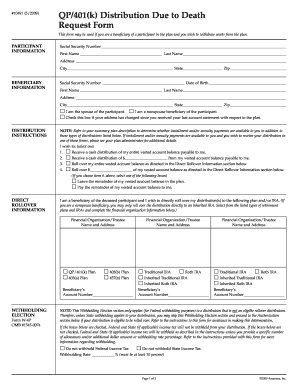

Qp401k Distribution Due to Death Request Form

What is the Qp401k Distribution Due To Death Request Form

The Qp401k Distribution Due To Death Request Form is a legal document used to initiate the distribution of funds from a 401(k) retirement plan following the death of the account holder. This form is essential for beneficiaries to claim their rightful inheritance from the deceased's retirement savings. It outlines the necessary information required by the plan administrator to process the distribution, ensuring that the funds are transferred in accordance with the plan's rules and regulations.

How to use the Qp401k Distribution Due To Death Request Form

Using the Qp401k Distribution Due To Death Request Form involves several key steps. First, beneficiaries need to obtain the form, which can typically be found on the plan administrator's website or requested directly from them. Once the form is acquired, beneficiaries should fill in the required details, including the deceased's information, the beneficiary's information, and any other relevant details as specified. After completing the form, it must be submitted to the plan administrator for processing. This process may vary slightly depending on the specific 401(k) plan, so it is advisable to review any accompanying instructions.

Steps to complete the Qp401k Distribution Due To Death Request Form

Completing the Qp401k Distribution Due To Death Request Form involves the following steps:

- Obtain the form: Access the form through the plan administrator's website or request it directly.

- Fill in the details: Provide accurate information about the deceased account holder and the beneficiary.

- Include necessary documentation: Attach any required documents, such as a death certificate or identification.

- Review the form: Ensure all information is complete and accurate to avoid delays.

- Submit the form: Send the completed form to the plan administrator via the specified method, which may include online submission, mail, or in-person delivery.

Legal use of the Qp401k Distribution Due To Death Request Form

The Qp401k Distribution Due To Death Request Form is legally binding when completed correctly. It serves as a formal request for the distribution of funds, and its acceptance by the plan administrator signifies compliance with the legal requirements governing retirement accounts. To ensure its legal validity, the form must be signed by the appropriate parties and may need to include supporting documentation, such as a death certificate. Adhering to the legal guidelines helps protect the rights of the beneficiaries and ensures proper fund distribution.

Required Documents

When submitting the Qp401k Distribution Due To Death Request Form, certain documents are typically required to facilitate the process. These may include:

- Death certificate: A certified copy of the deceased's death certificate is often necessary to verify the account holder's passing.

- Identification: Beneficiaries may need to provide a copy of their government-issued identification to confirm their identity.

- Beneficiary designation: Documentation showing the beneficiary designation on the 401(k) plan may be required to establish entitlement to the funds.

Form Submission Methods

The Qp401k Distribution Due To Death Request Form can typically be submitted through various methods, depending on the plan administrator's policies. Common submission methods include:

- Online: Many plan administrators offer an online portal for beneficiaries to submit forms electronically, streamlining the process.

- Mail: Beneficiaries can send the completed form and any required documents via postal mail to the designated address provided by the plan administrator.

- In-person: Some beneficiaries may prefer to deliver the form in person at the plan administrator's office, allowing for immediate confirmation of receipt.

Quick guide on how to complete qp401k distribution due to death request form

Complete Qp401k Distribution Due To Death Request Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Qp401k Distribution Due To Death Request Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Qp401k Distribution Due To Death Request Form without stress

- Find Qp401k Distribution Due To Death Request Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Qp401k Distribution Due To Death Request Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the qp401k distribution due to death request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Qp401k Distribution Due To Death Request Form?

The Qp401k Distribution Due To Death Request Form is a legal document used to initiate the distribution of a deceased person's 401(k) funds. This form is essential for beneficiaries to claim their entitled assets from the retirement plan efficiently. airSlate SignNow makes it easy to complete and eSign this important document.

-

How can I access the Qp401k Distribution Due To Death Request Form?

You can access the Qp401k Distribution Due To Death Request Form via the airSlate SignNow platform. We provide an intuitive interface that allows you to find, fill out, and eSign this form quickly. Additionally, our system ensures that you have access to all necessary templates and resources at your fingertips.

-

Are there any fees associated with using the Qp401k Distribution Due To Death Request Form through airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for document management, there may be fees based on the plan you choose. However, our pricing is competitive, providing excellent value for businesses handling the Qp401k Distribution Due To Death Request Form and other documents. You can explore our pricing plans to find the best option for your needs.

-

What features does airSlate SignNow offer for the Qp401k Distribution Due To Death Request Form?

airSlate SignNow offers several features for the Qp401k Distribution Due To Death Request Form, including easy document creation, eSigning, and secure storage. Additionally, users can track the status of their forms, set reminders, and automate workflows, making the document management process seamless and efficient.

-

How does using the Qp401k Distribution Due To Death Request Form benefit my business?

Using the Qp401k Distribution Due To Death Request Form through airSlate SignNow streamlines the asset distribution process, saving time and reducing paperwork. It helps ensure compliance with legal requirements while providing a convenient way for beneficiaries to claim their 401(k) benefits. This efficiency can help improve customer satisfaction and trust.

-

Can I integrate airSlate SignNow with other software for my Qp401k Distribution Due To Death Request Form?

Yes, airSlate SignNow offers integrations with a variety of business software, allowing for seamless data transfer and process optimization. This functionality allows you to connect the Qp401k Distribution Due To Death Request Form to your existing systems, enhancing productivity and efficiency in managing documents.

-

Is the Qp401k Distribution Due To Death Request Form secure with airSlate SignNow?

Absolutely! The Qp401k Distribution Due To Death Request Form is securely handled within airSlate SignNow's platform, which employs state-of-the-art encryption and security measures. We prioritize document security, ensuring that your sensitive information remains confidential and protected from unauthorized access.

Get more for Qp401k Distribution Due To Death Request Form

- Siding order form

- Seller authorization bright title amp trust llc form

- Model tenant estoppel certificate form lexology

- Month to month tenant estoppel certificate form

- Affidavit entitlement form

- Lien waiver request form united rentals

- Walk through addendum high point real estate group form

- Crs referral form

Find out other Qp401k Distribution Due To Death Request Form

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template