Monthly Ust 1 Telefile Worksheet Form

What is the Monthly Ust 1 Telefile Worksheet

The Monthly Ust 1 Telefile Worksheet is a crucial document for businesses in Ohio that need to report their sales tax obligations. This form is specifically designed for electronic filing, allowing businesses to efficiently submit their sales tax information on a monthly basis. It helps ensure compliance with state tax regulations and simplifies the reporting process for businesses of all sizes.

How to use the Monthly Ust 1 Telefile Worksheet

Using the Monthly Ust 1 Telefile Worksheet involves several straightforward steps. First, businesses must gather all relevant sales data for the reporting period. Next, they will input this information into the worksheet, ensuring accuracy in the figures reported. Once completed, the worksheet can be submitted electronically, which streamlines the filing process and reduces the likelihood of errors. It is essential to follow the specific guidelines provided by the Ohio Department of Taxation to ensure proper use.

Steps to complete the Monthly Ust 1 Telefile Worksheet

Completing the Monthly Ust 1 Telefile Worksheet requires careful attention to detail. Here are the steps to follow:

- Collect all sales records for the month.

- Calculate the total sales, taxable sales, and any exemptions.

- Fill in the worksheet with the calculated figures.

- Review the information for accuracy.

- Submit the completed worksheet electronically through the designated platform.

Key elements of the Monthly Ust 1 Telefile Worksheet

The Monthly Ust 1 Telefile Worksheet includes several key elements that are vital for accurate reporting. These elements typically consist of:

- Total sales for the month

- Taxable sales amount

- Exemptions claimed

- Sales tax collected

- Signature and date fields for verification

Filing Deadlines / Important Dates

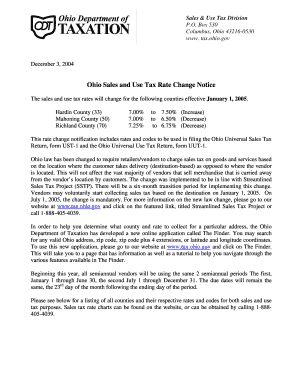

Understanding the filing deadlines for the Monthly Ust 1 Telefile Worksheet is essential for compliance. Generally, the worksheet must be submitted by the 23rd of the month following the reporting period. For example, sales made in January must be reported by February 23. Missing these deadlines can result in penalties and interest charges.

Penalties for Non-Compliance

Failure to properly complete and submit the Monthly Ust 1 Telefile Worksheet can lead to significant penalties. Businesses may face fines based on the amount of tax owed, as well as interest on any unpaid taxes. Additionally, repeated non-compliance can result in more severe consequences, including audits or legal action from the state.

Quick guide on how to complete monthly ust 1 telefile worksheet 1134343

Prepare Monthly Ust 1 Telefile Worksheet effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any delays. Manage Monthly Ust 1 Telefile Worksheet on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Monthly Ust 1 Telefile Worksheet with ease

- Obtain Monthly Ust 1 Telefile Worksheet and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Monthly Ust 1 Telefile Worksheet and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly ust 1 telefile worksheet 1134343

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the monthly ust 1 telefile worksheet and how does it work?

The monthly ust 1 telefile worksheet is a streamlined document designed for businesses to report and pay their user fees. With airSlate SignNow, you can easily fill out and electronically sign this worksheet, ensuring timely submission and compliance. Our platform simplifies the process, allowing users to manage their forms efficiently.

-

How much does the monthly ust 1 telefile worksheet feature cost?

The pricing for utilizing the monthly ust 1 telefile worksheet through airSlate SignNow is designed to fit various business budgets. We offer flexible plans that include numerous features to enhance document management and eSigning. You can find a plan that meets your specific needs and budget by visiting our pricing page.

-

What features does the monthly ust 1 telefile worksheet provide?

The monthly ust 1 telefile worksheet on airSlate SignNow includes features like customizable templates, electronic signatures, and real-time tracking of document status. These capabilities make it incredibly efficient to manage and submit worksheets. Additionally, users can save time with automated reminders for submission deadlines.

-

What are the benefits of using the monthly ust 1 telefile worksheet with airSlate SignNow?

Using the monthly ust 1 telefile worksheet with airSlate SignNow speeds up your reporting process while ensuring accuracy and compliance. The ease of eSigning eliminates the need for printing and scanning, thus enhancing productivity. You’ll also have access to cloud storage for easy retrieval of past documents.

-

Can I integrate the monthly ust 1 telefile worksheet with other software?

Yes, airSlate SignNow supports integrations with various software tools that can enhance your use of the monthly ust 1 telefile worksheet. Whether you’re using accounting software or project management tools, seamless integration options are available. This helps maintain your workflow without disruption.

-

Is the monthly ust 1 telefile worksheet secure and compliant with regulations?

Absolutely, the monthly ust 1 telefile worksheet is designed with high security standards in mind. airSlate SignNow employs encryption and complies with industry regulations to ensure your sensitive data remains protected. Users can sign documents securely, giving you peace of mind.

-

How can I get started with the monthly ust 1 telefile worksheet on airSlate SignNow?

Getting started with the monthly ust 1 telefile worksheet on airSlate SignNow is easy! Simply sign up for an account, choose the template for the monthly ust 1 telefile worksheet, and follow the prompts to fill it out and eSign. Our user-friendly interface ensures a smooth experience from start to finish.

Get more for Monthly Ust 1 Telefile Worksheet

Find out other Monthly Ust 1 Telefile Worksheet

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors