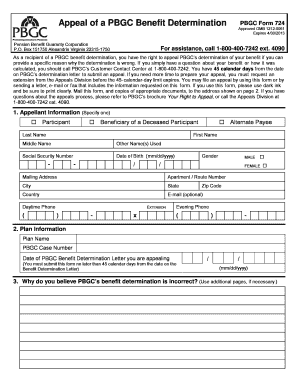

Pbgc Form 724

What is the PBGC Form 724

The PBGC Form 724 is a document used by the Pension Benefit Guaranty Corporation (PBGC) for various purposes related to pension plans. This form is essential for plan sponsors who need to report certain information to the PBGC, ensuring compliance with federal regulations. The form collects data that helps the PBGC monitor the financial health of pension plans and protect the benefits of participants. Understanding the purpose of this form is crucial for anyone involved in managing or administering pension plans.

How to Use the PBGC Form 724

Using the PBGC Form 724 involves several key steps. First, ensure that you have the most current version of the form, which can typically be found on the PBGC website. Next, gather all necessary information, including details about the pension plan and its participants. Fill out the form accurately, providing all required data. Once completed, the form can be submitted electronically or via mail, depending on the specific instructions provided by the PBGC. It is important to review the form for any errors before submission to avoid delays or compliance issues.

Steps to Complete the PBGC Form 724

Completing the PBGC Form 724 requires careful attention to detail. Follow these steps for a smooth process:

- Download the latest version of the form from the PBGC website.

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary documentation, including plan details and participant information.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any mistakes or missing information.

- Submit the form electronically or by mail, following the PBGC's submission guidelines.

Legal Use of the PBGC Form 724

The legal use of the PBGC Form 724 is governed by federal regulations that require accurate reporting of pension plan information. Completing and submitting this form ensures compliance with the Employee Retirement Income Security Act (ERISA) and other relevant laws. Proper use of the form helps protect the rights of pension plan participants and supports the PBGC in its role of safeguarding pension benefits. It is essential for plan sponsors to understand the legal implications of the information reported on this form.

Key Elements of the PBGC Form 724

The PBGC Form 724 includes several key elements that must be accurately reported. These elements typically encompass:

- Plan identification information, including the plan name and number.

- Details about the plan sponsor, such as contact information.

- Financial information regarding the pension plan's assets and liabilities.

- Participant data, including the number of active, retired, and terminated vested participants.

Each of these components plays a critical role in the PBGC's assessment of the pension plan's status and financial health.

Form Submission Methods

Submitting the PBGC Form 724 can be done through various methods. The preferred method is electronic submission, which is typically faster and allows for immediate confirmation of receipt. However, the form can also be submitted by mail if electronic submission is not feasible. When submitting by mail, it is advisable to use a trackable mailing service to ensure the form arrives safely at the PBGC. Always check the PBGC's official guidelines for the most current submission options and requirements.

Quick guide on how to complete pbgc form 724

Complete Pbgc Form 724 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, enabling you to locate the appropriate form and keep it securely stored online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Pbgc Form 724 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign Pbgc Form 724 with ease

- Locate Pbgc Form 724 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious document searching, or errors that necessitate new printouts. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Pbgc Form 724 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pbgc form 724

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PBGC Form 724 and when should it be used?

The PBGC Form 724 is used to report benefit payments made under a defined benefit pension plan. It must be submitted to the Pension Benefit Guaranty Corporation (PBGC) when a plan is terminated. Understanding when and how to use the PBGC Form 724 is crucial for compliance.

-

How can airSlate SignNow help with the PBGC Form 724?

airSlate SignNow provides a seamless platform for eSigning and sending the PBGC Form 724 electronically. Our solution simplifies the document management process, allowing you to submit the form efficiently without the hassle of printing and scanning.

-

Is there a cost associated with using airSlate SignNow for PBGC Form 724?

Yes, there are pricing plans available for using airSlate SignNow, which vary based on features and usage. However, our service is cost-effective compared to traditional methods of managing the PBGC Form 724. Investing in our platform can save your business time and operational costs.

-

What features does airSlate SignNow offer for managing PBGC Form 724?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time tracking for your PBGC Form 724. These features enhance the efficiency of preparing and submitting the form while ensuring compliance with regulatory requirements.

-

Can I integrate airSlate SignNow with other software for handling PBGC Form 724?

Absolutely! airSlate SignNow offers integrations with various productivity tools to streamline the submission of your PBGC Form 724. This means you can easily connect with your existing systems for a more cohesive document management experience.

-

How secure is my data when using airSlate SignNow for PBGC Form 724?

Your data's security is our top priority at airSlate SignNow. We utilize advanced encryption and secure storage practices to protect all documents, including the PBGC Form 724, ensuring that sensitive information remains confidential and safe from unauthorized access.

-

Can multiple users collaborate on PBGC Form 724 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate effectively on the PBGC Form 724. Our platform supports team functionalities, enabling seamless document sharing and editing to ensure everyone involved can contribute and review the form easily.

Get more for Pbgc Form 724

- Sample agreement between teacher and parents form

- Dd 200 army form

- Avid grade check form 24007383

- Family assessment device developed by nathan b epstein md lawrence m baldwin phd duane s bishop md form

- Overtime pre approval form

- Mv 94 form

- Motivation to read profile form

- Ptss application form patient travel subsidy scheme ptss

Find out other Pbgc Form 724

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed