Submit eSignature Document Simple

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Discover the easiest way to Submit eSignature Document Simple with our powerful tools that go beyond eSignature. Sign documents and collect data, signatures, and payments from other parties from a single solution.

Robust integration and API capabilities

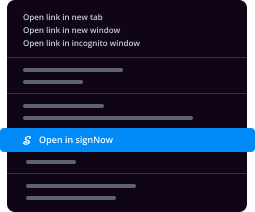

Enable the airSlate SignNow API and supercharge your workspace systems with eSignature tools. Streamline data routing and record updates with out-of-the-box integrations.

Advanced security and compliance

Set up your eSignature workflows while staying compliant with major eSignature, data protection, and eCommerce laws. Use airSlate SignNow to make every interaction with a document secure and compliant.

Various collaboration tools

Make communication and interaction within your team more transparent and effective. Accomplish more with minimal efforts on your side and add value to the business.

Enjoyable and stress-free signing experience

Delight your partners and employees with a straightforward way of signing documents. Make document approval flexible and precise.

Extensive support

Explore a range of video tutorials and guides on how to Submit eSignature Document Simple. Get all the help you need from our dedicated support team.

Keep your eSignature workflows on track

Make the signing process more streamlined and uniform

Take control of every aspect of the document execution process. eSign, send out for signature, manage, route, and save your documents in a single secure solution.

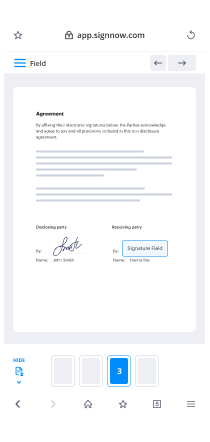

Add and collect signatures from anywhere

Let your customers and your team stay connected even when offline. Access airSlate SignNow to Submit eSignature Document Simple from any platform or device: your laptop, mobile phone, or tablet.

Ensure error-free results with reusable templates

Templatize frequently used documents to save time and reduce the risk of common errors when sending out copies for signing.

Stay compliant and secure when eSigning

Use airSlate SignNow to Submit eSignature Document Simple and ensure the integrity and security of your data at every step of the document execution cycle.

Enjoy the ease of setup and onboarding process

Have your eSignature workflow up and running in minutes. Take advantage of numerous detailed guides and tutorials, or contact our dedicated support team to make the most out of the airSlate SignNow functionality.

Benefit from integrations and API for maximum efficiency

Integrate with a rich selection of productivity and data storage tools. Create a more encrypted and seamless signing experience with the airSlate SignNow API.

Collect signatures

24x

faster

Reduce costs by

$30

per document

Save up to

40h

per employee / month

Our user reviews speak for themselves

How to Submit for Signature Using airSlate SignNow

Sending documents for signing has become simpler than ever with airSlate SignNow. This robust eSignature tool enables companies to optimize the signing workflow, conserving time and improving efficiency. With its intuitive design and cost-effective pricing, airSlate SignNow caters to the requirements of small to medium-sized enterprises.

Procedures to Submit for Signature with airSlate SignNow

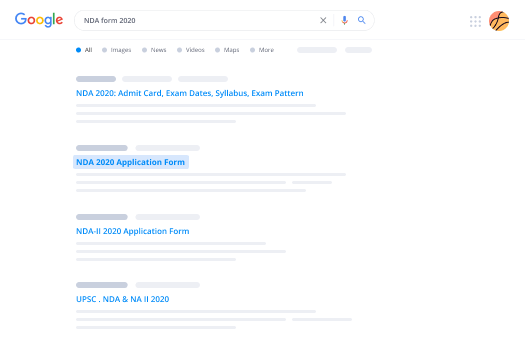

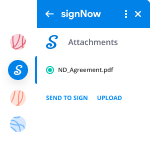

- Launch your web browser and go to the airSlate SignNow homepage.

- Register for a complimentary trial or log into your existing account.

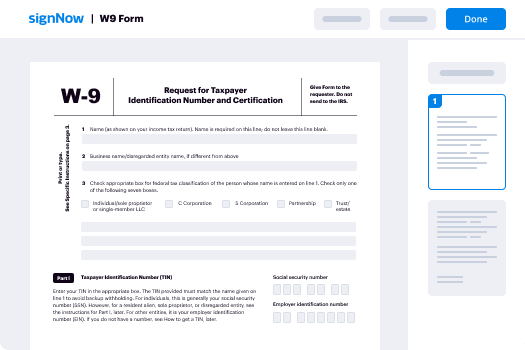

- Choose the document you want to sign or submit for signing and upload it.

- If you intend to reuse this document, save it as a template for later use.

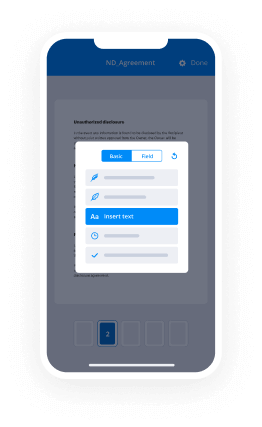

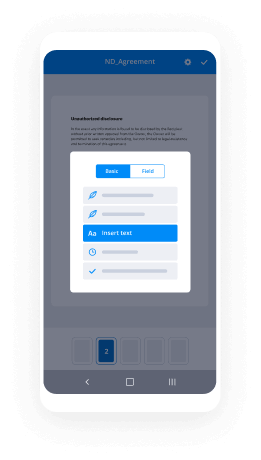

- Retrieve your uploaded document and modify it by inserting fillable fields or any other needed details.

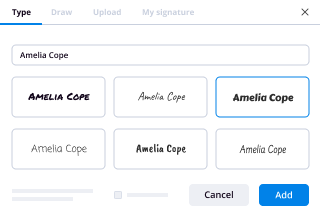

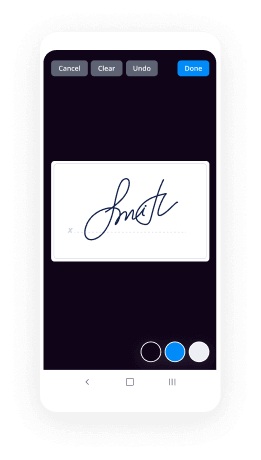

- Add your signature and specify signature fields for the designated recipients.

- Click on 'Continue' to set up and dispatch an eSignature request to the recipients.

In summary, airSlate SignNow provides an effective method to submit for signature, assisting businesses in managing their documentation with ease. With its extensive features and clear pricing, it guarantees a substantial return on investment for each dollar invested.

Ready to streamline your signing workflow? Start your free trial with airSlate SignNow today and discover the advantages firsthand!

How it works

Browse for a template

Customize and eSign it

Send it for signing

Rate your experience

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

FAQs

-

How do I submit for signature using airSlate SignNow?

To submit for signature with airSlate SignNow, simply upload your document, add the recipients' email addresses, and specify where they need to sign. Once you've prepared your document, click 'Send' to submit for signature. The recipients will receive an email notification prompting them to eSign the document instantly.

-

What features does airSlate SignNow offer for submitting documents for signature?

airSlate SignNow provides a range of features for submitting documents for signature, including customizable templates, automated workflows, and real-time tracking. You can easily add signature fields and notes, making the submission process seamless. Plus, the platform allows you to submit for signature on any device, enhancing flexibility.

-

Is there a free trial available to test the submit for signature feature?

Yes, airSlate SignNow offers a free trial that allows you to test the submit for signature feature without any commitment. During the trial, you can explore all the functionalities, including document templates and eSignature options. This is a great way to see how airSlate SignNow can streamline your document workflows.

-

What are the pricing plans for airSlate SignNow when submitting for signature?

airSlate SignNow offers flexible pricing plans to suit different business needs. You can choose from monthly or annual subscriptions, which start at an affordable rate, allowing you to submit for signature as many times as you need. Each plan includes various features that enhance your document management process.

-

Can I integrate airSlate SignNow with other tools to submit for signature?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and Microsoft Teams, making it easy to submit for signature directly from these platforms. This integration helps streamline your workflow and keeps all your documents organized in one place.

-

What benefits does using airSlate SignNow provide when submitting for signature?

Using airSlate SignNow to submit for signature offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. The platform ensures that your documents are signed quickly and safely, allowing you to focus on your core business activities. Additionally, it provides an eco-friendly alternative to traditional paper-based methods.

