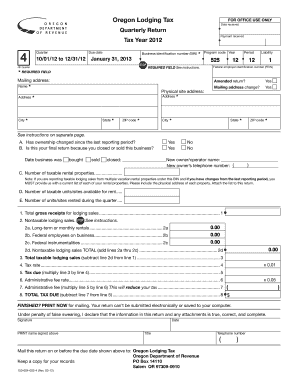

Oregon Lodging Tax Quarterly Return Form

What is the Oregon Lodging Tax Quarterly Return

The Oregon Lodging Tax Quarterly Return is a form used by lodging providers in Oregon to report the collection of lodging taxes. This tax applies to short-term rentals, hotels, motels, and other accommodations. The return details the amount of tax collected from guests and outlines the total revenue generated during the quarter. This form is essential for compliance with state tax regulations and ensures that lodging businesses contribute their fair share to local and state funding.

Steps to complete the Oregon Lodging Tax Quarterly Return

Completing the Oregon Lodging Tax Quarterly Return involves several key steps:

- Gather all necessary financial records, including total rental income and tax collected.

- Access the form, which can typically be downloaded from the Oregon Department of Revenue website.

- Fill in the required information accurately, ensuring that all figures reflect the actual amounts collected.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the Oregon Lodging Tax Quarterly Return

The Oregon Lodging Tax Quarterly Return is legally binding when filled out and submitted according to state guidelines. It must be completed truthfully, as inaccuracies can lead to penalties. The form serves as a legal document that demonstrates compliance with Oregon tax laws, and it is essential for maintaining good standing with the state. Proper execution of this form also protects lodging businesses from potential audits or legal issues related to tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Lodging Tax Quarterly Return are typically set for the end of the month following the end of each quarter. The key dates are:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

It is crucial for lodging providers to adhere to these deadlines to avoid penalties and ensure compliance with state regulations.

Who Issues the Form

The Oregon Lodging Tax Quarterly Return is issued by the Oregon Department of Revenue. This state agency is responsible for collecting and managing tax revenue, including lodging taxes. The department provides guidance on how to complete the form, as well as resources for lodging providers to understand their tax obligations.

Penalties for Non-Compliance

Failure to file the Oregon Lodging Tax Quarterly Return on time or submitting inaccurate information can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the overall amount owed.

- Potential audits from the Oregon Department of Revenue, leading to further scrutiny.

It is advisable for lodging providers to stay informed about their filing requirements to avoid these consequences.

Quick guide on how to complete oregon lodging tax quarterly return

Complete Oregon Lodging Tax Quarterly Return effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and safely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents swiftly without hindrance. Manage Oregon Lodging Tax Quarterly Return on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Oregon Lodging Tax Quarterly Return with ease

- Find Oregon Lodging Tax Quarterly Return and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information thoroughly, then click the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Edit and eSign Oregon Lodging Tax Quarterly Return and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon lodging tax quarterly return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon lodging tax quarterly return 2017?

The Oregon lodging tax quarterly return 2017 is a mandatory filing for businesses that offer lodging services in Oregon. It requires providers to report and remit collected lodging taxes quarterly, ensuring compliance with state regulations. Properly submitting this return helps avoid penalties and maintains good standing with the state.

-

How do I file my Oregon lodging tax quarterly return for 2017?

To file your Oregon lodging tax quarterly return for 2017, you can use the state's online filing system or traditional paper forms. Using services like airSlate SignNow can streamline this process by allowing you to eSign and submit documents quickly. Ensure all required information is accurately provided to avoid delays.

-

Are there any penalties for late submission of the Oregon lodging tax quarterly return 2017?

Yes, late submission of the Oregon lodging tax quarterly return 2017 may result in fines and penalties. The state has strict deadlines, and failing to meet them can lead to additional charges on top of the accrued tax. Therefore, timely filing is crucial for compliance.

-

What features does airSlate SignNow offer for filing Oregon lodging tax quarterly returns?

airSlate SignNow offers features such as document eSigning, templates for tax forms, and a user-friendly interface for completing your Oregon lodging tax quarterly return 2017. These tools make the filing process more efficient and less prone to errors. Additionally, you can store and access your documents securely within the platform.

-

Is there a cost associated with using airSlate SignNow for my tax filings?

Yes, using airSlate SignNow for filing your Oregon lodging tax quarterly return 2017 does involve a cost. However, the service is designed to be cost-effective and can save you time and potential penalties by simplifying the filing process. Pricing plans vary, so it’s best to review the options to find one that suits your needs.

-

Can airSlate SignNow integrate with other accounting software for easier tax management?

Yes, airSlate SignNow can integrate with various accounting software, allowing for a seamless tax management experience. This integration can help users efficiently track their lodging tax obligations, including filing the Oregon lodging tax quarterly return 2017. Utilizing these integrations can streamline both document management and compliance.

-

What are the benefits of using airSlate SignNow for lodging tax returns?

Using airSlate SignNow for filing your lodging tax returns, including the Oregon lodging tax quarterly return 2017, offers several benefits. It simplifies eSigning, provides access to templates, and enhances document security. Overall, it saves time and reduces the risk of errors during the filing process.

Get more for Oregon Lodging Tax Quarterly Return

Find out other Oregon Lodging Tax Quarterly Return

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy