NOL and Disaster Loss Limitations Corporations 2017

What is the NOL and Disaster Loss Limitations Corporations

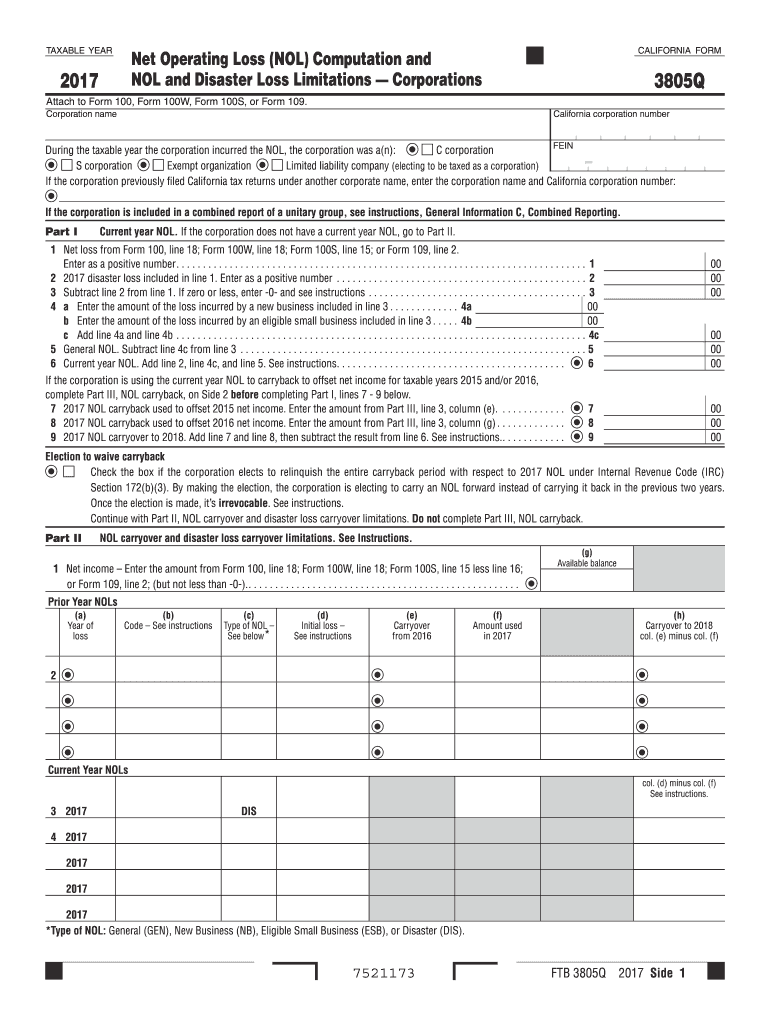

The NOL and disaster loss limitations for corporations refer to the rules governing how businesses can utilize net operating losses (NOLs) and disaster-related losses for tax purposes. An NOL occurs when a corporation's allowable tax deductions exceed its taxable income within a tax year. These losses can often be carried back to previous tax years or carried forward to offset future taxable income. Disaster loss limitations specifically address losses incurred due to federally declared disasters, allowing corporations to deduct these losses under certain conditions. Understanding these provisions is essential for effective tax planning and compliance.

How to use the NOL and Disaster Loss Limitations Corporations

Utilizing the NOL and disaster loss limitations involves several steps. First, corporations must determine their NOL by calculating total deductions and comparing them to taxable income. If a corporation has an NOL, it can choose to carry it back to offset income from previous years or carry it forward to future tax years. For disaster losses, corporations must ensure that the loss meets the criteria set by the IRS, including documentation of the loss and its connection to a federally declared disaster. Properly applying these rules can significantly reduce tax liability.

Steps to complete the NOL and Disaster Loss Limitations Corporations

Completing the NOL and disaster loss limitations form involves specific steps. First, gather all necessary financial documents, including income statements and loss records. Next, calculate the NOL by subtracting total deductions from total income. After determining the NOL, decide whether to carry it back or forward. For disaster losses, document the event and the losses incurred, referencing the applicable IRS guidelines. Finally, fill out the appropriate tax forms, ensuring all calculations are accurate before submission.

IRS Guidelines

The IRS provides detailed guidelines regarding the use of NOLs and disaster loss limitations. These guidelines outline eligibility criteria, documentation requirements, and the specific forms needed for reporting. For instance, corporations must adhere to the rules set forth in Internal Revenue Code Section 172 for NOLs and Section 165 for disaster losses. Additionally, the IRS frequently updates these guidelines, so it is crucial for corporations to stay informed about any changes that may affect their tax filings.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines related to NOLs and disaster loss limitations. Generally, the deadline for filing tax returns is April fifteenth of the following year. However, if a corporation opts to carry back an NOL, it must file a claim for a refund within three years of the original return due date. For disaster losses, the IRS may establish specific deadlines based on the disaster declaration date, so timely filing is essential to ensure eligibility for deductions.

