How To Submit eSignature Form

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Robust integration and API capabilities

Advanced security and compliance

Various collaboration tools

Enjoyable and stress-free signing experience

Extensive support

Keep your eSignature workflows on track

Our user reviews speak for themselves

How to submit a signature

Submitting a signature has never been simpler with airSlate SignNow. This user-friendly platform optimizes the procedure of signing and sharing documents, delivering a practical solution for enterprises of all scales. Whether you're signing a contract or dispatching a document for others to endorse, airSlate SignNow provides an accessible interface and powerful features that guarantee a seamless e-signing journey.

How to submit a signature using airSlate SignNow

- Launch your browser and go to the airSlate SignNow homepage.

- Sign up for a free trial account or log into your existing account.

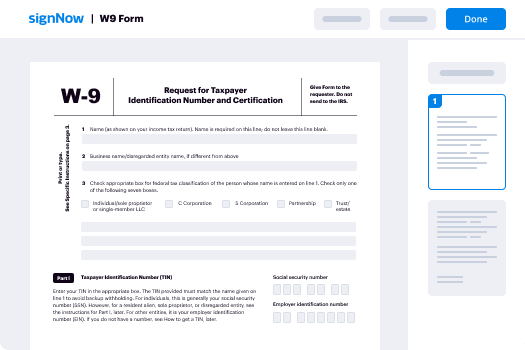

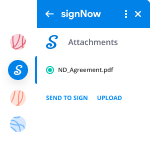

- Upload the document you intend to sign or transmit for signature.

- If you plan to utilize this document regularly, transform it into a reusable template.

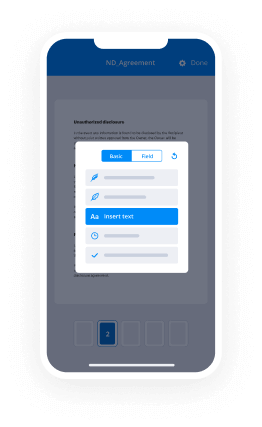

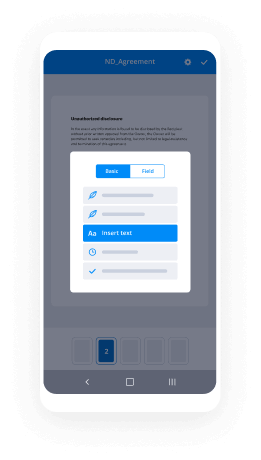

- Access your uploaded file and make necessary modifications: add fillable fields or insert essential information.

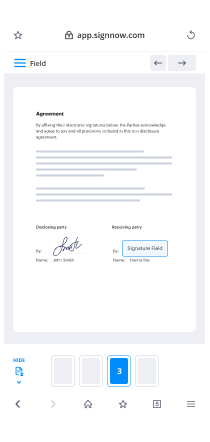

- Sign the document and assign signature fields for each recipient.

- Click 'Continue' to set up the eSignature invitation and send it out.

In summary, airSlate SignNow simplifies the signature submission sequence, providing an array of features that offer excellent value for your investment. With its user-friendly layout and extensive support, you can effectively manage your document signing requirements.

Prepared to improve your document workflow? Start your free trial with airSlate SignNow today and discover the advantages of smooth e-signing.

How it works

Rate your experience

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

FAQs

-

How do I submit a signature using airSlate SignNow?

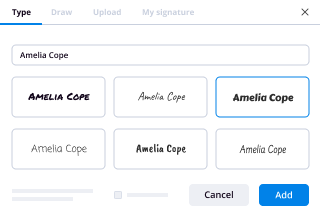

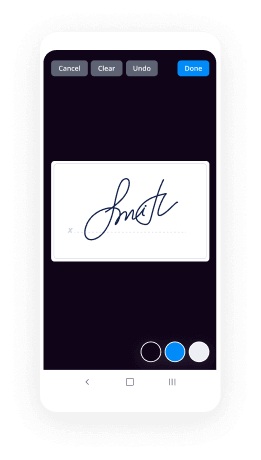

To submit a signature using airSlate SignNow, first, upload your document and select the area where you need a signature. Then, you can either draw your signature, upload an image of it, or type it out. Once you’re satisfied with your signature, click 'Submit' to finalize the process. This method demonstrates how to submit a signature quickly and efficiently.

-

What features does airSlate SignNow offer for submitting signatures?

airSlate SignNow provides several features to simplify the process of submitting signatures. Users can create templates, set signing orders, and integrate with other applications for a seamless experience. Additionally, the platform allows for mobile signing, making it easy to submit a signature on the go.

-

Is there a cost associated with submitting a signature on airSlate SignNow?

Yes, airSlate SignNow operates on a subscription model that varies based on the features you need. The pricing is designed to be cost-effective, providing various plans that allow businesses of all sizes to submit a signature without breaking the bank. You can choose a plan that fits your volume of document signing.

-

Can I submit a signature on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to submit a signature from your smartphone or tablet. Simply download the app, log into your account, and you can easily upload documents and sign them directly from your device, making it convenient to manage your signing needs.

-

What integrations does airSlate SignNow offer for submitting signatures?

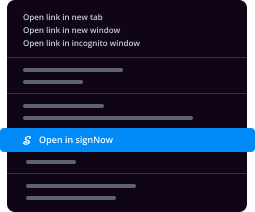

airSlate SignNow integrates seamlessly with various platforms like Google Drive, Salesforce, and Microsoft Office. These integrations enhance your workflow and simplify how to submit a signature by allowing you to access and sign documents from your preferred apps. This ensures efficiency and ease of use.

-

Can I track the status of my submitted signatures in airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of all submitted signatures. You will receive notifications when documents are viewed or signed, ensuring you stay informed throughout the signing process. This capability is essential for managing important documents.

-

What are the benefits of using airSlate SignNow to submit a signature?

Using airSlate SignNow to submit a signature offers numerous benefits, including increased efficiency and reduced turnaround times for document signing. The platform is user-friendly and helps streamline your workflow, allowing you to focus on other important tasks. Additionally, it ensures secure and legally binding signatures.

-

E-signing: Is typing your name on a form and clicking submit hold up as a legal signature?

In states which have passed it, the Uniform Electronic Transactions Act (UETA) would govern this. Section 7 of UETA, in particular, specifies: SECTION 7. LEGAL RECOGNITION OF ELECTRONIC RECORDS, ELECTRONIC SIGNATURES, AND ELECTRONIC CONTRACTS. (a) A record or signature may not be denied legal effect or enforceability solely because it is in electronic form. (b) A contract may not be denied legal effect or enforceability solely because an electronic record was used in its formation. (c) If a law requires a record to be in writing, an electronic record satisfies the law. (d) If a law requires a signature, an electronic signature satisfies the law.So, assuming that a signature is required for a contract to be valid, an "electronic signature" suffices. UETA defines "electronic signature" as follows:(8) "Electronic signature" means an electronic sound, symbol, or process attached to or logically associated with a record and executed or adopted by a person with the intent to sign the record.In basic language, this means that when you type out your name and click on the "submit" button, you've electronically signed the record, and the official comments to UETA (not technically law, but extremely persuasive) back this up:This definition includes as an electronic signature the standard webpage click through process. For example, when a person orders goods or services through a vendor's website, the person will be required to provide information as part of a process which will result in receipt of the goods or services. When the customer ultimately gets to the last step and clicks "I agree," the person has adopted the process and has done so with the intent to associate the person with the record of that process. The actual effect of the electronic signature will be determined from all the surrounding circumstances, however, the person adopted a process which the circumstances indicate s/he intended to have the effect of getting the goods/services and being bound to pay for them. The adoption of the process carried the intent to do a legally signNow act, the hallmark of a signature.Although not every state has adopted UETA either in part or in whole without modifications, I believe every state now has similar or identical provisions in its body of law. Assuming that this type of waiver would otherwise be legally enforceable (and many jurisdictions don't allow a waiver of liability for injuries under certain circumstances) then it would not be rendered unenforceable simply because it was signed electronically.Of course, in order to ensure the enforceability of any contract, one should generally consult with an attorney who is familiar with contract law in your jurisdiction and who could recommend a set of best practices for the storage and preservation of any contract stored as an electronic record.

-

How can one start a call center?

Its very common question in mind when someone willing to start call center business.Unfortunately there are many fake contracts in indian bpo market, especially when you are start up, only you get such offers.. dont know how, but start ups only get connected to such scammers in searching for project. experienced never fall for.Lets see how to avoid those and get genuine , long term projects.Did you think, why you getting scammers in all search results?? Because you are not searching for real bpo business. or real call center projects.For example..You arranged few computers , some furniture, few ac, cabin , chairs etc . Now you think your CALL CENTER office is ready to start. Search for projects.. What type projects exactly… most of time, you searching for data entry, copy paste, form filling, or something easy where you get assured billing for hitting keyboard keys. When your business plan is something like this , why not, you get only scammers in places.In reality, you see many big mnc’s doing something easy jobs and earning in crores. wake up dear.. NO one is fool to waste money on easy tasks.. Outsourcing industry always follow one simple logic.. Outsource Challenging tasks, keep simple ones. Unless your role is not productive , forget you get any genuine project.AT first place, you need to understand one thing very clear , whatever projects you gonna get, if its easy money for simple tasks, sure scam. More hard job, challenging tasks , sure sign of genuineness.Majority Genuine projects you may find in Outbound , Lead generation, telemarketing , sales and marketing only.MOst of time ive seen, budding entrepreneurs , tend to work on kiddish jobs and dream for big amounts n return.. Result.. fall for any scam offer, company close in next 2 or 3 months. and blame all bpo industry, all are scams in such. etc.. Dude, its you, who invited them.Instead, be realistic, work on lead generation, thats only entry for you as fresher , company start ups no matter what is your personal work experience in mncs.. when you start your own business, its fresh start only.Be prepare to do investments, not to purchase projects.. never do that.To purchase quality data sets, to hire quality staff.. Your own , your team performance is only main factor decides whether you make profit or losses. Data sets always differs with project to project. do not be overconfident you can arrange everything.. follow guidance, its for your own good. Never think, you have all connections, if you did, you wouldnt be searching for projects , you doing that means those expert resources of yours are not up to mark and lac of actual business skills. NO OFFENSE.with all these negative, just think and remove it from your thought, plans and start fresh.There are many genuine reference available .. few as client, few as genuine consultant.for good client reference trySaleem Shaik's answer to How can I start an outsourcing business?Good luck. regardsAgarwal Anjali

-

How do I file income tax return in India?

Greeting Friends !!!If you are going to file it yourself, then following is the procedure:-Before you start the process, keep your bank statements, Form 16 issued by your employer and a copy of last year's return at hand. Next, log on to http://incometaxindiaefiling.gov...Follow these steps:Step 1: Register yourself on the website. Your Permanent Account Number (PAN) will be your user ID.Step 2: View your tax credit statement — Form 26AS — for the financial year 2015–16 . The statement will reflect the taxes deducted by your employer actually deposited with the I-T department. The TDS as per your Form 16 must tally with the figures in Form 26AS. If you file the return despite discrepancies, if any, you could get a notice from the I-T department later.Step 3: Under the 'Download' menu, click on Income Tax Return Forms and choose AY 2016–17 (for financial year 2015–16 ). Download the Income Tax Return (ITR) form applicable to you.Which Income Tax Return Form Require to file or applicable F.Y. 2015–16 by Hetal M Kukadiya on Tax Knowledge Bank - IndiaStep 4: Open the downloaded Return Preparation Software (excel or Java utility) and complete the form by entering all the details , using your all documentsStep 5: Ascertain the tax payable by clicking the 'Calculate Tax' tab. Pay tax (if applicable) and enter the challan details in the tax return.Step 6: Confirm all the information in the worksheet by clicking the 'Validate' tab.Step 7: Proceed to generate an XML file and save it on your computer.Step 8: Go to 'Upload Return' on the portal's left panel and upload the saved XML file after selecting 'AY 2016-2017 ' and the relevant form. You will be asked whether you wish to digitally sign the file. If you have obtained a DS (digital signature), select Yes. Or, choose 'No'.Step 9: Once the website flashes the message about successful e-filing on your screen, you can consider the process to be complete. The acknowledgment form — ITR—Verification (ITR-V ) will be generated and you can download it.Step 10: you can Verify online with EVC Pin or Take a printout of the form ITR-V , sign it preferably in blue ink, and send it only by ordinary or Speed post to the Income-Tax Department-CPC , Post Bag No-1 , Electronic City Post Office, Bangalore - 560 100, Karnataka, within 120 days of filing your return online.Its Advisable to go with CA help for filling Tax return. There are lots of amendment come in every year, to file accurate return and Tax planning benefit etc so Prefer to go with expert like CA, Tax Preparer etc…Be Peaceful !!!

-

What is the procedure for online registration of a company in India?

To begin an entrepreneurial journey you must know about the basic legalities and process connected with a company.Company Registration or Incorporation is most important step for a business journey.There are few things you need to know before you move to registration process. There are different types of company registration in India.Private Limited Company – It is one of the most used domain of company registration due to following reasons.Partners have their own secure share holdings.Allow an ease in process in loan and funding.Allow customers to build a trust with company.2. One Person Company – In One Person Company, a single person gains full authority over the company thereby restricting his/her liability towards their contributions to the enterprise. Therefore, the said person will be the sole shareholder and director.So there will be no opportunity for contributing to employee stock options or equity funding. Additionally, if an OPC has an average turnover of Rs. 2 crores and over or acquires a paid-up fund of Rs. 50 lakh and over in 3 consecutive years , it has to be converted to a private limited company or public limited company within six months.3. Limited Liability Partnership – Limited Liability Partnership Registration, governed by LLP Act 2008 combines the benefits of a partnership with that of a limited liability company. LLP was introduced to provide a form of business that is easy to maintain and to help owners by providing them with limited liability.Limited Liability partnership is having following features.LLP gives the separate legal entity in which partners have limited liabilityIt gives an ease of process to transfer the ownership with other person.LLP is suitable for small business which is having capital of around 25 Lacs and turnover of 40 Lacs.Get straight away for registering your company with India’s 1st Legal Hub for Business / Startups / Individual only at www.getmeofficial.com

-

How do I get an import/export license in India to do business with China? What is the legal procedure, how long does it take, an

I can answer this question as I have just applied for iec as a individual /proprietor.You need following documents.1.current bank account, you need to give rs. 600 cheque from this account to buy class 2 digital signature from e Mudhra.2.photo I'd proof like voter card, aadhar card or driving license.3.pan cardHow to get digital signature certificate for iecAs per my recommendation e Mudhra dsc is cheap & best. You need following documents for getting digital signature certificate.Pan card with sign & firm stampPhoto ID with sign & stampEmudhra application form with passport photo of applicant with sign across, firm stamp & bank managers stamp & sign.Rs. 600 cheque from current account of applicant.Getting dsc may take approx 3-5 days. You will get it by courier.How to apply online for getting iec onlineGo to Google search, type '' iec online ''Go to first link of dgft.Apply for fresh application.Fill all your details as it as given in document.After filling all details you may need to pay rs.,500/- as a fees online. You can pay via netbanking or credit card or debit card.You may also need to upload your scan photograph not more than 5kb in size & in . Gif format only.You may also need to upload pan card copy in . Pdf or . Gif format not more than 5kb in size.You may need to submit scan copy of current bank account s cancel cheque & file size should not be more than 5kb &. Gif or Pdf format only.Now check all the spellings & address.Install Emudhra digital signature certificate by attach dingle to USB. Install software.You may also need updated java version. If you don't have, go to Google search, type updated java version . after updating java login to dgft site & submit your iec application through digital signature.Note :you don't need to send your documents to regional dgft offices.You need Internet Explorer as a browser to do all this process.Total cost for getting import export license in india is rs. 600for dsc & rs. 500 for licensing.Total rs. 1100.You don't need to renew your certificate ever.Ps. I am sharing as I am also budding importer.If you any questions, you can pm me.Big thanks to Mr. Kishan baraiWww.baraioverseas.com

-

I lost my PAN card and I want a new one with the old PAN number. How should I proceed?

There are adequate provisions in place to cover loss of PAN card, with an option to reprint a card provided by the government. So if you have lost your PAN card and aren’t sure as to what needs to be done next, here are a few simple steps which you need to follow to get a reprinted card.Log onto the official website of TIN-NSDL and navigate to the section on online application for PAN.Once here, choose the option “Reprint of PAN card.” This option can be chosen if your PAN Card was stolen, lost or misplaced.On clicking the aforementioned link, you will be directed to a different page, where you need to click on the “Online Application for changes/correction in PAN data” link.Clicking the aforementioned link will take you to a page which highlights the guidelines as to what needs to be done next. Post reading these guidelines one can choose the type of PAN they lost (individual, company, firm, HUF, etc.).They will now be required to fill up a lost pan card application form, providing details like their lost pan number, name, communication address, telephone number, email id, etc. Documents like photographs and ID proof need to be submitted along with the lost pan card application form, with an applicant expected to sign it before submission but if you have choosen Aaadhar based ekyc option there is no any physical document is required…The lost pan card application form can be submitted either online or posted to NSDL, along with necessary documents.Payment of approx Rs 110 (if the communication address is within the country) or Rs 989 (if the communication address is outside India) should be made, either though credit / debit card, net banking or demand draft.On successful payment an acknowledgment number will be generated which can be used for further correspondence.A duplicate PAN with the same pan card number will be delivered to the address in about two weeks.

-

I have lost my PAN card and I also forgot my PAN number. What is the procedure to reissue a PAN card?

As you have lost your PAN and you are not aware of your PAN details, the first thing you should do is search for your PAN number from Know Your PAN facility of income tax website and after you are aware of your PAN details you should make an application at NSDL website or by submitting a physical form. Both the process are explained below in details- It is possible to search the details of your Pan Card on the income tax website. To check your PAN card details Online, you can use “Know Your PAN” service provided by Income Tax Department. Steps to know your pan details.- * Browse to income tax website * Click on know your PAN as shown in the image below. * Fill in the required details ( Surname, Status Date of Birth and mobile numbers are mandatory) . Mobile number registered with the PAN Card is to be given. * Enter the OTP received on the registered mobile number. * You can get the detail of your PAN and Jurisdiction as shown in the image. You can make an application for E-Pan card which will be sent to you by mail or you can also apply for a physical PAN card. The applicant is only required to fill and submit the online application form along with online payment of the respective processing fee Steps to apply for PAN card * Visit the NSDL website * Select "Request for New PAN Card or/and Changes or Correction in PAN data" as Application type ( if PAN number has already been issued to you and want a fresh Pan/E-pan or want to make correction) and fill your status. * Fill in rest of the information asked such as name, and date of birth. Information marked with an asterisk sign has to be filled in mandatorily. It is mandatory to mention the email id in case of application for an E-PAN card. * A token number will be generated and same will be sent to your email id (But the same must be noted ). Click on continue with your Application. * A new page will appear on your screen. There will be three options asking you how you want to proceed with your application. To apply for E-PAN you must select No to the question “Whether Physical Pan is required?”. ( as shown in the image) ( Please check Note) * Enter your details such as Aadhaar number, parents name, etc. Aadhaar number is mandatory if you have choosed e sign and e KYC as an option. * Once you have filled all the relevant data, click on 'Next'. A new page will appear asking you to fill in Contact & Other details . * After you have filled the same you will be asked for document that you will submit as proof. As a proof of PAN you can submit Copy of PAN Card , Allotment letter. In case you have lost your PAN you must select no documents. * You will be required to give a declaration . Then you have to click submit. * You will be ask to recheck your application and you will be asked to make payment .You can pay using your debit or credit cards, Net banking . * Once you have made the payment, you will be required to undergo the Aadhaar authentication process. If your Aadhaar authentication process is successful,then a 15 digit unique acknowledgement number will be generated. * You will receive E PAN on your email after your application is processed or the physical PAN will be sent to your address Note- * There is a paperless facility called e-KYC and e-sign where your Aadhaar details will be used. You don't have to upload images such as photo, signature or other supporting documents. Your Aadhaar photograph will appear in your PAN if you use the e-KYC and e-sign facility. * There is a second method which is a standalone e-sign facility where you are required to upload your photograph, signature (in black ink) and specified supporting documents in a prescribed format.

-

What is the process to register a company in Chennai?

under the ministry of corporate affairs, every company is to be registered by the register of companies for the state this act maintains two types of companies called public and private companies the limited is the most commonly used corporate form at the end of the company name.There are 4 major steps to register in the companyACQUIRING DIGITAL SIGNATURE CERTIFICATE(DSC)ACQUIRING DIRECTOR IDENTIFICATION NUMBER(DIN)FILLING AN E-FORM OR NEW USER REGISTRATIONINCORPORATE THE COMPANYit is necessary to get registered yourself to run your business without any legal problem. India is a land of opportunities, no matter in which field your business is operating the changes of getting success is very high, so it just needs a start.follow this post we assure you on will end up in getting their business registered after following this procedureDIGITAL SIGNATURE CERTIFICATE:-DSC is a secure digital key that is issued by the authorities for the purpose of validating and signNowing the identity of a person holding this certificate. digital signatures make use of the public key to create a signatureDSC contains information about user name pin code, country, email address, date of insurance of certificate and name of the certyfying authority.DIRECTORS IDENTIFICATION NUMBER:-DIN refers to a unique identification number allotted by the central government to any person intending to be a director or an existing director of the company.it is an 8 digit unique number which has lifetime validity. through DIN details of directors are maintained in a database.NEW USER REGISTRATION:-This is about having a registered user account on MCA portal for filling an e-form, for online fee payment, for the different transaction as registered and business user. creating an account is totally free of cost. to register yourself on MCA portal clink on the link Ministry Of Corporate AffairsAPPLICATION OF THE COMPANY:-This is the final step in the registration of your company which includes incorporating the companyFORM 1:-# FORM- 1A: Application form for availability or change of company name. once you apply for a new company name, the MCA will suggest four different forms of your company name; you have to choose one among them to do the same you have to fill FORM-1A and submit.# FORM-1:- this is for application or declaration for incorporation of a company, in this form you have to fill the same name which you have chosen during application of FORM-1AFORM -18:-# this form is for the notice of the situation of a new company office or change of situation of previously registered office# for a new company you have to fill the form with genuine ofiice address and submit.FORM-32:-# for a new company this forms is for notice of appointment of new directors, managers, and secretary# for an existing company, this form is for change of directors, manager, secretary and company head.after submitting these forms, once the application is approved by MCA, you will receive a confirmation email regarding the application for incorporation of a new company. and the status of the form will get changed to approved.for further queries, you can go to our website as given on.https://virtualauditor.in/privat...

-

How do we sign the electronic form to submit articles of incorporation?

U.S. perspectiveIt is difficult to provide a definitive answer to this question because you have not identified the relevant state.You referred to “articles” rather than a “certificate” of incorporation, so the state evidently is not Delaware.If the state is California:Articles cannot be filed electronically.The articles must be filed as a paper copy, submitted in-person or by a delivery service or the Postal Service.The articles must have a signature that looks like it was written by a human being, even if it is a pasted-in image of a previously written signature.An e-signature or a typed signature (e.g., with “/s/” or a script font) will result in the articles being rejected by the Secretary of State.If the state is not California, then you will need to identify it to receive an on-target answer.

Trusted esignature solution— what our customers are saying

Get legally-binding signatures now!

Frequently asked questions

How do i add an electronic signature to a word document?

How do you sign financial documents in pdf?

How to create a webportal thatlets uses sign up for custom e-mail address?

Get more for How To Submit eSignature Form

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

Find out other How To Submit eSignature Form

- Subdivision development application form burwood council burwood nsw gov

- Advance payment bond sample form

- Msu digital login form

- Getting a bee certficate from nyda form

- Cafo compliance calendar pdf wisconsin department of dnr wi form

- Grand rapids data recovery recover lost files and data pc1 form

- Dghp mid market rent form

- Mayoralty permit new orleans form

- Hamk entrance exam questions form

- Alabama supplement exp 102011 form

- Rfp invitation sample form

- Application form for life membership iap infectious diseases chapter 1 iapidc

- Uft career training program form

- Melanau sickness images spirits given physical form college holycross

- Football camp waiver form

- 341856c for landlord use form

- Last will and testament missouri form

- Nashua nh zip code map form

- Rheem classic series dedicated horizontal package heat pump form

- Nadoa model form division order 9 95