LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc Form

Understanding the living will declaration

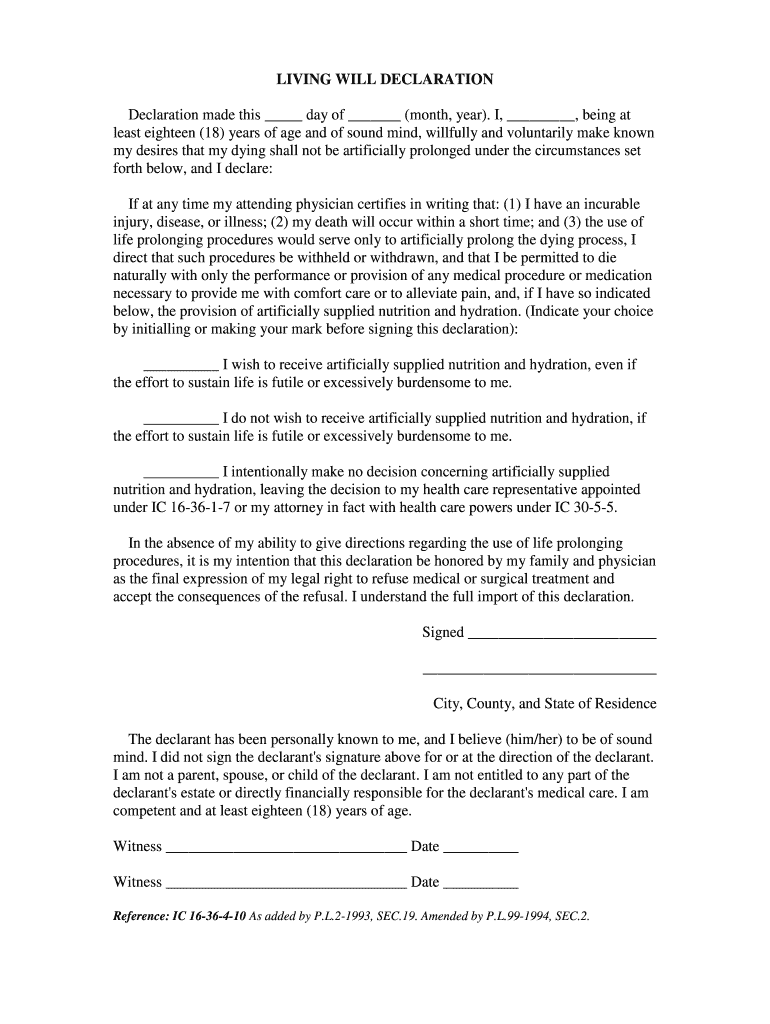

A living will declaration is a legal document that outlines an individual's preferences regarding medical treatment in situations where they may be unable to communicate their wishes. This document typically addresses end-of-life care and specifies the types of medical interventions a person desires or does not desire. It is crucial for ensuring that a person's healthcare preferences are respected, particularly in critical situations.

Key elements of the living will declaration

When creating a living will declaration, several key elements should be included to ensure its effectiveness:

- Identification: Clearly state your full name, date of birth, and address to establish your identity.

- Healthcare preferences: Specify your wishes regarding life-sustaining treatments, resuscitation efforts, and other medical interventions.

- Signature: Your signature is necessary to validate the document, along with the date it was signed.

- Witnesses: Depending on state laws, you may need one or more witnesses to sign the document, confirming that you are of sound mind and acting voluntarily.

- Notarization: Some states require notarization for added legal strength.

Steps to complete the living will declaration

Completing a living will declaration involves several straightforward steps:

- Research state laws: Understand the specific requirements for living wills in your state, as they can vary significantly.

- Gather necessary information: Collect personal details, including your medical preferences and any relevant health information.

- Draft the document: Use a template or consult a legal professional to draft your living will declaration.

- Review and revise: Carefully review the document to ensure it accurately reflects your wishes.

- Sign and witness: Sign the document in the presence of required witnesses or a notary, if necessary.

Legal use of the living will declaration

The legal use of a living will declaration is governed by state laws, which determine its validity and enforceability. Generally, a properly executed living will declaration is recognized as a legal document that healthcare providers must follow. It is essential to ensure that the document complies with state requirements to avoid any potential disputes regarding your healthcare wishes.

How to obtain the living will declaration

Obtaining a living will declaration can be accomplished in several ways:

- Online resources: Many legal websites offer templates and forms that you can download and customize.

- Legal professionals: Consulting with an attorney who specializes in estate planning can provide personalized guidance and ensure that your living will declaration meets all legal requirements.

- Healthcare providers: Some hospitals and healthcare facilities may offer resources or templates for creating a living will declaration.

State-specific rules for the living will declaration

Each state in the U.S. has its own laws regarding living wills, which can affect how these documents are created and enforced. It is important to be aware of the following:

- Witness requirements: Some states require witnesses to sign the document, while others may not.

- Notarization: Certain states mandate notarization for the living will declaration to be valid.

- Revocation procedures: States have specific guidelines on how to revoke or update a living will declaration.

Quick guide on how to complete living will declaration declaration made this iahhc iahhc

Easily Prepare LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc on Any Device

Managing documents online has gained popularity among both organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

The Simplest Way to Modify and Electronically Sign LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc

- Obtain LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc and then click Get Form to initiate the process.

- Utilize the resources we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from whichever device you prefer. Modify and electronically sign LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I have a class lesson assessment form that I need to have filled out for 75 lessons. The form will be exactly the same except for the course number. How would you do this?

Another way would be to use the option of getting pre-filled answers with the course numbers entered. A custom URL is created and the form would collect the answers for all of the courses in the same spreadsheet. Not sure if that creates another problem for you, but you could sort OR filter the sheet once all the forms had been submitted. This is what the URL would look like for a Text Box https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048=COURSE+NUMBER+75 The nice thing about this is you can just change the part of the URL that Contains "COURSE+NUMBER+75" to a different number...SO for course number 1 it would be https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048=COURSE+NUMBER+1This is what the URL would look like for a Text Box radio button, same concept. https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048&entry.1934317001=Option+1 OR https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048&entry.1934317001=Option+6The Google Doc would look like this Quora pre-filled form I'm not sure if this helps at all or makes too complicated and prone to mistakes.

-

Which ITR form should I fill for payments received from the USA to a salaried individual in India for freelancing work, and how should I declare this in ITR? There is no TDS record of this payment as it is outside India.

You can use ITR-1 to show it as Income from Other SOurcesIf you want to claim expense against this income, then you are better off showing it in ITR-2 again as Income from Other Sources. In this case dont claim too many expenses against Income from Other Sources because that usually triggers a scrutinyIf this is going to be regular, then you will need to fill ITR-3 and show this as Income from Business/Profession. The negative of this ITR is that it is quite voluminous and you will have to prepare a Balance Sheet and Profit and loss account even if your income from this source exceeds an amount as low as Rs. 1,20,000/-.

-

One of my friends lives far away from my school but he still wants to go to this school. He is using our address. How do we fill out the school form? We don't know what to exactly put on the form, we need massive help. We need to finish this today.

My district has a window of time that allows students to transfer to chosen schools. Almost all transfers are accepted.There is a specific procedure to do this correctly.If the student lives in a different district, they have to officially notify that district that they are planning on going to a neighboring district. Paperwork must be signed by both districts.Please contact all the districts involved. They can help you with the steps.Each year the student must reapply for the transfer. My district only denies transfers when attendance or behavior has been an issue.

-

If I was at a Casino and lost over $20,000 in a slot machine before hitting a $10,000 jackpot, will I still have to fill out a tax form and declare that as income even thought I really lost $10,000?

There are two ways to handle slot winnings/losses. The “regular” way is that all winnings (whether you receive a W-2G or not) are reported on your 1040 as “other income”, and your losses that you can substantiate are deducted on your Schedule A (assuming that you itemize, etc.). Under that method, yes, you would report the $10K jackpot (plus any other winnings that came out of the machine(s)), and you would deduct your losses up to the amount of your reported winnings as an itemized deduction.The other way to do it is the technically correct way — and that is to net your slot results on a “session” basis. That is, from the time that you pull your first lever (or push your first “spin” button”) of the day until you stop playing the slots, other than short breaks — but not beyond midnight — you total your net winnings/losses, and that’s your winnings or losses for the “session” that are reportable on your tax return. That method, for example, enables you to take advantage of losses even if you don’t itemize deductions. Now, that’s not going to match up with any W-2G’s that you get, because the casinos don’t report on that basis (they don’t even report on the basis of a midnight-to-midnight day). But the IRS has ways in which you can indicate that on your return.So the answer to your question is, maybe. It depends on (i) when did you lose the $20K and win the $10K?, (ii) what kind of records do you have (a “players’ card” statement would be great), and (iii) what else did you win gambling?

Create this form in 5 minutes!

How to create an eSignature for the living will declaration declaration made this iahhc iahhc

How to make an eSignature for the Living Will Declaration Declaration Made This Iahhc Iahhc in the online mode

How to generate an electronic signature for your Living Will Declaration Declaration Made This Iahhc Iahhc in Chrome

How to generate an electronic signature for signing the Living Will Declaration Declaration Made This Iahhc Iahhc in Gmail

How to make an eSignature for the Living Will Declaration Declaration Made This Iahhc Iahhc from your smartphone

How to create an electronic signature for the Living Will Declaration Declaration Made This Iahhc Iahhc on iOS devices

How to make an electronic signature for the Living Will Declaration Declaration Made This Iahhc Iahhc on Android devices

People also ask

-

What is a LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc?

A LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc is a legal document that outlines your healthcare preferences in case you become unable to communicate your wishes. It ensures that your medical treatment aligns with your values and decisions, providing peace of mind to you and your loved ones.

-

How can I create a LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc using airSlate SignNow?

Creating a LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc with airSlate SignNow is simple. You can use our user-friendly templates to fill out the necessary information, customize your preferences, and electronically sign the document, all within our secure platform.

-

Is there a cost associated with the LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc on airSlate SignNow?

Yes, there is a cost associated with creating a LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc on airSlate SignNow. We offer flexible pricing plans that cater to both individual and business needs, ensuring you receive a cost-effective solution for your document signing and management.

-

What are the benefits of using airSlate SignNow for my LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc?

Using airSlate SignNow for your LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc offers numerous benefits. Our platform ensures that your documents are securely signed and stored, provides easy access for you and your family, and allows for quick modifications should your preferences change over time.

-

Can I integrate airSlate SignNow with other applications for my LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easy to manage your LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc alongside your other essential tools. This integration enhances workflow efficiency and ensures all your documents are connected.

-

Is the LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc legally binding?

Yes, a LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc created through airSlate SignNow is legally binding, provided it meets your state’s requirements. Our platform is designed to assist you in ensuring that your document complies with local regulations.

-

How does airSlate SignNow ensure the security of my LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc?

airSlate SignNow employs robust security measures to protect your LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc. We use encryption, secure cloud storage, and strict access controls to ensure your sensitive information remains safe and confidential.

Get more for LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc

- Financial declaration utah form

- Princess house catalog form

- Employment contract template live in caregiver employer employee contract form

- Standup wireless form

- Chiropractic x ray forms pdf

- Pa schedule rk 1 resident schedule of shareholder form

- Rules coding resource training manual form

- Public records requestanderson county tennessee form

Find out other LIVING WILL DECLARATION Declaration Made This IAHHC Iahhc

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free