Tax Return City of Tucson Tucsonaz Form

What is the Tax Return City Of Tucson Tucsonaz

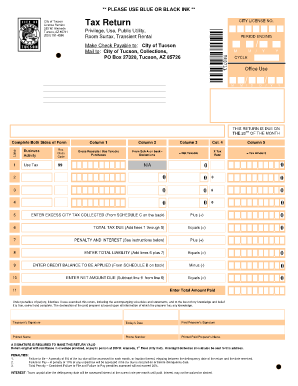

The Tax Return City of Tucson Tucsonaz is a specific form used by residents of Tucson, Arizona, to report their income and calculate their tax obligations. This form is essential for individuals and businesses operating within the city limits, as it ensures compliance with local tax regulations. It typically includes sections for reporting various types of income, deductions, and credits applicable to Tucson residents. Understanding this form is crucial for accurate tax filing and to avoid potential penalties.

How to use the Tax Return City Of Tucson Tucsonaz

Using the Tax Return City of Tucson Tucsonaz involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, download or access the form online, ensuring you have the latest version. Fill out the required sections, providing detailed information about your income, deductions, and any applicable credits. After completing the form, review it for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Tax Return City Of Tucson Tucsonaz

Completing the Tax Return City of Tucson Tucsonaz can be broken down into a few key steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Download the Tax Return City of Tucson Tucsonaz form from the official website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages, self-employment income, and investment earnings.

- Claim any deductions and credits for which you qualify, ensuring you have documentation to support your claims.

- Review the completed form for any errors before submitting it.

- Submit the form electronically or via mail, following the instructions provided on the form.

Key elements of the Tax Return City Of Tucson Tucsonaz

The Tax Return City of Tucson Tucsonaz includes several key elements that are vital for accurate completion:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: You must report all forms of income, including wages, self-employment earnings, and interest from investments.

- Deductions and Credits: Identify any deductions or credits you qualify for, such as those for education or property taxes.

- Signature: A signature is required to validate the form, whether electronic or handwritten.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Return City of Tucson Tucsonaz typically align with federal tax deadlines. Generally, the deadline for submitting your tax return is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to these deadlines, as local regulations may also apply.

Required Documents

To complete the Tax Return City of Tucson Tucsonaz, certain documents are necessary:

- W-2 Forms: These forms report your annual wages and the taxes withheld.

- 1099 Forms: For self-employed individuals or those with freelance income, 1099 forms report various income sources.

- Receipts for Deductions: Keep receipts for any deductible expenses, such as medical bills or educational costs.

- Previous Tax Returns: Having your last year’s return can help ensure consistency and accuracy.

Quick guide on how to complete tax return city of tucson tucsonaz

Complete Tax Return City Of Tucson Tucsonaz effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Tax Return City Of Tucson Tucsonaz on any device with the airSlate SignNow Android or iOS applications and simplify any document-related procedures today.

How to modify and eSign Tax Return City Of Tucson Tucsonaz with ease

- Find Tax Return City Of Tucson Tucsonaz and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Return City Of Tucson Tucsonaz and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return city of tucson tucsonaz

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting a Tax Return in the City Of Tucson, Tucsonaz?

To submit your Tax Return in the City Of Tucson, Tucsonaz, you can utilize airSlate SignNow's electronic signing features. Our platform allows you to easily upload, fill out, and sign your tax documents securely. Once completed, your return can be submitted electronically to the relevant authorities.

-

How does airSlate SignNow simplify the Tax Return process in Tucsonaz?

airSlate SignNow simplifies the Tax Return process in Tucsonaz by allowing real-time collaboration and document management. You can easily share your Tax Return with accountants or tax preparers, making it easier to handle any questions or edits on the fly. This prevents delays and ensures accuracy in your submissions.

-

What are the pricing options for using airSlate SignNow for Tax Returns in Tucsonaz?

airSlate SignNow offers competitive pricing packages tailored to meet the needs of individuals and businesses in Tucsonaz. Our cost-effective solution provides various features to help you manage your Tax Returns efficiently. We recommend visiting our pricing page for specific details and to choose the plan that suits you best.

-

Are there any integrations available for enhancing the Tax Return process in Tucsonaz?

Yes, airSlate SignNow supports various integrations that can enhance your Tax Return process in Tucsonaz. You can connect it with accounting software and mobile applications, streamlining the flow of information. This ensures that all necessary data is at your fingertips when preparing your Tax Return.

-

What security measures does airSlate SignNow implement for Tax Returns in Tucsonaz?

We prioritize your security while handling Tax Returns in the City Of Tucson, Tucsonaz. airSlate SignNow uses advanced encryption and secure servers to protect your sensitive tax information. You can have peace of mind knowing that your documents are safe with us.

-

Can I track the status of my Tax Return submissions in Tucsonaz with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Tax Return submissions in Tucsonaz. You will receive notifications and updates on any changes or actions related to your documents, keeping you informed throughout the process.

-

What benefits can I expect from using airSlate SignNow for my Tax Return in Tucsonaz?

Using airSlate SignNow for your Tax Return in the City Of Tucson, Tucsonaz, offers numerous benefits, including increased efficiency and reduced processing time. Our user-friendly platform enables you to handle paperwork swiftly, saving you time and effort. Plus, you'll have access to essential features that enhance organization and accuracy.

Get more for Tax Return City Of Tucson Tucsonaz

Find out other Tax Return City Of Tucson Tucsonaz

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer