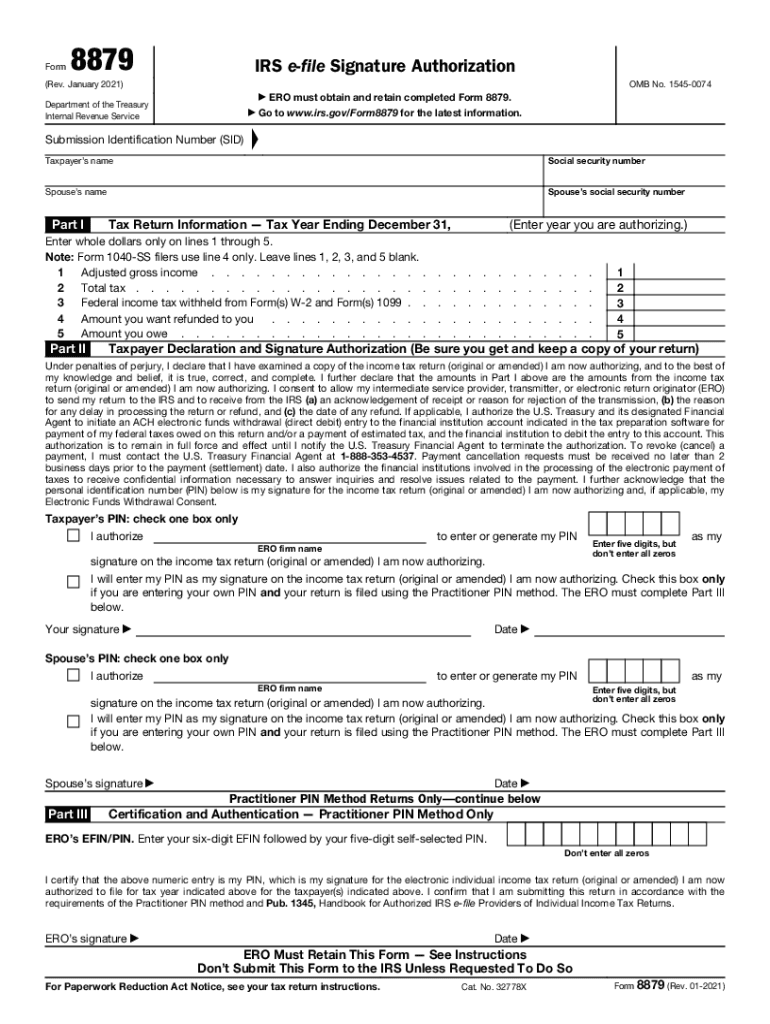

The Form 8879, also known as the IRS e-file signature authorization, is a document that allows taxpayers to electronically sign their tax returns. This form is essential for those who choose to e-file their tax returns, as it provides the necessary authorization for the tax preparer to submit the return on behalf of the taxpayer. The form is used primarily for individual income tax returns and is crucial for ensuring compliance with IRS regulations.

How to Use the Form 8879

Using the Form 8879 involves several straightforward steps. First, the taxpayer must complete their tax return using tax software or through a tax professional. After the return is prepared, the taxpayer needs to fill out the Form 8879. This includes providing personal information, such as the taxpayer's name, Social Security number, and the tax return details. Once completed, the taxpayer must sign the form, which can be done electronically if using a compliant e-signature solution. After signing, the form is submitted to the tax preparer, who will then use it to e-file the tax return with the IRS.

Steps to Complete the Form 8879

Completing the Form 8879 involves a few key steps:

- Gather necessary information, including your tax return details and identification.

- Fill out the form with accurate personal information and tax return data.

- Review the form for any errors or omissions.

- Sign the form electronically or manually, depending on your method of completion.

- Submit the signed form to your tax preparer for e-filing.

Legal Use of the Form 8879

The legal use of the Form 8879 is governed by IRS regulations, which stipulate that the form must be signed by the taxpayer to authorize the e-filing of their tax return. This signature serves as a legally binding agreement, allowing the tax preparer to submit the return on behalf of the taxpayer. It is important to ensure that the form is completed accurately and signed correctly to avoid any compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8879 align with the standard tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15th of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure that the Form 8879 is completed and submitted to their tax preparer by this deadline to ensure timely e-filing of their tax returns.

Form Submission Methods

The Form 8879 can be submitted through various methods, including:

- Electronically, using compliant e-signature solutions that meet IRS standards.

- Via mail, if a paper version is required by the tax preparer.

- In-person, if the taxpayer prefers to deliver the form directly to their tax preparer.

Quick guide on how to complete form 8879 rev january 2021 internal revenue service

Complete Form 8879 Rev January Internal Revenue Service seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can find the correct form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and eSign your documents quickly without delays. Manage Form 8879 Rev January Internal Revenue Service on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Form 8879 Rev January Internal Revenue Service with ease

- Locate Form 8879 Rev January Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent areas of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and then click on the Done button to store your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from a device of your preference. Modify and eSign Form 8879 Rev January Internal Revenue Service and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8879 rev january 2021 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 8879 rev january 2021 internal revenue service

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

How can airSlate SignNow help me with IRS document submissions?

airSlate SignNow simplifies how to IRS document submissions by allowing you to eSign and send forms quickly and securely. Our platform provides an intuitive interface that ensures compliance with IRS requirements, making the process efficient and easy to manage. You'll be able to focus on your business while we take care of the document handling.

-

What features does airSlate SignNow offer for IRS-related documents?

airSlate SignNow offers features such as templates for IRS forms, in-app editing, and secure eSignature options. These features are designed to streamline how to IRS functions, ensuring your documents are completed accurately and efficiently. Additionally, you can track the status of your documents in real-time to stay informed.

-

Is there a free trial available to test airSlate SignNow for IRS purposes?

Yes, airSlate SignNow offers a free trial that allows you to explore its capabilities for how to IRS processes without any commitment. This trial enables you to test the platform’s functionality, including eSigning and document management features. Experience firsthand how seamless your IRS document workflows can be.

-

What is the pricing structure for airSlate SignNow to handle IRS documents?

airSlate SignNow offers flexible pricing plans tailored for different business needs, making it cost-effective for how to IRS document management. Our plans include essential features for any organization, allowing you to choose a package that fits your budget and requirements. Contact us for a detailed pricing guide, or use our free trial to evaluate the options.

-

Can airSlate SignNow integrate with other tools I use for IRS tasks?

Absolutely, airSlate SignNow integrates seamlessly with various tools such as Google Drive, Dropbox, and CRM systems. This integration capability enhances how to IRS document handling by allowing you to access and manage all your documents in one place. Streamlining your workflows and ensuring compliance with the IRS has never been easier.

-

What benefits does airSlate SignNow provide for small businesses dealing with IRS forms?

For small businesses, airSlate SignNow offers an easy-to-use platform that simplifies how to IRS documentation processes. The ability to eSign and send documents quickly reduces turnaround times, allowing businesses to focus on growth while staying compliant. Additionally, our affordable pricing makes it accessible for businesses of all sizes.

-

How secure is airSlate SignNow when it comes to IRS-related documents?

Security is a top priority for airSlate SignNow, especially for sensitive IRS-related documents. We employ advanced encryption methods and compliance standards to ensure your data is protected throughout the signing process. You can confidently manage how to IRS document submissions knowing that your information is secure.

Get more for Form 8879 Rev January Internal Revenue Service

Find out other Form 8879 Rev January Internal Revenue Service

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later