Tax Forms Rhode Island Division of Taxation RI Gov 2019

Overview of Rhode Island Tax Forms

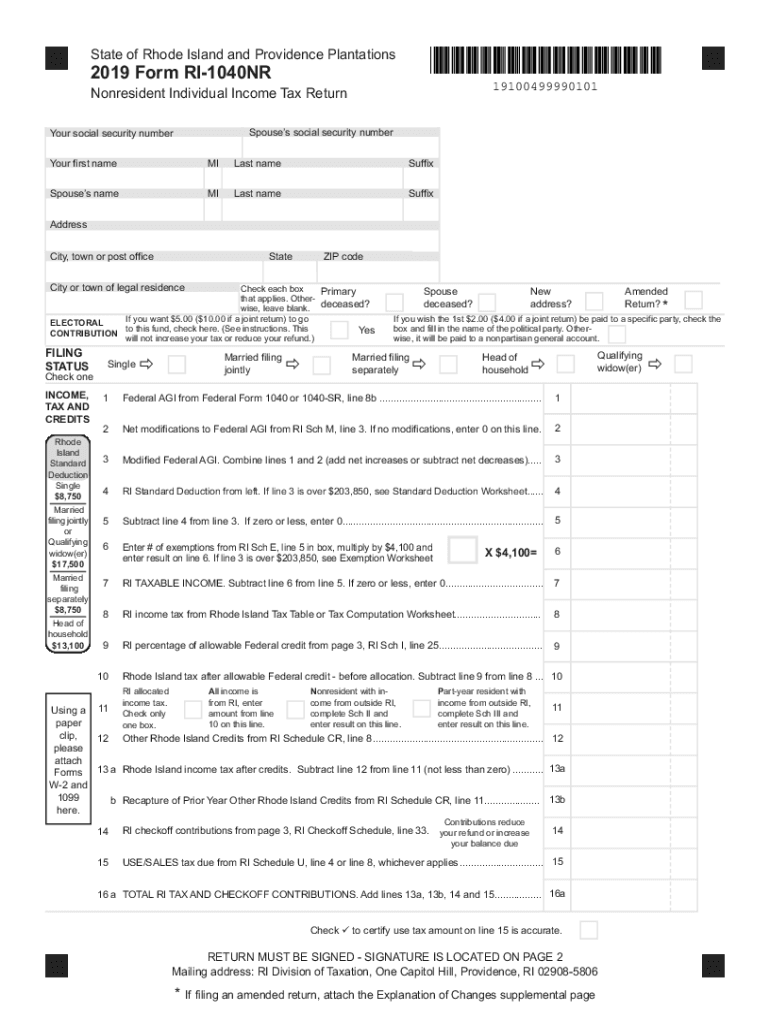

The Rhode Island Division of Taxation provides various tax forms essential for residents and nonresidents. These forms facilitate the filing of state taxes, ensuring compliance with local laws. The primary forms include the RI-1040 for residents and the RI-1040NR for nonresidents. Each form serves specific tax obligations and must be filled out accurately to avoid penalties.

Steps to Complete Rhode Island Tax Forms

Completing Rhode Island tax forms involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and other income statements.

- Determine your residency status to select the appropriate form (RI-1040 or RI-1040NR).

- Carefully fill out the form, ensuring all information is accurate and complete.

- Calculate your tax liability or refund based on the provided instructions.

- Review the form for errors before submission.

Legal Use of Rhode Island Tax Forms

Rhode Island tax forms are legally binding documents required for tax compliance. Filing these forms accurately ensures that taxpayers meet their obligations under state law. It is crucial to understand that any misrepresentation or errors may lead to penalties or audits by the Rhode Island Division of Taxation.

Filing Deadlines and Important Dates

Timely filing of Rhode Island tax forms is essential to avoid penalties. The standard deadline for filing individual tax returns is typically April fifteenth. However, extensions may be available under certain circumstances. Taxpayers should stay informed about any changes to deadlines or specific dates relevant to their filing situation.

Form Submission Methods

Rhode Island tax forms can be submitted through various methods:

- Online submission via the Rhode Island Division of Taxation’s website.

- Mailing the completed forms to the designated address provided in the instructions.

- In-person submission at local tax offices, if applicable.

Required Documents for Filing

To complete Rhode Island tax forms, several documents are necessary:

- W-2 forms from employers to report wages.

- 1099 forms for any additional income, such as freelance work.

- Records of any deductions or credits claimed.

- Previous year’s tax return, if available, for reference.

Quick guide on how to complete tax forms rhode island division of taxation rigov

Complete Tax Forms Rhode Island Division Of Taxation RI gov effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tax Forms Rhode Island Division Of Taxation RI gov on any device with the airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

The simplest way to modify and eSign Tax Forms Rhode Island Division Of Taxation RI gov without hassle

- Locate Tax Forms Rhode Island Division Of Taxation RI gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Forms Rhode Island Division Of Taxation RI gov and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax forms rhode island division of taxation rigov

Create this form in 5 minutes!

How to create an eSignature for the tax forms rhode island division of taxation rigov

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Rhode Island BCI report 2017, and why is it important?

The Rhode Island BCI report 2017 is a background check document that provides a detailed criminal history of an individual. This report is crucial for employers, landlords, and organizations seeking to ensure the safety of their environments. By understanding the contents of the Rhode Island BCI report 2017, you can make informed decisions that align with safety and compliance standards.

-

How can I obtain my Rhode Island BCI report 2017?

To obtain your Rhode Island BCI report 2017, you can submit a request through the Rhode Island State Police or authorized agencies. You will typically need to provide identification and pay a processing fee. Utilizing efficient eSigning solutions like airSlate SignNow can streamline the documentation process.

-

Is there a fee for accessing the Rhode Island BCI report 2017?

Yes, there is a nominal fee associated with obtaining the Rhode Island BCI report 2017. The exact fee may vary depending on the agency processing your request. Being informed about these costs upfront allows for better budgeting when seeking background check services.

-

How does airSlate SignNow facilitate the handling of the Rhode Island BCI report 2017?

airSlate SignNow allows users to easily eSign and manage documents related to the Rhode Island BCI report 2017 securely. This solution simplifies workflow processes, making document management easier and more efficient. Additionally, it ensures that all necessary signatures are compliant and legally binding.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features for document signing, including customizable templates, real-time tracking, and multi-party signing. These functionalities enhance the efficiency of processing documents like the Rhode Island BCI report 2017. With airSlate SignNow, users can ensure timely execution and compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for managing the Rhode Island BCI report 2017?

Yes, airSlate SignNow can be integrated with various applications including CRM systems, cloud storage, and project management tools. These integrations enhance the usability of the platform, especially when handling documents like the Rhode Island BCI report 2017. This connectivity helps streamline your workflow and maintain organized records.

-

What are the benefits of using airSlate SignNow for the Rhode Island BCI report 2017?

Using airSlate SignNow for handling the Rhode Island BCI report 2017 offers numerous benefits including time efficiency, improved document security, and simplified compliance. The platform’s user-friendly interface permits even those without technical expertise to navigate the signing process easily. Ultimately, this empowers businesses to focus more on their core operations rather than paperwork.

Get more for Tax Forms Rhode Island Division Of Taxation RI gov

- Bill of sale without warranty by individual seller utah form

- Bill of sale without warranty by corporate seller utah form

- Utah amended form

- Verification of creditors matrix utah form

- Correction statement and agreement utah form

- Utah statement form

- Flood zone statement and authorization utah form

- Name affidavit of buyer utah form

Find out other Tax Forms Rhode Island Division Of Taxation RI gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors