Submit eSignature Document Easy

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Robust integration and API capabilities

Advanced security and compliance

Various collaboration tools

Enjoyable and stress-free signing experience

Extensive support

Keep your eSignature workflows on track

Our user reviews speak for themselves

Permanent Account Number is essential for and configuration at the moment of onboarding

When it pertains to administering records effectively, possessing a dependable e-signature solution is crucial. airSlate SignNow is an impactful tool that provides substantial advantages for enterprises, particularly throughout the onboarding phase. Ensuring that a Permanent Account Number is essential for and configuration at the moment of onboarding can optimize operations and improve compliance, rendering airSlate SignNow a signNow resource for any organization.

Grasping the necessity of a Permanent Account Number for and configuration at the moment of onboarding

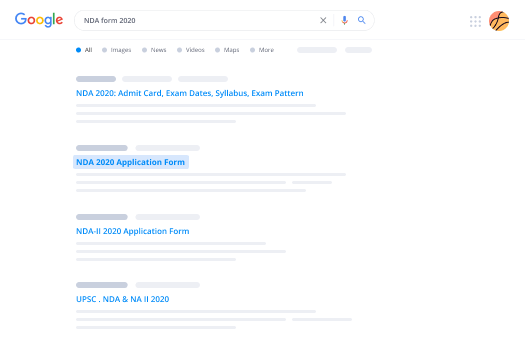

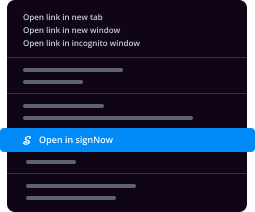

- Launch your web browser and visit the airSlate SignNow website.

- Sign up for a complimentary trial or log in to your current account.

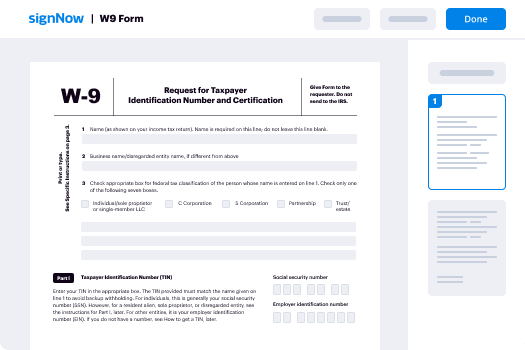

- Upload the document that requires signature or distribution for approvals.

- To simplify future use, think about saving your document as a template.

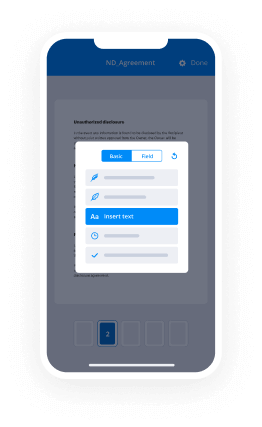

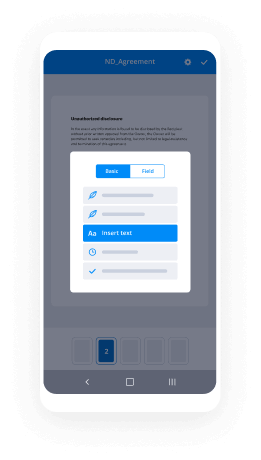

- Access your file to implement necessary changes: add fillable fields or extra information.

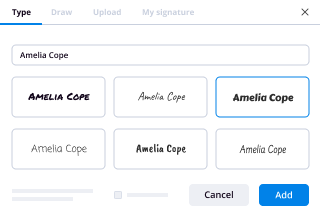

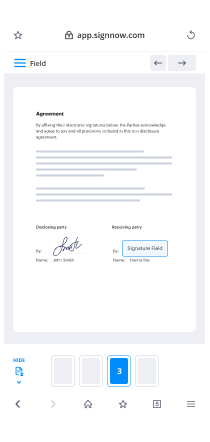

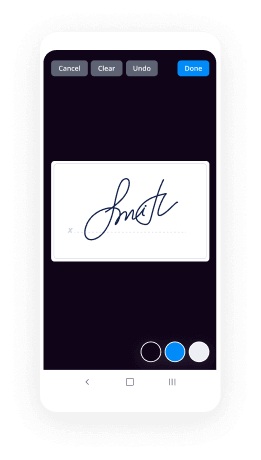

- Sign the document and allocate signature fields for all participants.

- Press Continue to set up and send the eSignature invitation.

In conclusion, airSlate SignNow provides companies with an intuitive and budget-friendly option for document management. By making a Permanent Account Number essential for and configuration at the moment of onboarding, businesses can guarantee compliance and effectiveness in their proceedings.

Eager to improve your document workflow? Initiate your free trial with airSlate SignNow today and witness the advantages firsthand!

How it works

Rate your experience

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

FAQs

-

Why is PAN mandatory for and constitution at the time of onboarding with airSlate SignNow?

Providing your PAN is mandatory for and constitution at the time of onboarding to ensure compliance with tax regulations. This helps verify the identity of users and streamlines the eSigning process. Additionally, it enhances the security of your transactions and protects against fraud.

-

What features does airSlate SignNow offer regarding onboarding processes?

airSlate SignNow offers a range of features tailored to simplify onboarding, including customizable templates and automated workflows. These features ensure that collecting documents, such as PAN is mandatory for and constitution at the time of onboarding, is efficient and seamless. You can also track the status of documents in real-time to ensure timely completion.

-

How does airSlate SignNow ensure the security of documents during onboarding?

Security is a top priority at airSlate SignNow. Our platform employs robust encryption and secure data storage to protect sensitive information, including details like PAN is mandatory for and constitution at the time of onboarding. Additionally, we comply with industry standards to safeguard your documents throughout the signing process.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to provide value, whether you're a small startup or a large enterprise. You can start with a free trial to explore our features, including those related to PAN is mandatory for and constitution at the time of onboarding, before committing to a subscription.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications, including CRM systems and project management tools. This integration allows for a smooth flow of data and ensures that vital information like PAN is mandatory for and constitution at the time of onboarding is easily accessible across your platforms. Streamlining your processes has never been easier!

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers numerous benefits, including increased efficiency, cost savings, and enhanced user experience. By implementing our solution, you can quickly gather required documents, such as PAN is mandatory for and constitution at the time of onboarding, and reduce turnaround times signNowly. This ultimately leads to improved customer satisfaction.

-

Is training available for new users of airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive training resources for new users. This includes tutorials, webinars, and dedicated support to guide you through essential processes, such as handling scenarios where PAN is mandatory for and constitution at the time of onboarding. Our goal is to ensure you feel confident using our platform.

-

What is the process to register a company in Chennai?

under the ministry of corporate affairs, every company is to be registered by the register of companies for the state this act maintains two types of companies called public and private companies the limited is the most commonly used corporate form at the end of the company name.There are 4 major steps to register in the companyACQUIRING DIGITAL SIGNATURE CERTIFICATE(DSC)ACQUIRING DIRECTOR IDENTIFICATION NUMBER(DIN)FILLING AN E-FORM OR NEW USER REGISTRATIONINCORPORATE THE COMPANYit is necessary to get registered yourself to run your business without any legal problem. India is a land of opportunities, no matter in which field your business is operating the changes of getting success is very high, so it just needs a start.follow this post we assure you on will end up in getting their business registered after following this procedureDIGITAL SIGNATURE CERTIFICATE:-DSC is a secure digital key that is issued by the authorities for the purpose of validating and signNowing the identity of a person holding this certificate. digital signatures make use of the public key to create a signatureDSC contains information about user name pin code, country, email address, date of insurance of certificate and name of the certyfying authority.DIRECTORS IDENTIFICATION NUMBER:-DIN refers to a unique identification number allotted by the central government to any person intending to be a director or an existing director of the company.it is an 8 digit unique number which has lifetime validity. through DIN details of directors are maintained in a database.NEW USER REGISTRATION:-This is about having a registered user account on MCA portal for filling an e-form, for online fee payment, for the different transaction as registered and business user. creating an account is totally free of cost. to register yourself on MCA portal clink on the link Ministry Of Corporate AffairsAPPLICATION OF THE COMPANY:-This is the final step in the registration of your company which includes incorporating the companyFORM 1:-# FORM- 1A: Application form for availability or change of company name. once you apply for a new company name, the MCA will suggest four different forms of your company name; you have to choose one among them to do the same you have to fill FORM-1A and submit.# FORM-1:- this is for application or declaration for incorporation of a company, in this form you have to fill the same name which you have chosen during application of FORM-1AFORM -18:-# this form is for the notice of the situation of a new company office or change of situation of previously registered office# for a new company you have to fill the form with genuine ofiice address and submit.FORM-32:-# for a new company this forms is for notice of appointment of new directors, managers, and secretary# for an existing company, this form is for change of directors, manager, secretary and company head.after submitting these forms, once the application is approved by MCA, you will receive a confirmation email regarding the application for incorporation of a new company. and the status of the form will get changed to approved.for further queries, you can go to our website as given on.https://virtualauditor.in/privat...

-

What is the process to do e-signature in GST?

E- sign is a new facility provided for GST enrolment. It will enable the taxpayer to sign their GST enrolement application without using DSC. It is however mandatory for some taxpayers to sign GST enrolement applicating using DSC only.Electronically signing of enrolement application using DSC is mandatory for:CompaniesForeign companiesLi mited liability partnership (LLP)Foreign limited liability partnership (FLLP’s)Only the taxpayers other than mentioned above will be able to file their enrolment application without using DSC. If you are an individual , HUF and partnership then you can file the enrolment application without DSC. You can sign the enrolment application electronically using the E- sign. It will result in cost saving as you will not have pay for the DSC. It will be easier for you as other procedure like registering DSC will also not be required.What is E- sign? How does it work?E- sign stands for electronic signature. It is an online electronic signature service that allows an Aadhaar holder to digitally sign a document. If the taxpayer opts to electronically sign the enrolement application or any other document at the GST common portal using the e- sign services.Following steps will be required to use E- signThe GST common portal prompts the taxpayer to enter the Aadhaar number of the authorized signatory.After validating the Aadhar number , the GST common portal sends a request to UIDAI system to send an OTPUIDAI system sends an OTP to e- mail address and mobile number registered against Aadhar number.the GST system prompts the taxpayer to enter the OTP.The taxpayer enters the OTP and submits the Enrollment Application or the document. The E- signing process is completed.This facility is free of cost and easy to use.It is mandatory to file your application with digital sign. This sign can be via DSC or E-sign. You will not be able to file your enrolement application without signature.

-

What is the procedure to register a startup company in India and how much will it cost?

These are four major steps required to register a start up company in india :Acquiring Digital Signature Certificate(DSC)Acquiring Director Identification Number(DIN)Document required for a DIN :A. Identity Proof (Any one of the following) PAN CardDriving LicensePassportVoter ID CardOthers (to be specified)B. Residence Proof (Any one of the following)Driving LicensePassportVoter ID CardTelephone BillRation CardElectricity BillBank StatementOthers (to be specified)Filing an e-Form or New user registrationIncorporate the company Once your company has been incorporated you can open a Current account in any of the leading banks for carrying out your operations. You will need to submit a copy of Certificate of Incorporation and Memorandum of Association along with Borad resolution to open the bank account.Then you need to apply for TAN and PAN for the Company If your services are in Software related area you can apply for STPI license which will give you certain benefits like Company need not pay tax for 5 years, there will be no import or expurty duty levied on software/hardware,You will get office spaces at lower rates at STPI units. These are few of the benefits of becoming an STPI member.All this you can do on your own or you can outsource these to professional auditor. We did it through Auditor and it took almost three weeks (Upto Step 7 excluding STPI) and all charges(excluding sTPI) would approximately cost you Rs.25,000.

-

What is the best Contract Lifecycle Management system (from your experience)?

Like others in this thread, I agree that it depends on the specific features your industry/company demands. Hopefully one of the following tools will suit your needs.We did a huge crowd-sourcing of the best sales tools out there in different categories. This list of contract lifecycle managementt tools might do some service here. These should help you get your email workflows to be more efficient and easier to track throughout campaigns.The whole list of all 157 tools in different categories is here —-> Sales Tools: The Complete List (2017 Update) | Sales HackerHere are the ones we highligh...

-

How can a non-India citizen get a PAN card?

Greeting !!!Is it possible for a non-india citizen to get a PAN card?Hetal : Yescan i apply for it online?Hetal : Yes you can apply onlineif yes what are process and requirements for?Hetal : Following are the procedure for - How to Apply for PAN Card in India(Online)Step 1 : Open the NSDL Website (Guidelines for filling PAN New Application)Step 2 : Read all the Guidelines Carefully . You can also convert the text in Hindi to read in Hindi Language. Scroll till the bottom of the Page and you will be able to Select the Category of the Applicant.Step 3 : Select the Category of Applicant from the Drop Down Menu and click on SelectStep 4 : Read and Fill the Complete Form Carefully. Finally, after filling up the form, a fee of Rs.107 has to be paid by Demand Draft/Cheque/Credit or Debit Card/Net Banking. (Note: Demand draft / cheque shall be in favour of ‘NSDL – PAN’ payable at Mumbai)Search your AO Code hereIf the Applicant wants to go for Paperless PAN Application for New PAN Card, he/she may selectYES wherein a Digital Signature is Required. Otherwise select NO (For Physical Submission of the Hard Copies of the Documents).In Paperless PAN Application, you can Upload your Photo, Signature & Documents Online and there is no need for Physical Submission of the Documents & the New PAN Card Application process would end here.Applicants willing to submit Hard Copies of the Documents may proceed with Step no.5.Step 5 : You will now get an Acknowledgement Form with a 16 Digit Acknowledgement Number. Take a printout of this Acknowledgement Form. For e.g : If your Acknowledgement Number is 10997693003. Then the heading on the envelope should be ” Application for PAN CHANGE REQUEST – 10997693003Step 6 : Paste 2 Recent Photographs of the Applicant in this Acknowledgement Form in the space provided. Put your Signature in the Box.Step 7 : Enclose your Demand Draft or Cheque (If you did not pay Pay Online), Acknowledgement Form and the self attested Documents Mentioned earlier in the form in an Envelope.Step 8 : Heading on the Envelope should be ” Application for PAN – (Your Acknowledgement Number) “Step 9 : Post this Envelope to the Physical Address of NSDL :Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016.Telephone Number : 020 – 27218080Step 10 : Make sure that the Envelope with your Application and Supporting Documents should signNow NSDL Address within 15 days after getting the Acknowledgement.Your Pan Application will be sent for processing as soon NSDL receives it. You will get an e-mail regarding the same on your E-mail Address. You must have noticed that this process to apply Pan Card Online is easy & hassle free.You can also Contact the NSDL Helpline to track the Status of your PAN at 02027218080Be Peaceful !!!

-

What is digital signature?

What is a Digital Signature Certificate?A digital signature is a mathematical scheme that validates the integrity or authenticity of a given digital document or digital message. Digital signature certificates are the electronic or digital equivalent of paper certificates. Digital signature certificates validate your digital signature and for affixing digital signatures to e-documents digital signature certificates are required. Generally certificates are used to prove the identity of a person for particular purpose like driving license or passport or pan card or others. Similarly digital signature certificates are used to prove the identity of the person digitally to avail information or services on the internet and to sign certain documents digitally.Check Here : Digital Signature Certificate PriceWhat are the types of Digital Signature Certificates?There are three types of digital signature certificates depending on the validation of identity and type of use. They are:Class I DSC – Individuals get it for validating the email identification of the users and in situations where risk is minimal and here the signature is stored in software.Class II DSC – Business organizations or individuals use this digital signature certificate to validate the information given by the subscriber in the application against the information available in a trusted consumer database and in other such situations where security risk is moderate. In this case a hardware cryptographic device is used for storing the signature.Class III DSC – This digital certificate is directly issued by the signNowing authority and it is required that the person applying for DSC must be present at the signNowing authority’s premises and prove his/her identity in front of the authority and the security risk involved in this case is very high. In this case also a hardware cryptographic device is used for storing the signature.How to get a Digital Signature?A licensed authority also called as Certification Authority (CA) that has been granted the license to issue digital signature certificates by the Government of India can issue digital signature certificate under the Information Technology Act 2000. You should pay a specified fee and submit certain documents for obtaining DSC from CA. The e-KYC documents will fetch your DSC on the same day from CA. The documents are:Self-attested PAN card as identity proof.Voter ID card or driving license or passport or latest utility bill as address proof.The Necessity of Digital Signature CertificatesFor e-filing of the income tax returns by any individual, the Government of India has made it mandatory to affix digital signatures to the income tax returns documents. For affixing the digital signature one must have digital signature certificates issued by licensed certification authority.In addition, Ministry of Corporate Affairs has set the mandatory guidelines for the companies directing them to file all reports, applications and forms using a digital signature only and this again requires a digital signature certificate.For GST also a company must verify its GST application by affixing a digital signature using digital signature certificate in order to get registered for GST.These days many Government procedures, filling different applications, amendments and forms require digital signatures made by using digital signature certificates.Benefits of Digital Signature CertificatesSaves Money & Time: As there is no need of physical presence you can digitally sign your PDF files and other documents using DSC anywhere & anytime. You need not sign your paper documents and then scan them to send them across through internet if you follow the above given option. You can save the money which would otherwise be spent on printing and scanning the document. You can also go green by saving paper.Secured Data: The digitally signed documents are tamper proof as the digital signatures are secured with a private key and public key and they cannot be edited after digitally signing the document.Authentic: Digitally signed documents are authentic and the receiver can be completely sure about the sender’s identity and integrity. The receiver can easily execute the information in the document without worrying about the document being forged.What is the Validity of Digital Signature Certificates?The digital signature certificates in India issued by licensed signNowing authority approved by Ministry of Information & Technology are valid in India as per the ‘Information Technology Act 2000’. The DSC’s come with an explicit starting date & explicit expiration date. Usually the expiration time for standard digital signature certificates issued by CA will be from 1 year to 2 years. The digital signature certificates are managed by Certificate Revocation List (CRL) based on expiration date. An Indian national can have two DSC’s, one for his personal identification and another one for official identification.Check Here : Digital Signature Certificate Price

-

What are the registration charges for house purchase including GST in Telangana?

Generally, the property or land registration procedure is the same in every state of the India; however, the percentage may differ. If you pay the registration charges, then you will be going to get the possession of the property. For that reason, there are some important steps that you should not miss at any cost. The process of buying the property remains incomplete till it is registered in the name of the owner. Once you have gone through it, you will be able to defend the property in case of frauds or disputes. Registering it with the state government and give the levied charges is also important. It is about the land registration charges.Telangana Registration Fees and Stamp Duty:At the same time, flat registration charges in Hyderabad/Telangana are interlinked to the registration charges. It means that the rates of both registration and stamp duty charges are dependent on the price of the property registered, or the ready reckoner rate like for flats or apartments that are under construction.According to the GST, the initial two-service tax and VAT will be included and the new rate will be twelve percent from the current 5.75 percent. As the registration charge is a state subject, stays the same taking the total sum of the tax to 18.1%. The explanation of taxes for building materials will be included in the costs. That means, the compliance costs will go higher that will be moved to the customers. Based on the GST terms, it is an important thing to pay registration charges for apartment build-up area, land, and undivided share of land. A customer will have to experience the Telangana stamps and registration process while registering the property.Required Documents Needed For To Buy/Sell Property :To meet the legal needs and get the property registered, it is important to have the legal documents required for the purchase of a property. You need to present the below-mentioned documents at the time of the property registration:DD or Challan that proofs the payment of the full stamp duty Telangana, registration fee, transfer duty and user charges.Two witnesses, who will recognize the parties and ID cards with photos of these individuals.A photograph that captures a frontal view of the property.Section 32A photo form of witnesses or claimants or executants.Witnesses and executant’s address proofSPA or GPA, if any in original along with the Photostat copyLink document copiesYou can also submit e-challan registration Telangana. You must give all the original documents that bear a signature of all parties. The government has provided an apartment or flat registration and plot registration documents along with property registration charges online so that people can save a lot of time, making the overall procedure quick and easy. On the web, you can also come to know about the gift deed and non-occupancy charges.Now, the main thing to know is that how to calculate registration charges on property in Hyderabad, read as follows:Property value- Rs.10 lakh (Example)Stamp duty payable= Property value*4/100, registration fees= Property value*0.5/100, transfer duty= Property value*1.5/100Total cost-Rs. 100000 + 40000 (stamp duty paid) + 5000(registration fees) + 15000(transfer duty)= Rs. 10,60,000Wazzeer - Smart Platform for Legal, Accounting & Compliance services.

-

How do I apply for a learning license at Mumbai RTO?

The task for applying driving licence in Mumbai has become easy. You can visit the ministry’s website which is Sarathi, fill in the online application form and submit the required documents.Step 1: Fill in the online application formLog on to Sarathi website, Download and fill in the required parts which are marked as red, and submit it online. For applicants who are less than 18 years of age need to download and print the application form take the signature of their parent of guardian and then upload & submit it.Step 2: Submit the required Documents:Below are the list of documents that needs to uploaded and submitted on the website.Proof of residenceThree passport size photosProof of ageProof of citizenshipLearner’s application formPermanent addressLearner’s licenseCertificate from a recognized driving schoolDocuments relating to the type of vehicle to operate. This might be a motorcycle, personal vehicle or transport vehicle.Once you’re done upload the documents, you will receive an SMS or email, to track the status of your application.The online application form for a driving license is divided into four parts which include the following:Part AThis part shows the personal information of the applicant such as name, gender, date of birth, citizenship among others. It will also show the blood group, education level and type of license you want to apply for.Part BThis part contains information relating to the type of vehicle you want to operate. As an applicant, you are allowed to list as much as 19 different types of vehicles which you want to drive. You will be required to provide a vivid description of the types of vehicles and the type of license you want.Part CThis part include a list of all the documents being submitted together with the application form. Such documents may include proof of age, proof of residence among other documents. It will also contain information relating to the registering RTO and the date of issue.Part DThis is where the applicant declares that he has submitted all materials as required. It may also include information such as a certificate of medical fitness, license of documents among other things.Part EThis part contains information relating to applicants of age between 16 to 18 years. The parents or guardians will be required to sign as a way of authorizing the applicant to apply for a learner’s license. The guardian or parent can only sign this part in the presence of the authorizing officer. This is to avoid cases where underage applicants sign the forms themselves or ask their friends to sign.

Trusted esignature solution— what our customers are saying

Get legally-binding signatures now!

Frequently asked questions

How do i add an electronic signature to a word document?

How do you sign financial documents in pdf?

How do i sign into my e-mail account with my new password?

Get more for Submit eSignature Document Easy

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

Find out other Submit eSignature Document Easy

- Schedule k 1 p form

- Airport hangar lease agreement cityofwauchulacom form

- Proof of death formclear formprint mail to admini

- Form ira

- Tc 721a utah sales tax exemption affidavit for exclusive use outside utah forms ampamp publications

- Automated external defibrillator aed incident report form wichita kumc

- Ap gov review pdf form

- Commercial term lending rent roll apartment apartment rent roll 242 mfl form

- Verbal verification of employment for a salaried borrower form

- Affidavit of request consent and guarantee weg docx form

- Trade licence application checklist form

- Northern tier high adventure boy scouts of america ntier form

- Option form christ church foundation school

- Fillable online omega psi phi fraternity inc form

- Sanctuary psycho education manual domuskidsorg form

- Nsa umpire evaluation form nsa california umpires

- Application for a residency and employment rights form

- Cat eye enduro 2 form

- Coagsense ptinr test strip shipment qc log sheet form

- Homemaker personal care waiver service delivery do form