-

Is it safe to submit for signature with airSlate SignNow?

Yes, it is completely safe to submit for signature using airSlate SignNow. The platform employs advanced encryption and security protocols to protect your documents and personal information. You can have peace of mind knowing that your data is securely managed throughout the signing process.

-

What is the procedure for online registration of a company in India?

To begin an entrepreneurial journey you must know about the basic legalities and process connected with a company.Company Registration or Incorporation is most important step for a business journey.There are few things you need to know before you move to registration process. There are different types of company registration in India.Private Limited Company – It is one of the most used domain of company registration due to following reasons.Partners have their own secure share holdings.Allow an ease in process in loan and funding.Allow customers to build a trust with company.2. One Person Company – In One Person Company, a single person gains full authority over the company thereby restricting his/her liability towards their contributions to the enterprise. Therefore, the said person will be the sole shareholder and director.So there will be no opportunity for contributing to employee stock options or equity funding. Additionally, if an OPC has an average turnover of Rs. 2 crores and over or acquires a paid-up fund of Rs. 50 lakh and over in 3 consecutive years , it has to be converted to a private limited company or public limited company within six months.3. Limited Liability Partnership – Limited Liability Partnership Registration, governed by LLP Act 2008 combines the benefits of a partnership with that of a limited liability company. LLP was introduced to provide a form of business that is easy to maintain and to help owners by providing them with limited liability.Limited Liability partnership is having following features.LLP gives the separate legal entity in which partners have limited liabilityIt gives an ease of process to transfer the ownership with other person.LLP is suitable for small business which is having capital of around 25 Lacs and turnover of 40 Lacs.Get straight away for registering your company with India’s 1st Legal Hub for Business / Startups / Individual only at www.getmeofficial.com

-

E-signing: Is typing your name on a form and clicking submit hold up as a legal signature?

In states which have passed it, the Uniform Electronic Transactions Act (UETA) would govern this. Section 7 of UETA, in particular, specifies: SECTION 7. LEGAL RECOGNITION OF ELECTRONIC RECORDS, ELECTRONIC SIGNATURES, AND ELECTRONIC CONTRACTS. (a) A record or signature may not be denied legal effect or enforceability solely because it is in electronic form. (b) A contract may not be denied legal effect or enforceability solely because an electronic record was used in its formation. (c) If a law requires a record to be in writing, an electronic record satisfies the law. (d) If a law requires a signature, an electronic signature satisfies the law.So, assuming that a signature is required for a contract to be valid, an "electronic signature" suffices. UETA defines "electronic signature" as follows:(8) "Electronic signature" means an electronic sound, symbol, or process attached to or logically associated with a record and executed or adopted by a person with the intent to sign the record.In basic language, this means that when you type out your name and click on the "submit" button, you've electronically signed the record, and the official comments to UETA (not technically law, but extremely persuasive) back this up:This definition includes as an electronic signature the standard webpage click through process. For example, when a person orders goods or services through a vendor's website, the person will be required to provide information as part of a process which will result in receipt of the goods or services. When the customer ultimately gets to the last step and clicks "I agree," the person has adopted the process and has done so with the intent to associate the person with the record of that process. The actual effect of the electronic signature will be determined from all the surrounding circumstances, however, the person adopted a process which the circumstances indicate s/he intended to have the effect of getting the goods/services and being bound to pay for them. The adoption of the process carried the intent to do a legally signNow act, the hallmark of a signature.Although not every state has adopted UETA either in part or in whole without modifications, I believe every state now has similar or identical provisions in its body of law. Assuming that this type of waiver would otherwise be legally enforceable (and many jurisdictions don't allow a waiver of liability for injuries under certain circumstances) then it would not be rendered unenforceable simply because it was signed electronically.Of course, in order to ensure the enforceability of any contract, one should generally consult with an attorney who is familiar with contract law in your jurisdiction and who could recommend a set of best practices for the storage and preservation of any contract stored as an electronic record.

-

What is the procedure to register a startup company in India and how much will it cost?

These are four major steps required to register a start up company in india :Acquiring Digital Signature Certificate(DSC)Acquiring Director Identification Number(DIN)Document required for a DIN :A. Identity Proof (Any one of the following) PAN CardDriving LicensePassportVoter ID CardOthers (to be specified)B. Residence Proof (Any one of the following)Driving LicensePassportVoter ID CardTelephone BillRation CardElectricity BillBank StatementOthers (to be specified)Filing an e-Form or New user registrationIncorporate the company Once your company has been incorporated you can open a Current account in any of the leading banks for carrying out your operations. You will need to submit a copy of Certificate of Incorporation and Memorandum of Association along with Borad resolution to open the bank account.Then you need to apply for TAN and PAN for the Company If your services are in Software related area you can apply for STPI license which will give you certain benefits like Company need not pay tax for 5 years, there will be no import or expurty duty levied on software/hardware,You will get office spaces at lower rates at STPI units. These are few of the benefits of becoming an STPI member.All this you can do on your own or you can outsource these to professional auditor. We did it through Auditor and it took almost three weeks (Upto Step 7 excluding STPI) and all charges(excluding sTPI) would approximately cost you Rs.25,000.

-

What is the best Contract Lifecycle Management system (from your experience)?

Like others in this thread, I agree that it depends on the specific features your industry/company demands. Hopefully one of the following tools will suit your needs.We did a huge crowd-sourcing of the best sales tools out there in different categories. This list of contract lifecycle managementt tools might do some service here. These should help you get your email workflows to be more efficient and easier to track throughout campaigns.The whole list of all 157 tools in different categories is here —-> Sales Tools: The Complete List (2017 Update) | Sales HackerHere are the ones we highligh...

-

I am 21 years old. I want to change my signature on my PAN card. Is it possible? If yes, what's the procedure?

Listed below are the simple steps you need to follow when you change the signature on your PAN Card:Visit the NSDL website by typing in the following link in the address bar – Guidelines for filling PAN Change Request ApplicationRead the guidelines and instructions carefully before applying for any changes that need to be made on your PANScroll down to the bottom half of the document until you locate the “Category of the Applicant” tabSelect the category that you fall into and then click on the “Select” optionYou will then have to fill in the change request form after carefully reading itAll boxes which have “*” against it should be filled up without fail as your form will neither be accepted or processed if any of the mandatory fields have been left blankSelect the box that reads “Signature Mismatch”You will also have to submit your current PAN in the box that corresponds to “Permanent Account Number (PAN)”You could also select the paperless route when submitting your documents:You do not have to physically submit the documents that are required for a change in signature on your PAN CardYou can simply provide a digital signature or upload a photo of the same, your photograph, and other documents that are requiredAfter you have completed the steps mentioned above, click on the “Submit” optionYou will have to pay a change request fee of Rs.107 through any of the following channels:ChequeDemand DraftDebit CardCredit CardNet BankingOnce you have completed the submission of your PAN Change Request form and payment, you will have to take a printout of the acknowledgement form along with its 16 digit acknowledgement numberYou will have to attach 2 recent passport photographs to your acknowledgement formEnclose the cheque or demand draft in the cover where the heading should read “Application for PAN change request –16 digit acknowledgement number” which means that if your acknowledgement number is 1726239458594404. The cover heading would be “Application for PAN change request–1726239458594404”You will then have to post this cover to the NSDL address:Income Tax PAN Services Unit,NSDL e-Governance Infrastructure Limited,5th floor, Mantri Sterling, Plot No. 341,Survey No. 997/8, Model Colony,Near Deep Bungalow Chowk, Pune–411016. Phone number: 020–2721 8080.You will have to make sure that the cover signNowes the NSDL office within 15 days from the date of receiving the acknowledgementOnce you have completed the steps mentioned above, you will receive an e-mail on your registered e-mail address.Thanks.

-

What is the registration process for CS?

CS Executive Registration Dec 2018 & June 2018.Here I have given CS Executive registration details,, CS Executive Registration last date to apply and fees details. The students who will pass in Dec 2017 CS Foundation exam, can apply online Registration for CS Executive Exam Dec 2018. CS Students needs that the last date for CS Executive Registration for December 2018 is 28th Feb 2018 and for June 2018 was 31st August 2017.In this article, I will be sharing online registration process for December 2018 and June 2018. The last date for CS Executive Registration June 2017 attempt was 31st Augu...

-

How do I register a startup in India? How much money and time does it take? If am currently only 17, what issues will I face dur

Algorithm for starting a Private Limited Company: Engineer's View Personally I believe, If someone is starting a company with long term perspective or to bring some change through their unique Product/Services, one must go for Private limited firm. Prime reason for this is easy to raise funds from Angels/VC in case you go for investment. Step 1. Registration of Company 1. Name Selection: Check whether your desired company name is available or not at MCA website [ http://www.mca.gov.in/ ]. Name must be unique & must resemble with business you intend to do (highlighted one). EX: Arihant Labs Retail Services Pvt. Ltd 2. Registration of Name at ROC: Name approval usually takes maximum of 14 days. This is done online through MCA website. Moreover, you need to apply with at least 4 names for approval with a writeup about significance of names with main business of the company. 3. 1. Documents Required: 2. 1. Options for names for the proposed Company (on the basis of preference) 2. Amount of Share Capital; proposed shareholding ratio 3. A paragraph on the proposed major line of business of the company (main objects) 4. City of Registered Office. 5. Copy of ownership deed/sale deed(if property is owned) 6. Copy of rent agreement with NOC (if property is rented) 7. Copy of latest electricity bill/telephone bill/mobile bill for both directors 8. Copy of latest electric bill/telephone bill for the registered office proof. 4. Obtaining DIN & DSC: 5. 1. Documents Required 2. 1. PAN Card copies for directors and shareholders. 2. Voter ID/Passport/Driving License for directors and shareholders. 3. Occupation of the Directors for directors and shareholders. 4. E-Mail IDs of all directors and shareholders. 5. Phone Numbers for all directors and shareholders. 6. Photos for directors and shareholders 6. Company Incorporation: After above mentioned formalities have been completed, we need to file following forms/docs in Rs 100 stamp paper: 7. 1. Affidavits for non- acceptance 2. INC 9, INC 10 3. DIR 2 4. NOC : This is required to be filed by the owner of the property on which your company will be situated. 5. Subscriber Sheets of MOA & AOA 6. Documents required for filling MOA & AOA 7. 1. Must be filled on OWN handwriting 2. Passport size photos 3. Sheets needs to be witnessed by CA/CS/Advocate Step 2. Obtaining PAN/TAN: After company gets incorporated, you may apply for PAN/TAN. Step 3. Trade Licence in case you are selling PRODUCTS: This is required in some places for carrying out sales. You can obtain this from local Municipality. Step 4. VAT/CST registration for selling Products: For selling intra-state, you need VAT registration & for selling inter-state, you need to register for CST. 1. Documents Required: 2. 1. Trade Licence 2. Company Incorporation Certificate 3. PAN card of company as well as of all the directors 4. Proof of residence of Directors 5. Proof of occupancy of place of business (Rent agreement/ ownership deed, Rent Bills etc) 6. MOA & AOA of company 7. Current Account in the name of company in any national bank Step 5. Service tax registration for Service Industry: In India, you need to pay service tax of 14.5% on every services you have charged customer for. 1. Documents Required: 2. 1. Company Incorporation Certificate 2. PAN card of company as well as of all the directors 3. Proof of residence of Directors 4. Proof of occupancy of place of business (Rent agreement/ ownership deed, Rent Bills etc) 5. MOA & AOA of company 6. Current Account in the name of company in any national bank That's All folks! Your STARTUP is up to Conquer the World. UPVOTE & SHARE your views/issues We at labkafe [ http://labkafe.com/ ], prefer taxmantra [ http://taxmantra.com/ ] for our legal requirements.

-

Is e-aadhaar not valid without digital signature?

Click here for aadhaar digital signature [ https://signyourdoc.com/ ] Aadhaar Signature Validation – e-Aadhaar Card Pdf Digital Signature Validate Aadhaar Signature Validation for e-Aadhaar Card Digital Signature Validation using signNow for Validity Unknown solution… The Unique Identification Authority of India (UIDAI), has announced e-Aadhaar Card Signature Validation [ https://itsmytrend.com/aadhaar-signature-validation/ ] produce for online downloaded Aadhaar Card letter signature valid through signNow for Validation of validity Unknown signature. After successfully Downloading of e-aadhaar card online [ https://aadhaar-update.in/e-aadhaar-download/ ] everyone can see Validity Unknown on the pdf, now you can update your e-Aadhaar letter signature valid from the following simple produce. How to Validate e-Aadhaar pdf Digital Signature by using signNow – Aadhaar Signature Validation After Successfully downloading of e-Aadhaar Letter [ https://aadhaar-update.in/e-aadhaar-download/ ] everyone can see Signature Validity Unknown and this is also valid for all government services and there is no issue the UIDAI has providing the steps to validate signature just follow * Open the e-Aadhaar Letter through signNow Downloaded from UIDAI Resident Portal * Right-click on the ‘validity unknown‘ icon and click on ‘Validate Signature’. * You will get the signature validation status window, click on ‘Signature Properties’. * Click on ‘Show Certificate..’ * Verify that there is a certification path named ‘NIC sub-CA for NIC 2011, National Informatics Center’. * This identifies ‘NIC sub-CA for NIC 2011, National Informatics Center’ as the owner of the digital certificate that has been used when signing the document. * Mark the certification path named ‘NIC sub-CA for NIC 2011, National Informatics Center’, click the ‘Trust’ tab and then ‘Add to Trusted Identities’ Answer ‘OK’ to any security question that follows. * Check (✓) the field for ‘Use this certificate as a trusted root’ and click ‘OK’ twice to close this and the next window. * Click ‘Validate Signature’ to execute the validation. Note: – Once ‘NIC sub-CA for NIC 2011, National Informatics Center’ has been as a Trusted Identity, any subsequent documents with digital signatures from CCA will be validated automatically when opened. Now your e-Aadhaar Card Digital Signature is Validated, take a copy of printout and use for all services authorized by UIDAI. Frequently Asked Questions I have Successfully Downloaded my aadhaar letter as e-aadhaar pdf and taken printout and use it, is it valid document or no? There is no issue to use without using Validate Signature and your aadhaar number is valid to use and there is no mandated to Validate digital Signature of aadhaar, but need to Validate Signature is authorized signature for the digital document that’s the way e-aadhaar letter [ https://aadhaar-update.in/e-aadhaar-download/ ] also has digital Signature and validate it from your self. I have downloaded my Aadhaar Card through mAadhaar App [ https://aadhaar-update.in/maadhaar-app-apk-download/ ], its also need validate signature? No, there is no need to validate signature for mAadhaar App [ https://aadhaar-update.in/maadhaar-app-apk-download/ ]downloaded Aadhaar Cards, because of mAadhaar also a digital document showing through Mobile phone and it have QR code to check the details. Need to locate Aadhaar Enrollment Centers [ https://aadhaar-update.in/locate-aadhaar-enrollment-centers/ ] to Validate Signacher? No, there is no need to locate Aahaar Center to validate digital Signacher, the pdf document will be validate through signNow Application. I have Submitted my Aadhaar to Correction of Name Change [ https://aadhaar-update.in/aadhaar-card-update/ ] and I need to check Status, After updated of Aadhaar [ https://aadhaar-update.in/aadhaar-status-check/ ] I need to Validate? If you have seen your aadhaar pdf, Validity Unknown you need to validate digital signacher. * Aadhaar Signature Validation – e-Aadhaar Card Pdf Digital Signature Validate [ https://aadhaar-update.in/aadhaar-signature-validation/ ] * Aadhaar Card Update for Aadhaar Details Edit or Change for Name, Address, Mobile Number, DOB [ https://aadhaar-update.in/aadhaar-card-update/ ] * Locate Aadhaar Enrollment Centers to New Aadhaar Card or Aadhaar Corrections [ https://aadhaar-update.in/locate-aadhaar-enrollment-centers/ ] * e-Aadhaar Download, Aadhaar Card Download Online as Aadhaar Printout [ https://aadhaar-update.in/e-aadhaar-download/ ] * mAadhaar App APK Download for Aadhaar Mobile Services [ https://aadhaar-update.in/maadhaar-app-apk-download/ ] * Aadhaar Status Check for UIDAI Aadhaar Card Application Status Check Online [ https://aadhaar-update.in/aadhaar-status-check/ ] Reader

-

What does GST mean to a daily wage worker?

