MI 1040CR 7, Michigan Home Heating Credit ESmart Tax Form

What is the MI 1040CR 7, Michigan Home Heating Credit ESmart Tax

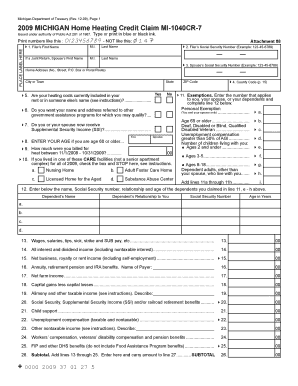

The MI 1040CR 7 is a tax form used in Michigan to apply for the Home Heating Credit. This credit is designed to assist eligible residents with their home heating costs, providing financial relief during the colder months. The form is part of the state's tax system and is essential for those who meet specific income and residency criteria. Completing the MI 1040CR 7 accurately is crucial for ensuring that applicants receive the benefits they qualify for.

How to use the MI 1040CR 7, Michigan Home Heating Credit ESmart Tax

Using the MI 1040CR 7 involves several steps to ensure proper submission and eligibility for the Home Heating Credit. Applicants must gather necessary documentation, including proof of income and heating expenses. Once the form is completed, it can be submitted electronically or by mail. Utilizing digital tools can streamline the process, making it easier to fill out and sign the form securely. Understanding the requirements and instructions is key to effectively using this form.

Eligibility Criteria

To qualify for the Home Heating Credit using the MI 1040CR 7, applicants must meet specific eligibility criteria. This includes being a Michigan resident, having a valid Social Security number, and demonstrating financial need based on household income. The income limits are adjusted annually, so it is important to check the current thresholds. Additionally, applicants must provide details about their heating costs and household size to determine the amount of credit they may receive.

Steps to complete the MI 1040CR 7, Michigan Home Heating Credit ESmart Tax

Completing the MI 1040CR 7 involves a series of steps that ensure all necessary information is accurately provided. First, gather required documents, including income statements and heating bills. Next, fill out the form with personal information, including your name, address, and Social Security number. After entering income details and heating expenses, review the form for accuracy. Finally, submit the completed form either online through a secure platform or by mailing it to the appropriate state office.

Legal use of the MI 1040CR 7, Michigan Home Heating Credit ESmart Tax

The MI 1040CR 7 is legally recognized as a valid document for applying for the Home Heating Credit in Michigan. To ensure its legal validity, it must be completed in accordance with state guidelines. This includes providing accurate information and signatures. When submitted electronically, the form must comply with eSignature laws, ensuring that the digital signature holds the same weight as a handwritten one. Utilizing a trusted eSigning platform can enhance the legal standing of the submitted form.

Form Submission Methods (Online / Mail / In-Person)

Applicants can submit the MI 1040CR 7 through various methods, providing flexibility based on personal preference. The form can be completed and submitted online via a secure eSigning platform, which simplifies the process and ensures timely submission. Alternatively, individuals can print the completed form and mail it to the designated state address. In-person submissions may also be possible at local tax offices, allowing for direct assistance if needed. Each method has its own advantages, so choosing the right one can facilitate a smoother application experience.

Quick guide on how to complete mi 1040cr 7 michigan home heating credit esmart tax

Effortlessly Prepare MI 1040CR 7, Michigan Home Heating Credit ESmart Tax on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage MI 1040CR 7, Michigan Home Heating Credit ESmart Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign MI 1040CR 7, Michigan Home Heating Credit ESmart Tax Easily

- Find MI 1040CR 7, Michigan Home Heating Credit ESmart Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign MI 1040CR 7, Michigan Home Heating Credit ESmart Tax while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1040cr 7 michigan home heating credit esmart tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI 1040CR 7 and how is it used?

The MI 1040CR 7 is a Michigan homestead property tax credit form. It is utilized by residents to claim tax credits for property taxes paid, which can result in signNow savings. By filling out the MI 1040CR 7 accurately, you ensure you receive the maximum benefit and financial support from the state.

-

How can airSlate SignNow help me with MI 1040CR 7?

airSlate SignNow provides a smooth eSigning experience for your MI 1040CR 7 form. You can easily upload, sign, and send your completed documents securely, allowing for a quick and efficient submission process. This helps ensure you meet important deadlines and avoid penalties.

-

What are the key features of using airSlate SignNow for MI 1040CR 7?

Using airSlate SignNow for your MI 1040CR 7 form includes features like secure document sharing, multiple signing options, and real-time tracking. These features streamline the process, making it faster and more reliable. Additionally, the user-friendly interface means you can manage your documents with ease.

-

Is there a cost associated with using airSlate SignNow for MI 1040CR 7?

Yes, airSlate SignNow offers a variety of pricing plans to cater to your needs, including options for both individuals and businesses. The cost is transparent, and the benefits of eSigning your MI 1040CR 7 form can lead to savings through improved efficiency. Check the website for the latest pricing details.

-

Can I integrate airSlate SignNow with other tools for handling MI 1040CR 7?

Absolutely! airSlate SignNow supports integration with numerous applications, allowing seamless management of your MI 1040CR 7 process. Whether you use CRM systems or document storage solutions, airSlate SignNow can enhance your workflow and improve collaboration with your team.

-

What benefits does eSigning my MI 1040CR 7 provide?

eSigning your MI 1040CR 7 through airSlate SignNow offers numerous benefits, such as faster processing times and enhanced security. It eliminates the need for physical document handling, reducing the risk of errors and delays. Moreover, you can sign from anywhere, making it incredibly convenient.

-

Is my information secure when using airSlate SignNow to file MI 1040CR 7?

Yes, airSlate SignNow prioritizes your security with top-tier encryption and compliance measures. Your information is kept confidential and secure while filing the MI 1040CR 7 form. This ensures that your sensitive data remains protected throughout the eSigning process.

Get more for MI 1040CR 7, Michigan Home Heating Credit ESmart Tax

- Instructions for filing a motion united states district court form

- Order re modification or restriction of parenting time jdf form

- Disclosure of the following mandatory disclosure documents required by c form

- Justia consent release or refusal to contact colorado form

- Convert from a petition for dissolution of marriage to a petition for legal separation form

- Section 3 preview of the courts docket william ampamp mary law form

- You must submit to the court some form of written parenting plan addressing all of the issues which are

- Judgment and order for possession form

Find out other MI 1040CR 7, Michigan Home Heating Credit ESmart Tax

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple