AR4506 Request for Copies of Arkansas Tax Returns Dfa Arkansas Form

What is the AR4506 Request For Copies Of Arkansas Tax Returns DFA Arkansas

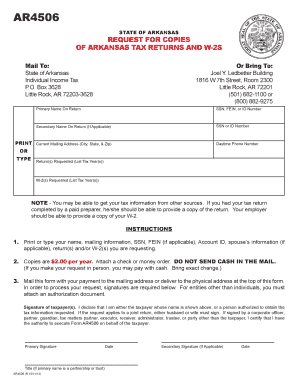

The AR4506 Request For Copies Of Arkansas Tax Returns is a form issued by the Arkansas Department of Finance and Administration (DFA). This form allows individuals and businesses to request copies of their Arkansas tax returns for various purposes, such as verifying income, applying for loans, or fulfilling legal obligations. It is essential for taxpayers who need access to their past tax documents for personal or professional reasons.

How to use the AR4506 Request For Copies Of Arkansas Tax Returns DFA Arkansas

Using the AR4506 form involves a straightforward process. First, you must complete the form with accurate information, including your name, Social Security number, and the tax years for which you are requesting copies. Once filled out, the form can be submitted to the DFA through mail or in person, depending on your preference. Ensure that you provide any required identification or additional documentation as specified on the form to facilitate the request.

Steps to complete the AR4506 Request For Copies Of Arkansas Tax Returns DFA Arkansas

To successfully complete the AR4506 form, follow these steps:

- Download the AR4506 form from the official DFA website or obtain a physical copy.

- Fill in your personal details, including your full name, address, and Social Security number.

- Specify the tax years for which you need copies of your returns.

- Include any additional information or documentation required by the DFA.

- Review the form for accuracy and completeness.

- Submit the completed form via mail or in person to the designated DFA office.

Legal use of the AR4506 Request For Copies Of Arkansas Tax Returns DFA Arkansas

The AR4506 form is legally recognized for requesting copies of tax returns, which can be crucial for various legal and financial processes. When filled out correctly and submitted, it serves as a formal request to the state, ensuring that you can obtain necessary documents for audits, loan applications, or other legal matters. Adhering to the guidelines and providing accurate information helps maintain the legal validity of your request.

Required Documents

When submitting the AR4506 form, you may need to include certain documents to verify your identity and support your request. Commonly required documents include:

- A copy of your government-issued identification, such as a driver's license or passport.

- Proof of your Social Security number, if not already included on the form.

- Any previous correspondence with the DFA regarding your tax returns, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The AR4506 form can be submitted through several methods to accommodate different preferences. You can:

- Mail the completed form to the appropriate DFA office, ensuring it is sent to the correct address for processing.

- Submit the form in person at a local DFA office, where staff can assist you with any questions.

- Check if online submission is available for your request, as some forms may be processed electronically.

Quick guide on how to complete ar4506 request for copies of arkansas tax returns dfa arkansas

Effortlessly prepare AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas on any device

Digital document management has gained tremendous traction among organizations and individuals. It offers a perfect environmentally friendly substitute to conventional printed and signed documents, as you can easily locate the suitable form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to edit and electronically sign AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas with ease

- Locate AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then press the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, cumbersome form navigation, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar4506 request for copies of arkansas tax returns dfa arkansas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas form?

The AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas form is a document that allows individuals to request copies of their Arkansas tax returns from the Department of Finance and Administration. This form is essential for those who need to verify past tax information for personal, legal, or financial reasons. Utilizing airSlate SignNow, users can easily complete and eSign this form to streamline their request process.

-

How can I use airSlate SignNow to fill out the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas?

With airSlate SignNow, filling out the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas has never been easier. Simply upload the form to our platform, fill in the required fields, and electronically sign the document. Our user-friendly interface ensures that all steps are straightforward, empowering you to submit your request efficiently.

-

Are there any costs associated with submitting the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas form via airSlate SignNow?

Using airSlate SignNow to submit the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas may involve nominal fees based on the plan you choose. We offer various pricing tiers that cater to different needs, ensuring you get the best value for your document management. It's worth checking our pricing page for the latest information and potential discounts.

-

What are the benefits of using airSlate SignNow for the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas?

The benefits of using airSlate SignNow for the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas include enhanced security, ease of use, and quick turnaround times. Our platform allows you to securely sign and send documents from anywhere, reducing the hassle of manual paperwork. Plus, with our document tracking feature, you’ll always know the status of your request.

-

Can I integrate airSlate SignNow with other tools to manage my AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas?

Yes, airSlate SignNow offers integrations with various productivity tools to streamline the management of your AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas. You can connect with services like Google Drive, Dropbox, and more, allowing you to access and store your documents conveniently. This ensures an efficient workflow and simplifies document management.

-

What types of customers typically use the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas form?

The AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas form is commonly used by individuals, businesses, tax professionals, and legal representatives. Anyone who needs to obtain previous tax returns for verification or compliance reasons can benefit from this form. Utilizing airSlate SignNow helps these users manage the process with ease and efficiency.

-

Is the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas form available in multiple formats via airSlate SignNow?

Yes, airSlate SignNow provides the AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas form in multiple formats. You can easily convert and edit the document as needed, making it accessible for various users. Our platform supports PDF and other popular formats to ensure a versatile experience.

Get more for AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas

- Determination regarding fees and costs form

- F agent has informed the seller of the seller obligations under 42 u

- Massachusetts eye and ear infirmary application for form

- Form m 792 certificate releasing massachusetts estate tax

- Mark affixed by name of signer by mark form

- File for guardianship of an incapacitated personmassgov form

- Alleged incapacitated personrespondent form

- Relationship to minor form

Find out other AR4506 Request For Copies Of Arkansas Tax Returns Dfa Arkansas

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure