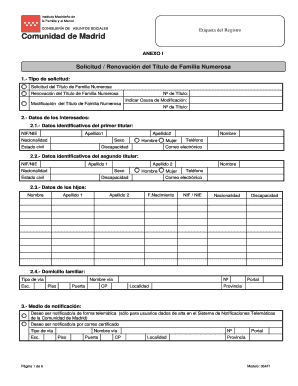

Modelo 364f1 Form

What is the Modelo 364f1

The modelo 364f1 is a specific form used for tax purposes in the United States. This form is primarily utilized by individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the modelo 364f1 is essential for ensuring compliance with tax laws and regulations.

How to use the Modelo 364f1

Using the modelo 364f1 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information required for the form. Next, fill out the form carefully, ensuring that all details are correct and complete. Once the form is filled, review it for any errors before submission. It is important to follow the specific guidelines provided by the IRS to avoid any complications.

Steps to complete the Modelo 364f1

Completing the modelo 364f1 can be broken down into a few clear steps:

- Gather required documents such as income statements, receipts, and previous tax returns.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income and any deductions or credits you are eligible for.

- Review all entries for accuracy and completeness.

- Sign and date the form before submitting it to the IRS.

Legal use of the Modelo 364f1

The modelo 364f1 is legally recognized as a valid document for tax reporting when completed and submitted according to IRS guidelines. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. Utilizing electronic signature solutions can enhance the legal validity of the form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the modelo 364f1 are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year. However, if April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any updates or changes to these deadlines by consulting the IRS website or a tax professional.

Who Issues the Form

The modelo 364f1 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations and the information required for accurate reporting.

Quick guide on how to complete modelo 364f1

Complete Modelo 364f1 effortlessly on any device

Web-based document management has gained traction among enterprises and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Manage Modelo 364f1 on any platform using airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The easiest method to modify and eSign Modelo 364f1 without hassle

- Obtain Modelo 364f1 and click on Get Form to initiate.

- Utilize the tools we offer to submit your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you prefer to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management within a few clicks from any device you select. Modify and eSign Modelo 364f1 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the modelo 364f1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is modelo 364f1 and how can it benefit my business?

Modelo 364f1 is an innovative eSigning solution that allows businesses to streamline document workflows. With modelo 364f1, companies can reduce paperwork and speed up contract signing, leading to improved productivity. Additionally, it provides a secure platform to ensure that all documents are signed legally and efficiently.

-

How much does modelo 364f1 cost?

The pricing for modelo 364f1 varies based on the specific features and volume of usage required by your business. airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes, ensuring that you get the best value for your investment in eSigning solutions. It's best to check the airSlate website for the most up-to-date pricing information.

-

What key features does modelo 364f1 offer?

Modelo 364f1 includes features such as advanced eSigning, document templates, real-time tracking, and secure cloud storage. These features help businesses manage their documents more efficiently, ensuring that every step of the signing process is transparent and streamlined. With modelo 364f1, you can also customize workflows to suit your business needs.

-

Is modelo 364f1 secure for handling sensitive documents?

Absolutely, modelo 364f1 prioritizes security with bank-level encryption and secure access controls. This ensures that all sensitive documents are protected throughout the signing process. Additionally, modelo 364f1 complies with eSignature laws and regulations, providing peace of mind for all users.

-

Can modelo 364f1 integrate with other software or tools I use?

Yes, modelo 364f1 offers seamless integration with various popular tools such as Google Drive, Salesforce, and Microsoft Office. This allows for a more streamlined workflow, enabling you to send and eSign documents directly from your existing platforms. Check the integration options on the airSlate website to see how modelo 364f1 can fit into your current setup.

-

How can modelo 364f1 improve my document workflow?

Modelo 364f1 can dramatically improve your document workflow by automating cumbersome tasks such as printing, scanning, and mailing. With its easy-to-use interface, you can quickly create, send, and track documents in real-time. This optimization leads to faster turnarounds and ultimately enhances overall business efficiency.

-

What types of businesses can benefit from modelo 364f1?

Modelo 364f1 is versatile and can benefit a wide range of businesses, from small startups to large enterprises. Any organization that requires document signatures, contracts, or agreements can enhance its operational efficiency with modelo 364f1. Its flexibility makes it suitable for industries such as real estate, education, healthcare, and more.

Get more for Modelo 364f1

- This cover page is intended to facilitate the online completion of these forms using adobe reader

- Fillable online confidential pediatric intake form www

- Subdomain finder scan of ilovepdfcom c99nl form

- Form cg1capital gains tax return 2020 capital gains tax return 2020

- Form 11 2020 tax return and self assessment for the year

- Agency case no uniform residential loan application

- Insurance verification form date name of provider in goldstarmedical

- Physician standing orders for non prescription earlylearningacademy form

Find out other Modelo 364f1

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself