Ptax 762 C Form

What is the Ptax 762 C Form

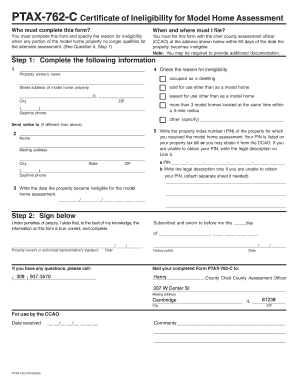

The Ptax 762 C Form is a property tax exemption application used in certain jurisdictions within the United States. This form allows eligible property owners to apply for specific tax exemptions, which can significantly reduce their property tax liabilities. Understanding the purpose and requirements of this form is essential for homeowners seeking financial relief through property tax reductions.

How to use the Ptax 762 C Form

Using the Ptax 762 C Form involves several key steps. First, ensure you meet the eligibility criteria for the exemption being sought. Next, download the form from the appropriate local government website or office. Fill out the required information accurately, including personal details and property information. Once completed, submit the form according to the instructions provided, either online, by mail, or in person, depending on local regulations.

Steps to complete the Ptax 762 C Form

Completing the Ptax 762 C Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as proof of ownership and identification.

- Download the form from the local tax authority's website.

- Fill out the form with accurate information, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form by the specified deadline to ensure consideration for the tax exemption.

Legal use of the Ptax 762 C Form

The legal use of the Ptax 762 C Form is governed by state and local laws. It is important to ensure that the form is filled out correctly and submitted within the designated time frame to comply with legal requirements. Failure to adhere to these guidelines may result in the denial of the exemption request. Understanding the legal implications of this form can help property owners navigate the process more effectively.

Key elements of the Ptax 762 C Form

Key elements of the Ptax 762 C Form include:

- Property Information: Details about the property for which the exemption is being requested.

- Owner Information: Personal details of the property owner, including name and contact information.

- Eligibility Criteria: Specific conditions that must be met to qualify for the exemption.

- Signature: A signature certifying that the information provided is accurate and truthful.

Who Issues the Form

The Ptax 762 C Form is typically issued by local tax authorities or county assessors in the jurisdiction where the property is located. These offices are responsible for managing property tax assessments and exemptions, ensuring that property owners have access to necessary forms and information regarding tax relief options.

Quick guide on how to complete ptax 762 c form

Effortlessly Prepare Ptax 762 C Form on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Ptax 762 C Form on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to Edit and Electronically Sign Ptax 762 C Form with Ease

- Locate Ptax 762 C Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, time-consuming form searches, or errors that necessitate printing additional copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Ptax 762 C Form and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 762 c form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ptax 762 C Form?

The Ptax 762 C Form is an essential document used for property tax purposes in certain states. It helps property owners and assessors calculate property tax assessments accurately. Understanding this form can ensure that you are compliant with local tax regulations.

-

How can airSlate SignNow assist with the Ptax 762 C Form?

airSlate SignNow provides a seamless platform for electronically signing and sending the Ptax 762 C Form. By using our service, you'll save time on paperwork and ensure that your forms are securely processed. Our user-friendly interface makes it easy to manage your documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the Ptax 762 C Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. We aim to deliver a cost-effective solution for managing your documents, including the Ptax 762 C Form. You can find a plan that fits your budget and requirements on our pricing page.

-

What features does airSlate SignNow offer for electronic signatures?

airSlate SignNow offers several features for electronic signatures, including customizable signing workflows, document templates, and real-time tracking. These features facilitate the signing process of important documents like the Ptax 762 C Form. Our platform is designed to enhance productivity and ensure compliance.

-

Can I integrate airSlate SignNow with other software applications for managing the Ptax 762 C Form?

Yes, airSlate SignNow offers integrations with popular software applications, including CRM and document management systems. This allows you to manage the Ptax 762 C Form alongside other important documents within your existing workflow. Our integration capabilities enhance the overall efficiency of your business processes.

-

What are the benefits of using airSlate SignNow for the Ptax 762 C Form?

Using airSlate SignNow for the Ptax 762 C Form streamlines the signing process and reduces turnaround time. Benefits include improved document security, easier compliance tracking, and enhanced collaboration among stakeholders. This leads to a more efficient workflow and increased customer satisfaction.

-

How secure is airSlate SignNow for handling the Ptax 762 C Form?

airSlate SignNow prioritizes security with features like encryption and compliance with industry standards. We ensure that your documents, including the Ptax 762 C Form, are protected throughout the signing process. Our platform offers audit trails and secure storage, giving you peace of mind.

Get more for Ptax 762 C Form

Find out other Ptax 762 C Form

- Edit eSignature Form Android

- Submit eSignature Word Mobile

- Submit eSignature Document Fast

- Submit eSignature Document Simple

- Submit eSignature Document Easy

- How To Submit eSignature Form

- Convert eSignature PDF Online

- Convert eSignature PDF Free

- Convert eSignature Word Online

- Convert eSignature Document Online

- How To Convert eSignature Document

- Can I Convert eSignature Document

- Convert eSignature Form iOS

- Convert eSignature Form iPad

- Print eSignature PDF Secure

- Print eSignature Word Free

- Print eSignature Form Mobile

- Print eSignature Word Mac

- How To Print eSignature Word

- How Can I Print eSignature Document