GST meaning Goods and Service Tax is touted as the biggest tax reform of independent India. Before GST, the Central and the State Government levied separate taxes like service tax, VAT, etc. The introduction of Goods and Service Tax took all the existing tax forms into a single unified tax regime. It replaced 17 indirect taxes like excise duty, sales tax, VAT, service tax, etc. Presently, only two products are exempted from the GST purview, namely Alcohol and Petroleum.GST for a laymanFor the common taxpayer, GST meaning is “One Nation One Tax.” Under this new tax structure, if your business turnover exceeds Rs. 20 Lakh annually, you have to register your business under GST. However, there are exemptions for states like Jammu & Kashmir, Himachal Pradesh, etc. whose limit has been capped at Rs. 10 Lakh.Additionally, if you're engaged in multiple lines of businesses – then multiple GST registrations would be required. After the GST registration procedure, you’ll be handed over a unique GST number.Register for GSTThe registration procedure of GST is kept simple even for a layman. Here's how you can register yourself in two stages –Log on the official registration portal of GST.Choose the ‘Services' tab from the menu and select the ‘Registration' option.Select the status as ‘GST practitioner’ in the new page.Fill up the mandatory details and proceed.You’ll be taken to a verification page where you’ll receive an OTP via your mobile number.After successful verification, you'll be handed a provisional GST identification number.Now starts the second stage:Enter the temporary GSTIN to login again to the official portal.Select the required details and proceed.Put in your bank account details and upload the required documents.Complete the e-signature process and submit.Once done, you'll receive an acknowledgement through your registered mobile number. For a layman like a wage worker, this is all that you must know about GST.

Trusted esignature solution— what our customers are saying

be ready to get more

Get legally-binding signatures now!

Frequently asked questions

How do i add an electronic signature to a word document?

When a client enters information (such as a password) into the online form on , the information is encrypted so the client cannot see it. An authorized representative for the client, called a "Doe Representative," must enter the information into the "Signature" field to complete the signature.

How do you sign financial documents in pdf?

- I can't help you with that. I do not know if a pdf is a legal document or not, but I don't feel comfortable with you just printing something out and signing it with a signature machine.

- If you have any other questions, just let me know. I will respond as soon as possible.

If you have a question, feel free to send me an email, and I will try to respond as fast as I can.

Regards,

Sharon

How long does it take to get settlement documents for sign?

How can I pay my lawyer directly for the case, instead of paying the firm, and who does it all cost for?

If I go to a lawyer at a legal aid clinic, what are the fees and how do they affect my claim payout?

What if you've been accused of something, and the lawyer refuses to represent you? Is the matter over with?

How much money can I collect in a wrongful death lawsuit?

Can I collect if my case goes to trial, if I'm not sure my case is true?

Can I collect on the money I got when I was injured in an accident? Is a lump sum amount the answer, or will I have to get medical treatment that costs thousands of dollars?

What are my choices?

The answer to all three questions depends on your situation. I've been sued. It was for the death of my mother. I've lost my license to practice. In each case, the amount of damages I could get ranged from a couple of thousand to hundreds of thousands.

The question is, how much should I be paid? I think if you are in dire straits, you probably should be able to get more than $5,000. But, as you read through the following pages, you'll be surprised by just how much you can get and how long you can keep it, if you choose the right lawyer.

I'm not an attorney, and I don't claim to be one. So, if you are a lawyer, feel free to correct me if I'm wrong. All statements are as true, accurate, and complete as I can make them. However, I am not licensed by any state, county, or municipality to practice law. I can't say if these lawyers are...

Get more for Submit eSignature Document Simple

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

Find out other Submit eSignature Document Simple

- Urinalysis log sheet form

- Toddler lesson plans pdf form

- Trainee evaluation form

- Pdf word smart 4th editionnadir abbas academiaedu form

- Release of medical information authorization

- Anatomy and physiology test bank form

- Circle the even numbers worksheets form

- 1098 t uvu form

- Welcome letter template a sample for your business to use form

- Northwestern state university transcript request form

- Sick leave form template

- Submittal log form

- Ila oral proficiency interview opi faqs maryland board of nursing form

- Fillable online at need written statement of person fax form

- Andrews university undergraduate graduation application and agreement form

- 2021 georgia form

- Faculty amp staff separation checklist form

- Chart form

- Department form

- Chapter 10 biology test answers form