California K 1 Form 2016

What is the California K-1 Form

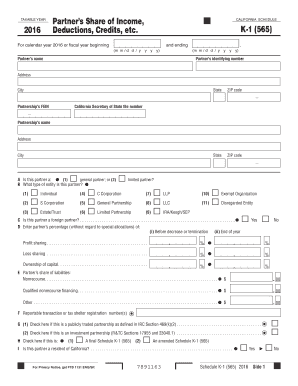

The California K-1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who receive income from these entities, as it provides the necessary information to accurately report earnings on personal tax returns. The California K-1 Form includes details such as the recipient's share of income, losses, and other tax-related items, ensuring compliance with state tax regulations.

How to use the California K-1 Form

Using the California K-1 Form involves several steps. First, recipients must receive the form from the entity that generated the income. Once in possession of the form, individuals should review the information for accuracy, including their share of income and deductions. The next step is to incorporate the details from the K-1 into their personal tax return, typically on Form 540 or 1040. It is important to retain a copy of the K-1 for personal records and future reference.

Steps to complete the California K-1 Form

Completing the California K-1 Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the partnership, S corporation, estate, or trust.

- Review the form for accuracy, ensuring all income, deductions, and credits are correctly reported.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Enter the amounts reported on the K-1 into your personal tax return, following the specific guidelines for reporting income and deductions.

- Keep a copy of the completed K-1 for your records.

Legal use of the California K-1 Form

The California K-1 Form is legally binding when properly completed and submitted. It serves as an official record of income distribution from partnerships, S corporations, estates, or trusts. To ensure its legal validity, recipients must accurately report the information on their tax returns and comply with all relevant state tax laws. Failure to do so may result in penalties or audits by the California Franchise Tax Board.

Key elements of the California K-1 Form

Several key elements make up the California K-1 Form. These include:

- Recipient Information: Name, address, and taxpayer identification number of the individual receiving the K-1.

- Entity Information: Name and identification number of the partnership, S corporation, estate, or trust.

- Income Details: Breakdown of the recipient's share of income, losses, deductions, and credits.

- Tax Year: The tax year for which the K-1 is issued, ensuring it aligns with the recipient's tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the California K-1 Form align with the tax return deadlines for the entities involved. Generally, partnerships and S corporations must provide K-1s to recipients by March 15. Recipients should ensure they receive their K-1 in time to accurately file their personal tax returns, which are typically due on April 15. Being aware of these dates is crucial to avoid late filing penalties.

Quick guide on how to complete california k 1 form 2016

Prepare California K 1 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and safely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your files swiftly without delays. Manage California K 1 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign California K 1 Form effortlessly

- Find California K 1 Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select necessary sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your revisions.

- Choose how you'd like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign California K 1 Form and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california k 1 form 2016

Create this form in 5 minutes!

How to create an eSignature for the california k 1 form 2016

How to generate an eSignature for the California K 1 Form 2016 online

How to make an electronic signature for your California K 1 Form 2016 in Chrome

How to generate an eSignature for putting it on the California K 1 Form 2016 in Gmail

How to generate an eSignature for the California K 1 Form 2016 from your smartphone

How to create an electronic signature for the California K 1 Form 2016 on iOS devices

How to make an eSignature for the California K 1 Form 2016 on Android OS

People also ask

-

What is a California K 1 Form?

The California K 1 Form is a tax document that provides information about a partner's share of income, deductions, and credits from a partnership for state tax purposes. It's crucial for ensuring accurate tax filings in California, particularly for partnerships. Understanding this form is essential for both partners and tax professionals.

-

How can airSlate SignNow assist with the California K 1 Form?

airSlate SignNow simplifies the process of sending and eSigning the California K 1 Form, allowing users to streamline their tax document management. With our platform, businesses can securely send these forms to partners and receive legally binding signatures, ensuring compliance and efficiency. This saves time and reduces errors in handling important tax paperwork.

-

What are the pricing options for using airSlate SignNow for the California K 1 Form?

airSlate SignNow offers various pricing plans tailored to fit the needs of businesses, whether small or large. Each plan includes features that facilitate easy document management, including the California K 1 Form. Contact our sales team for a detailed overview of pricing and to find the best option for your company's needs.

-

What features make airSlate SignNow ideal for managing the California K 1 Form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for document status. These tools are particularly advantageous for managing the California K 1 Form, ensuring that all pertinent information is correctly documented and accessible. Our platform enhances productivity and minimizes the risk of delays in processing.

-

How secure is airSlate SignNow when handling the California K 1 Form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the California K 1 Form. Our platform employs industry-standard encryption and complies with various data protection regulations, ensuring that your documents are safe from unauthorized access. You can trust us to keep your tax-related information secure.

-

Can airSlate SignNow integrate with accounting software for the California K 1 Form?

Yes, airSlate SignNow seamlessly integrates with various accounting software platforms, making it easy to import and export the California K 1 Form data. This integration helps streamline your workflow and reduces the need for manual data entry, saving time and improving accuracy. Take advantage of our integrations to enhance your financial operations.

-

What are the benefits of using airSlate SignNow for the California K 1 Form over traditional methods?

Using airSlate SignNow for the California K 1 Form offers numerous benefits compared to traditional document handling methods. Our platform allows for quick eSigning, real-time document tracking, and secure storage, making the entire process faster and more efficient. Additionally, electronic signatures are legally valid, reducing the need for physical copies and mail.

Get more for California K 1 Form

- Usfsp application update form 2012

- How fill form medgulf contractors job safety briefing fill form

- Official transcript request university of texas at brownsville utb form

- Concentra authorization form fillable

- Nsfaf online application 2018 form

- Ppa form

- Cambridge college online transcript request form

- Bmo pre authorized form online

Find out other California K 1 Form

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form