Form 4835 Internal Revenue Service 2020

What is the Form 4835?

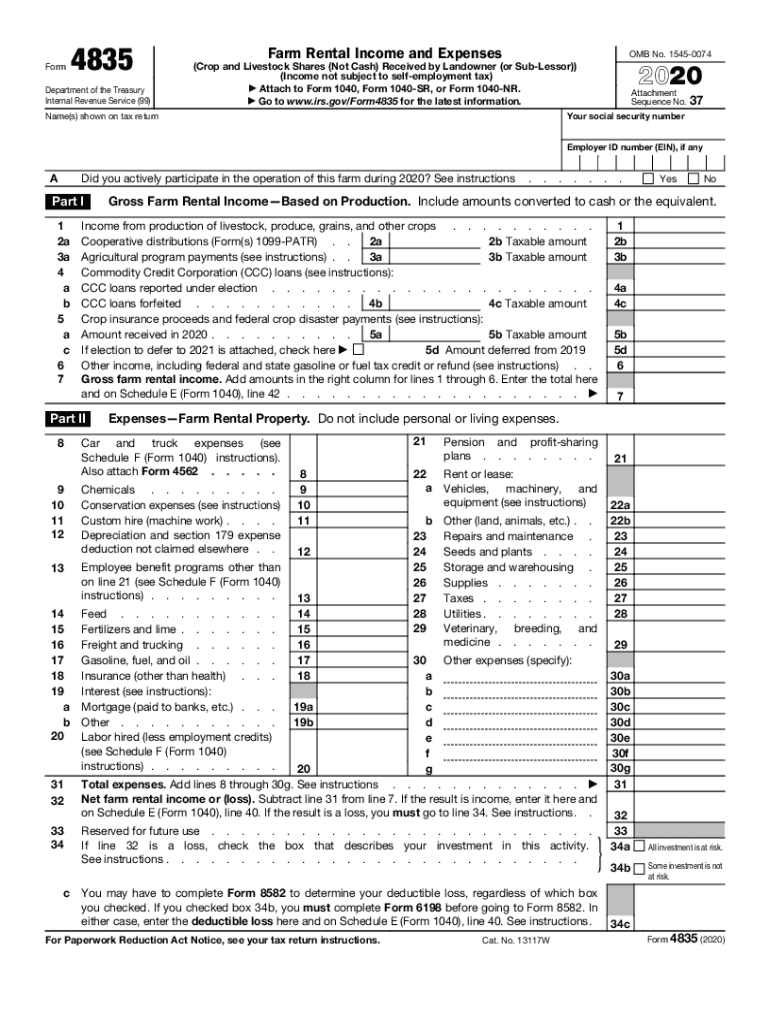

The Form 4835 is a tax form used by individuals who are engaged in farming activities and are reporting income or loss from those activities. This form is particularly relevant for those who are not the owners of the farm but are instead renting land or equipment. It is essential for reporting rental income and expenses associated with farming operations. The Internal Revenue Service (IRS) requires this form to accurately assess the tax obligations of individuals involved in agricultural activities.

How to use the Form 4835

Using the Form 4835 involves several steps to ensure accurate reporting of income and expenses. First, gather all necessary financial documents related to the farming activities, including records of rental income and any associated expenses. Next, fill out the form by providing personal information, details about the rental property, and a breakdown of income and expenses. Once completed, the form must be submitted to the IRS as part of your annual tax return. It is advisable to maintain copies of the form and any supporting documents for your records.

Steps to complete the Form 4835

Completing the Form 4835 requires careful attention to detail. Follow these steps:

- Begin by entering your name, address, and Social Security number at the top of the form.

- Provide information about the rental property, including its location and type of farming activity.

- List all sources of rental income received during the tax year.

- Detail any expenses incurred in relation to the rental activities, such as repairs, maintenance, and supplies.

- Calculate the total income and expenses to determine the net profit or loss.

- Sign and date the form before submitting it with your tax return.

Key elements of the Form 4835

Several key elements must be included when filling out the Form 4835. These include:

- Personal Information: Your name, address, and Social Security number.

- Rental Property Details: Information about the property being rented, including its location and type.

- Income Reporting: Total rental income received during the tax year.

- Expense Reporting: A detailed list of expenses related to the rental activities, which can include repairs, advertising, and utilities.

- Net Profit or Loss Calculation: The difference between total income and total expenses, which affects your overall tax liability.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 4835. It is crucial to adhere to these guidelines to ensure compliance and avoid penalties. The form must be filed along with your annual tax return by the designated deadline, typically April 15. Additionally, the IRS recommends keeping accurate records of all income and expenses related to farming activities for at least three years in case of an audit. Understanding these guidelines can help ensure that you meet all necessary requirements and accurately report your tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4835 align with the general tax return deadlines set by the IRS. Typically, the form must be submitted by April 15 of the year following the tax year being reported. If you require additional time, you may file for an extension, which extends the deadline by six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these important dates is essential for timely compliance.

Quick guide on how to complete 2020 form 4835 internal revenue service

Effortlessly Prepare Form 4835 Internal Revenue Service on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 4835 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest method to alter and eSign Form 4835 Internal Revenue Service with ease

- Locate Form 4835 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and eSign Form 4835 Internal Revenue Service to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 4835 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 4835 internal revenue service

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is form 4835 and how can airSlate SignNow help?

Form 4835 is a tax form used to report income from rental real estate. airSlate SignNow streamlines the process of preparing and signing this form, allowing you to manage your tax documents efficiently and securely without the hassle of traditional paperwork.

-

Are there any costs associated with using airSlate SignNow for form 4835?

Yes, airSlate SignNow offers a range of pricing plans suitable for various business needs. These plans are designed to ensure you can effectively manage forms like 4835 while benefiting from features such as unlimited signing and document templates.

-

What features does airSlate SignNow offer for managing form 4835?

airSlate SignNow provides features such as easy document creation, eSignature capabilities, and secure cloud storage. These tools make it simple to create, customize, and store your form 4835, ensuring compliance and security.

-

Can airSlate SignNow assist with the electronic submission of form 4835?

While airSlate SignNow does not directly submit form 4835 to the IRS, it simplifies the process of preparing the form for electronic submission. You can eSign your completed document and keep it in a secure location for filing.

-

Is airSlate SignNow compliant with legal standards for form 4835?

Yes, airSlate SignNow complies with industry standards and regulations regarding eSignatures and document management. This means that your signed form 4835 is legally binding and will hold up in a court of law if needed.

-

What integrations does airSlate SignNow offer for working with form 4835?

airSlate SignNow integrates with a variety of applications, including cloud storage and productivity tools. This means you can easily import or export your form 4835 from other software, enhancing your workflow and document management process.

-

How does airSlate SignNow enhance collaboration for form 4835 preparation?

With airSlate SignNow, multiple users can collaborate simultaneously on form 4835 preparation. You can invite team members to view, edit, and sign the document, making it easy to gather input and finalize your tax returns efficiently.

Get more for Form 4835 Internal Revenue Service

- Certificate of enrollment form

- Mmpi 2 rf excel form

- Online dmc metric form

- Pain management follow up questionnaire form

- Statement regarding criminal pleaconviction form

- Dv 700 request to renew restraining order form

- Membership application form blue spader blue spaders

- Blood lead testing certificate form

Find out other Form 4835 Internal Revenue Service

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online