Eligibility Criteria

Eligibility for utilizing NOLs and disaster loss limitations is determined by several factors. To qualify for an NOL, a corporation must have incurred losses that exceed its income for the tax year. For disaster losses, the corporation must demonstrate that the loss occurred due to a federally declared disaster and must provide adequate documentation to support the claim. Additionally, corporations must comply with IRS regulations regarding the timing and reporting of these losses to maintain eligibility.

Quick guide on how to complete nol and disaster loss limitations corporations

Accomplish NOL And Disaster Loss Limitations Corporations effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources necessary for you to create, modify, and eSign your documents swiftly without complications. Manage NOL And Disaster Loss Limitations Corporations on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign NOL And Disaster Loss Limitations Corporations with ease

- Find NOL And Disaster Loss Limitations Corporations and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with options that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes no time and has the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes requiring the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and eSign NOL And Disaster Loss Limitations Corporations and guarantee effective communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nol and disaster loss limitations corporations

Create this form in 5 minutes!

How to create an eSignature for the nol and disaster loss limitations corporations

How to make an electronic signature for the Nol And Disaster Loss Limitations Corporations in the online mode

How to create an eSignature for the Nol And Disaster Loss Limitations Corporations in Chrome

How to generate an eSignature for signing the Nol And Disaster Loss Limitations Corporations in Gmail

How to generate an eSignature for the Nol And Disaster Loss Limitations Corporations right from your mobile device

How to create an eSignature for the Nol And Disaster Loss Limitations Corporations on iOS

How to make an eSignature for the Nol And Disaster Loss Limitations Corporations on Android devices

People also ask

-

What are NOL and disaster loss limitations for corporations?

NOL and disaster loss limitations for corporations refer to the regulatory guidelines that dictate how businesses can utilize net operating losses and recover from disaster-related losses. Understanding these limitations is crucial for tax planning and ensuring compliance with federal regulations. Companies need to stay informed about these rules to maximize their financial relief options.

-

How does airSlate SignNow help with NOL and disaster loss documentation?

airSlate SignNow offers a streamlined platform that simplifies the documentation process for NOL and disaster loss limitations for corporations. Businesses can easily prepare, sign, and send the necessary documents electronically, reducing the administrative burden. This efficiency helps ensure that corporations can efficiently manage their tax-related paperwork.

-

What features does airSlate SignNow offer related to NOL and disaster loss forms?

With airSlate SignNow, users can easily create customizable templates for NOL and disaster loss forms. The solution also includes advanced features such as automated workflows and secure eSignature capabilities. These tools enable corporations to efficiently handle their documentation while ensuring that all forms comply with relevant regulations.

-

Can airSlate SignNow integrate with accounting software for managing NOL and disaster loss filings?

Yes, airSlate SignNow seamlessly integrates with various accounting software systems, allowing corporations to manage NOL and disaster loss filings efficiently. This integration ensures that all financial data stays synchronized, reducing errors and enhancing the accuracy of submitted forms. Businesses can streamline their operations by leveraging both platforms in tandem.

-

Is airSlate SignNow cost-effective for managing NOL and disaster loss documents?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for managing NOL and disaster loss documents. With its competitive pricing model, businesses can benefit from signNow savings compared to traditional document management approaches, allowing them to allocate resources effectively while remaining compliant.

-

How secure is the eSigning process for NOL and disaster loss documents?

The eSigning process with airSlate SignNow is highly secure, employing industry-standard encryption and authentication protocols. This ensures that all documents, including those related to NOL and disaster loss limitations for corporations, are protected from unauthorized access. Users can confidently conduct their business transactions knowing that their sensitive information is safe.

-

What benefits do corporations gain from using airSlate SignNow for NOL filings?

By using airSlate SignNow for NOL filings, corporations can benefit from enhanced efficiency and accuracy throughout the documentation process. The platform reduces turnaround times for approvals and filings, allowing businesses to respond quickly to changing financial circumstances. Additionally, the ease of use translates to less training and a faster adoption rate by employees.

Get more for NOL And Disaster Loss Limitations Corporations

- Pacificare authorization form

- Beneficiary affidavit form

- How to fill pharmacy order form

- Wellcare request for medicare prescription drug coverage determination form

- Viverae form

- Authorization for use or disclosure albany medical center amc form

- Transcript request form new for website alc

- Ocn membership application community association form

Find out other NOL And Disaster Loss Limitations Corporations

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement