Form 5227 Irs 2017

What is the Form 5227 Irs

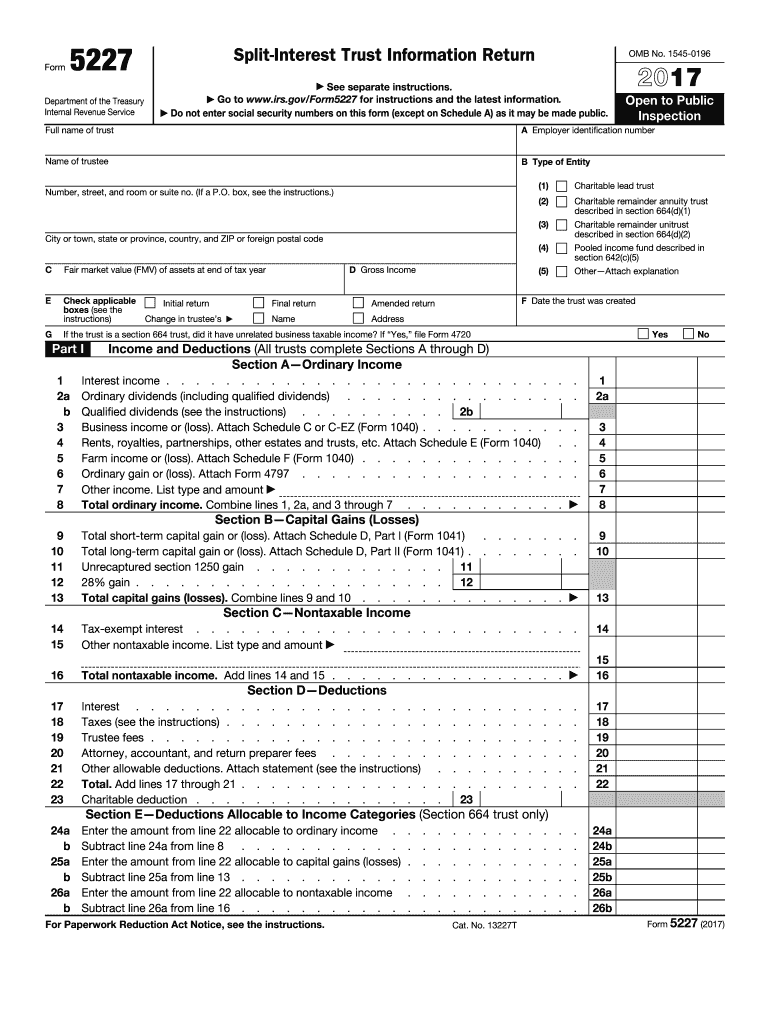

The Form 5227, officially known as the "Split-Interest Trust Information Return," is a tax form used by certain trusts to report their financial activities to the Internal Revenue Service (IRS). This form is specifically designed for split-interest trusts, which are trusts that provide benefits to both charitable and non-charitable beneficiaries. The Form 5227 captures essential information regarding the trust's income, deductions, and distributions, ensuring compliance with federal tax regulations.

How to use the Form 5227 Irs

Using the Form 5227 involves several key steps. First, determine whether your trust qualifies as a split-interest trust. If it does, gather all necessary financial information, including income earned, expenses incurred, and distributions made to beneficiaries. Complete the form by accurately reporting this information in the designated sections. After filling out the form, ensure that it is signed and dated by the appropriate trustee. Finally, submit the form to the IRS by the specified deadline to maintain compliance.

Steps to complete the Form 5227 Irs

Completing the Form 5227 requires careful attention to detail. Follow these steps for accurate submission:

- Identify the type of split-interest trust and gather relevant financial documents.

- Fill out the trust's identifying information, including name, address, and taxpayer identification number.

- Report income generated by the trust, including interest, dividends, and capital gains.

- Detail any deductions the trust is eligible for, such as administrative expenses or charitable contributions.

- Document distributions made to beneficiaries, specifying amounts and types of distributions.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 5227 Irs

The legal use of Form 5227 is crucial for ensuring compliance with IRS regulations. This form must be filed by the due date to avoid penalties. It serves as a formal declaration of the trust's financial activities, which is necessary for maintaining transparency and accountability. Failure to file the form or providing inaccurate information can lead to legal repercussions, including fines and audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5227 are typically aligned with the tax year of the trust. Generally, the form is due on the fifteenth day of the fourth month following the end of the trust's tax year. For example, if the trust operates on a calendar year, the form would be due by April fifteenth. It is essential to stay informed about any changes to deadlines or extensions that may apply to your specific situation.

Form Submission Methods (Online / Mail / In-Person)

The Form 5227 can be submitted to the IRS through various methods. While electronic filing is not available for this specific form, it can be mailed to the appropriate IRS address based on the trust's location. Ensure that the form is sent via a secure method, such as certified mail, to confirm delivery. In-person submission is generally not an option for this form, as the IRS primarily accepts mailed submissions.

Quick guide on how to complete form 5227 irs

Complete Form 5227 Irs effortlessly on any device

Online document administration has become a trend among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form 5227 Irs on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Form 5227 Irs without hassle

- Obtain Form 5227 Irs and click on Get Form to initiate.

- Utilize the tools available to submit your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form 5227 Irs and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5227 irs

Create this form in 5 minutes!

How to create an eSignature for the form 5227 irs

How to generate an eSignature for the Form 5227 Irs online

How to create an eSignature for your Form 5227 Irs in Google Chrome

How to generate an electronic signature for putting it on the Form 5227 Irs in Gmail

How to create an electronic signature for the Form 5227 Irs right from your mobile device

How to generate an eSignature for the Form 5227 Irs on iOS

How to create an electronic signature for the Form 5227 Irs on Android devices

People also ask

-

What is Form 5227 IRS and why do I need it?

Form 5227 IRS is used by certain organizations to report the activities of charitable remainder trusts. This form is essential for compliance with IRS regulations and helps ensure that you maintain your tax-exempt status. Using airSlate SignNow, you can easily eSign and manage your Form 5227 IRS documents securely.

-

How can airSlate SignNow help me with Form 5227 IRS?

airSlate SignNow streamlines the process of completing and submitting Form 5227 IRS by allowing you to eSign documents electronically. Our platform offers templates and tools that simplify document management, ensuring you can focus on compliance without the hassle of paperwork.

-

Is airSlate SignNow affordable for filing Form 5227 IRS?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 5227 IRS and other documentation. With flexible pricing plans, you can choose an option that fits your budget while gaining access to essential features that enhance your document workflow.

-

What features does airSlate SignNow offer for managing Form 5227 IRS?

Our platform provides a range of features for managing Form 5227 IRS, including customizable templates, secure eSigning, and automated workflows. These tools help you efficiently complete your forms while ensuring compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other applications for Form 5227 IRS?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to easily import and manage your Form 5227 IRS documents alongside your other important files.

-

How secure is my data when using airSlate SignNow for Form 5227 IRS?

Security is our top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your data when managing Form 5227 IRS. You can confidently eSign and submit your documents knowing that your information is safe.

-

What support options are available for airSlate SignNow users handling Form 5227 IRS?

airSlate SignNow provides comprehensive support options, including live chat, email support, and an extensive knowledge base. Whether you have questions about Form 5227 IRS or need assistance with our platform, our team is here to help you every step of the way.

Get more for Form 5227 Irs

- Cleveland clinic florida authorization to use and disclose protected health information form instructions

- Your resource guide to patient navigation fox chase cancer fccc form

- Printable sports physical form

- Af form 1466

- Nc dhhs drug workplace form

- Memorial hermann medical power of attorney form

- Application form of selena

- Texas thap form

Find out other Form 5227 Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors