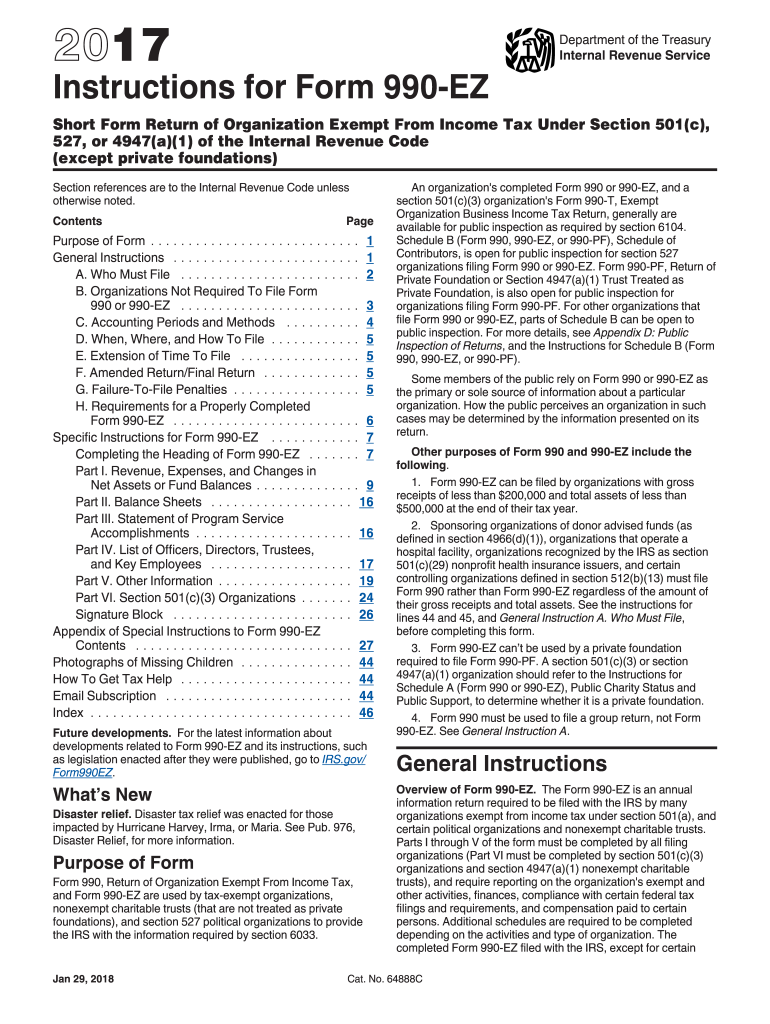

990 Ez Instructions Form 2017

What is the 990 Ez Instructions Form

The 990 Ez Instructions Form is a simplified version of the IRS Form 990, designed for smaller tax-exempt organizations. This form provides essential guidelines for these organizations to report their financial information, activities, and compliance with tax regulations. The 990 Ez is particularly beneficial for organizations with gross receipts of less than two hundred fifty thousand dollars and total assets of less than five hundred thousand dollars. By using this form, organizations can fulfill their annual reporting requirements while ensuring transparency and accountability.

How to use the 990 Ez Instructions Form

Using the 990 Ez Instructions Form involves several straightforward steps. First, gather all necessary financial data, including income, expenses, and asset information. Next, carefully read the instructions provided with the form to understand each section and its requirements. Fill out the form accurately, ensuring all figures are correct and consistent with your financial records. Once completed, review the form for any errors before submission. It is advisable to keep a copy of the filled form for your records, as it may be needed for future reference or audits.

Steps to complete the 990 Ez Instructions Form

Completing the 990 Ez Instructions Form requires attention to detail. Follow these steps for a successful submission:

- Gather financial records, including income statements and balance sheets.

- Review the form's sections, including revenue, expenses, and net assets.

- Enter the required information accurately, ensuring it aligns with your records.

- Double-check calculations and verify that all required fields are filled.

- Sign and date the form, ensuring it is submitted by the deadline.

Legal use of the 990 Ez Instructions Form

The 990 Ez Instructions Form is legally binding when completed and filed correctly. Organizations must adhere to IRS regulations to ensure compliance. This includes accurately reporting financial information and maintaining proper records. Failure to comply with these legal requirements can result in penalties, including fines or loss of tax-exempt status. It is essential for organizations to understand their obligations under federal tax law to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Ez Instructions Form are crucial for compliance. Generally, organizations must file their form by the fifteenth day of the fifth month after the end of their fiscal year. For organizations with a fiscal year ending on December thirty-first, the filing deadline would be May fifteenth of the following year. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. Organizations can apply for an extension if needed, but they must ensure that any required payments are made on time to avoid penalties.

Who Issues the Form

The 990 Ez Instructions Form is issued by the Internal Revenue Service (IRS). The IRS is responsible for overseeing tax compliance and ensuring that tax-exempt organizations adhere to federal regulations. Organizations must obtain the form directly from the IRS or through authorized channels, ensuring they use the most current version to meet their reporting obligations. Keeping abreast of any changes in IRS guidelines is essential for accurate and compliant filings.

Quick guide on how to complete 990 ez instructions form 2017

Easily Prepare 990 Ez Instructions Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle 990 Ez Instructions Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Modify and Electronically Sign 990 Ez Instructions Form Effortlessly

- Obtain 990 Ez Instructions Form and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of the documents or obscure sensitive data using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 990 Ez Instructions Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 990 ez instructions form 2017

Create this form in 5 minutes!

How to create an eSignature for the 990 ez instructions form 2017

How to generate an eSignature for your 990 Ez Instructions Form 2017 in the online mode

How to create an electronic signature for the 990 Ez Instructions Form 2017 in Google Chrome

How to make an electronic signature for putting it on the 990 Ez Instructions Form 2017 in Gmail

How to create an eSignature for the 990 Ez Instructions Form 2017 straight from your smartphone

How to make an eSignature for the 990 Ez Instructions Form 2017 on iOS devices

How to create an eSignature for the 990 Ez Instructions Form 2017 on Android OS

People also ask

-

What is the 990 Ez Instructions Form and why is it important?

The 990 Ez Instructions Form is a simplified IRS form designed for small tax-exempt organizations to report their financial activities annually. It is essential for compliance, ensuring that your organization fulfills its tax obligations efficiently. Using the 990 Ez Instructions Form helps maintain transparency and accountability in your nonprofit's operations.

-

How can airSlate SignNow help with the 990 Ez Instructions Form?

airSlate SignNow streamlines the process of preparing and signing the 990 Ez Instructions Form by allowing you to manage documents digitally. You can easily fill out, eSign, and share your form securely, saving time and reducing errors. This way, you can focus more on your organization's mission rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for the 990 Ez Instructions Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial. The cost-effectiveness of our solution makes it a perfect choice for organizations looking to manage their 990 Ez Instructions Form efficiently without overspending. Explore our pricing options to find the best fit for your organization.

-

What features does airSlate SignNow offer for the 990 Ez Instructions Form?

With airSlate SignNow, you can easily create, edit, and eSign the 990 Ez Instructions Form. Our platform offers templates, cloud storage, and automated workflows that simplify document management. Additionally, you can track the status of your forms and receive notifications when they are signed.

-

Can I integrate airSlate SignNow with other applications for the 990 Ez Instructions Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, such as Google Drive, Dropbox, and CRM systems, enhancing your workflow when handling the 990 Ez Instructions Form. This integration allows for a more cohesive experience, enabling you to manage all your documents in one place.

-

What are the benefits of using airSlate SignNow for nonprofits filing the 990 Ez Instructions Form?

Using airSlate SignNow for your 990 Ez Instructions Form simplifies the filing process, reduces paperwork, and enhances collaboration among team members. The platform ensures that your organization stays compliant with tax regulations while allowing for quick and secure document handling. This efficiency ultimately saves you time and resources.

-

How secure is airSlate SignNow when submitting the 990 Ez Instructions Form?

airSlate SignNow prioritizes your security with top-notch encryption protocols, ensuring that your 990 Ez Instructions Form and all documents are protected. We comply with industry standards to safeguard your sensitive information, giving you peace of mind as you manage your forms online.

Get more for 990 Ez Instructions Form

Find out other 990 Ez Instructions Form

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple